XLM Price Forecast: Stellar rebound misleads, eyes 40% decline

- XLM price stakes support at the critical 61.8% Fibonacci retracement level.

- Shooting star candlestick pattern keeps bears in control.

- Bearish momentum divergence on multiple time frames adds to downward pressure.

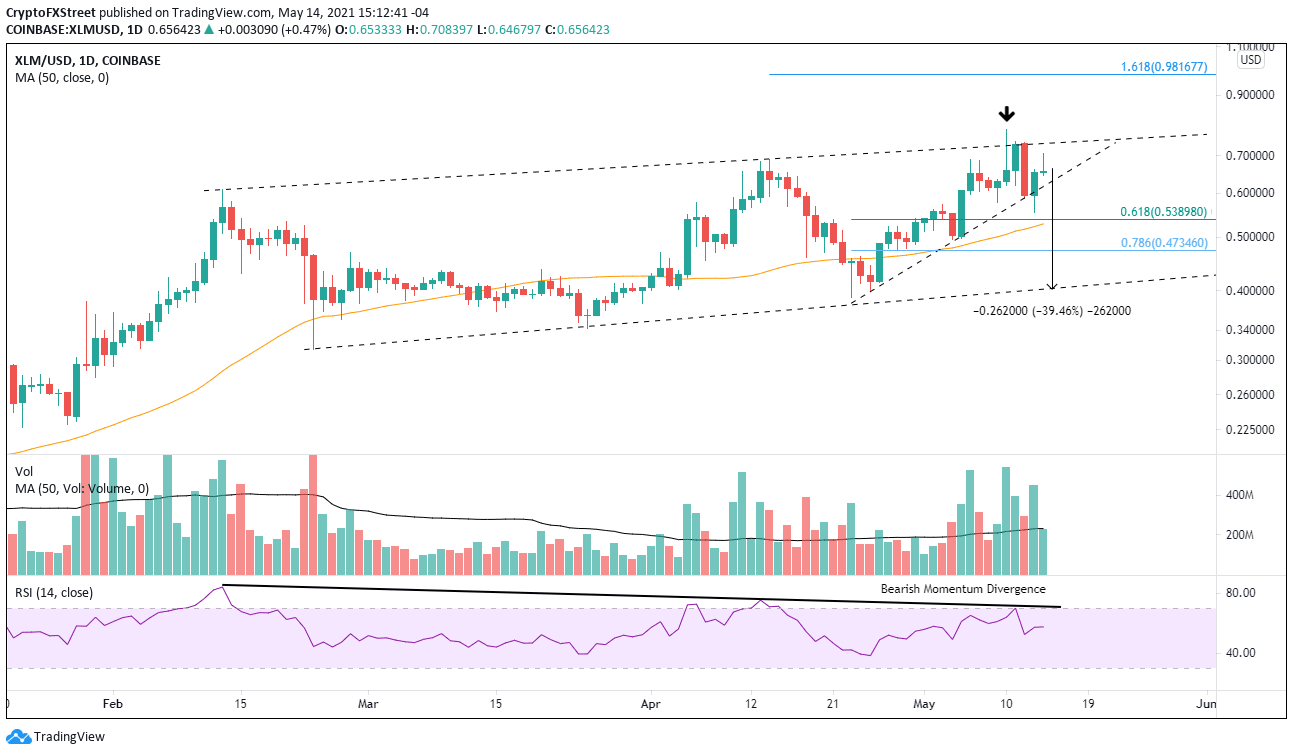

XLM price realized a bearish shooting star candle pattern on May 10 after testing the channel’s upper trend line. As long as Stellar remains below the candle’s high, the outlook is pointed bearish, targeting a 40% decline.

XLM price reveals few places to hide

Stellar rallied strongly into February, but XLM price has only managed to print marginal new highs in April and again in May, delivering a disappointing 30% return from the February high to the May high.

On May 10, XLM price closed with a bearish shooting star candlestick on the daily chart. It was an eventful end to Stellar’s first attempt to release above the multi-month channel. The candlestick reversal pattern features buyers’ struggles to lift prices higher against the overpowering distribution of the sellers.

On May 12, XLM price declined below the shooting star low at $0.618, confirming the pattern and a bearish outlook.

To add to the heightened bearishness, the daily and weekly Relative Strength Indexes (RSI) have not printed a new high along with XLM price since February, creating a bearish momentum divergence.

Downside support begins at the 61.8% retracement of the April-May rally at $0.539 and then the 50-day simple moving average (SMA) at $0.528. Some support may develop at the 78.6% retracement at $0.473, but the channel’s lower trend line currently at $0.402 will capture sellers’ attention and leave Stellar with a 40% decline from price at the time of writing.

Stellar has recovered over the last two days, but to invalidate the bearish outlook, XLM price needs to rally above the shooting star high at $0.780.

XLM/USD daily chart

A general rebound for the crypto market may permit XLM price to extend the current rebound, raising the odds that Stellar will finally overcome the channel’s upper trend line at $0.733 and surpass the shooting star candlestick high at $0.780.

Under this scenario, bullish investors can expect XLM price to target the 161.8% extension of the April decline at $0.981 and the psychologically important $1.00.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.