With 22 billion Shiba Inu recently destroyed, traders prepare for a bullish breakout

- 22 billion Shiba Inu tokens were destroyed in 497 transactions, permanently pulling them out of circulation.

- The Dogecoin-killer Shiba Inu added 22,000 new holders over the past week, fueling a bullish sentiment among traders.

- Analysts have identified bullish potential in Shiba Inu, predicting a reversal in the meme coin’s trend.

Shiba Inu has witnessed a rise in adoption in the crypto community as the meme coin adds 22,000 new SHIB holders. The Dogecoin-killer continues to face massive SHIB burn, reducing its circulating supply.

Also read: What’s next for Dogecoin and Shiba Inu after dropping over 80%.

Shiba Inu token burn intensifies, 22 billion SHIB burned

Shiba Inu burn has intensified with the recent 22 billion SHIB destruction over 497 transactions. Based on data from the Shiba Inu burn portal, a total of 410.36 trillion SHIB tokens have been burned. This represents over 41% of Shiba Inu’s total supply.

The rapid burn of Shiba Inu pulls the burnt tokens out of circulation and reduces the meme coin’s supply. A drop in supply across exchanges is expected to push prices higher.

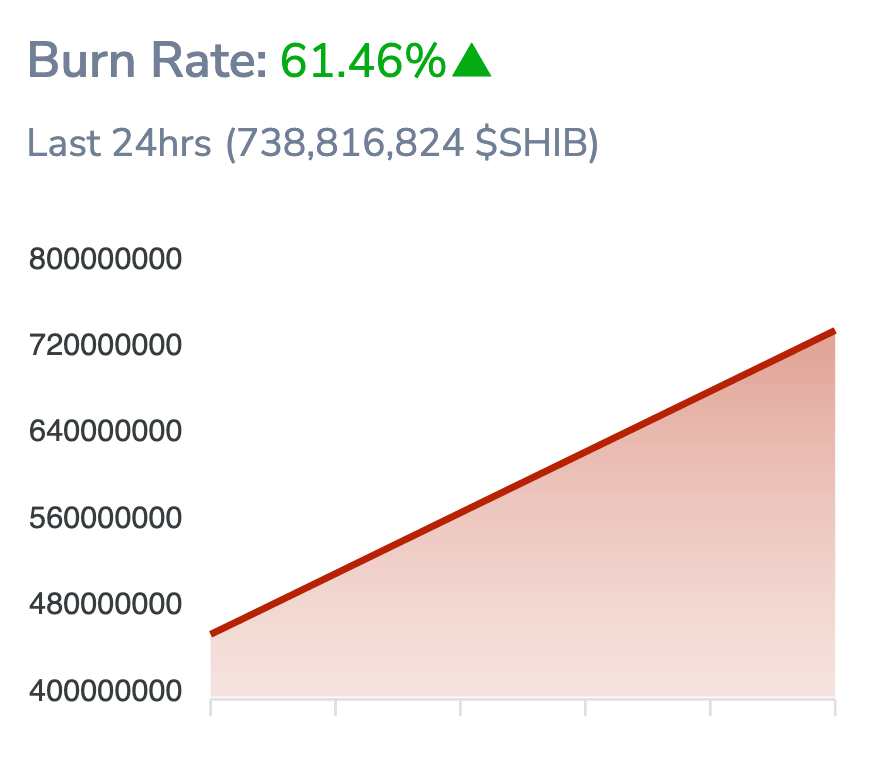

Over the past 24 hours, the Shiba Inu burn rate, an indicator used to identify the speed at which the meme coin is being burnt, has increased by 61.46%.

Shiba Inu burn rate from Shibburn.com

Shiba Inu price could break out with this bullish signal

Analysts have evaluated the Shiba Inu price trend and predicted a recovery in the meme coin’s price. Crispus Nyaga, a crypto analyst, noted that the four-hour price chart indicates that Shiba Inu has been in the consolidation phase for the past few days.

Shiba Inu has found support at $0.000011 and the meme coin has climbed higher since then. Nyaga argues that Shiba Inu price has sustained above a descending trend line, and it could continue its climb. The analyst has a bullish outlook on Shiba Inu and predicted a continuation of the Dogecoin-killer’s uptrend.

SHIBUSD four-hour Chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.