XLM Price Forecast: Stellar remains indecisive after massive market crash

- XLM price seems to have stopped the bleeding as buyers undid 15% of the sell-off.

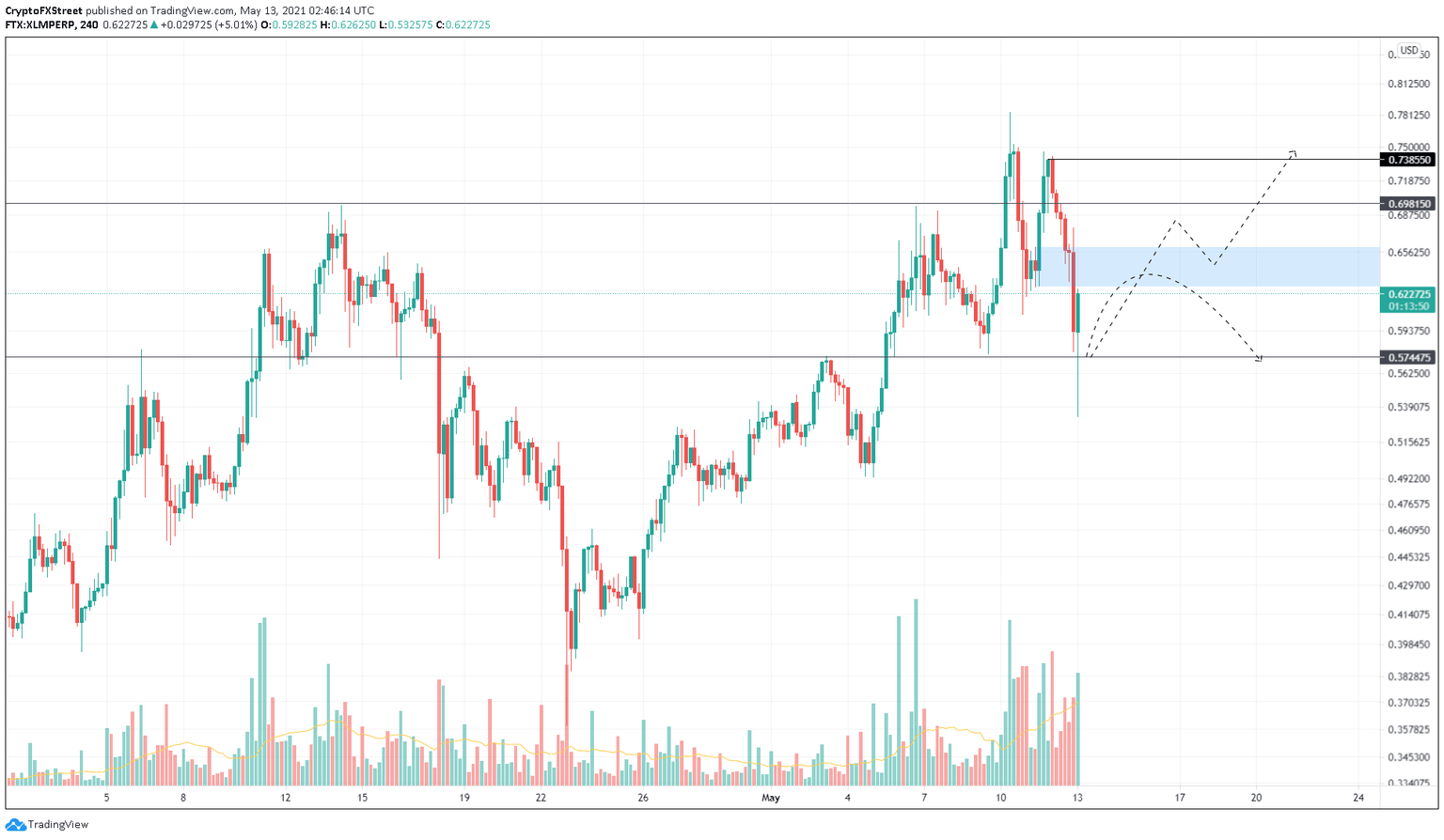

- If Stellar slices through the supply barrier that extends from $0.627 to $0.660, it will signal the start of an upswing.

- On the other hand, a rejection at this resistance zone will result in a retest of the support level at $0.574.

XLM price suffered a fatal fall as a selling frenzy took over the cryptocurrency market. However, Stellar can still recover and kick-start an uptrend if it clears a crucial price level.

XLM price faces a make-or-break moment

The work is cut out for Stellar. On the 4-hour chart, XLM price shows a 15% recovery from the crash as it heads toward the supply zone extending from $0.627 to $0.660. This level is pivotal since breaching it will signify the presence of buyers and convert it into a support that will serve as a platform for the next leg up.

Considering the current indecisive state of the market XLM price does not show a clear bias. Therefore, investors need to wait for Stellar to react to the resistance area mentioned above.

An unsustained close above $0.660 will most likely push XLM price lower. In such a case, investors can expect an 8% downswing to $0.574. A potential spike in selling pressure that breaks down this support floor will result in a 9% downtrend to $0.52.

XLM/USDT 4-hour chart

Supposing there is a huge inflow of bid orders that produces a massive 4-hour green candlestick that closes well above the supply zone’s upper boundary at $0.660, market participants can expect the remittance token to continue this uptrend.

In that case, XLM price will rise 5% to test the $0.698 level, following which it might climb another 5.8% to retest the recent swing high at $0.739.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.