Will the Fed Interest Rate Decision spell disaster for Bitcoin price?

- Bitcoin price shows a clear sign of exhaustion as it hovers around $23,100.

- Fed Interest Rate Decision will be pivotal for cryptocurrencies to trigger trend reversals.

- For the bullish outlook to continue, BTC needs to undo the bearish signs and tag the $30,000 level.

Bitcoin (BTC) price has ignored major sell signals on multiple timeframes and has continued its ascent since January 1. While impressive as that has been, the bears are weighing this rally down as the buyers run out of ammo. Combined with this slow exhaustion, the United States Federal Reserve (Fed) Interest Rate Decision is scheduled on February 1 at 19:00 GMT, a crucial event for the market.

Following this pivotal event, the Federal Reserve press conference is set to take place 30 minutes later. In this meeting, Fed chairman Jerome Powell will outline the bank’s decision on taming inflation.

Also read: Why do macro events affect Bitcoin price and cryptocurrencies?

Bitcoin price and impact of Fed’s interest rate decision

Bitcoin price will display higher-than-usual volatility due to the announcement of the interest rate decision and the Federal Open Market Committe (FOMC) Meeting set to take place on Wednesday. The Federal Reserve has two major mandates – making sure the unemployment rates are at a minimum and the inflation is under control.

Based on what the numbers say for these two mandates, the Fed can either be hawkish, with an aggressive stance which usually includes raising interest rates to keep inflation under check, or a dovish stance, which focuses less on interest rates and more on economic growth and employment.

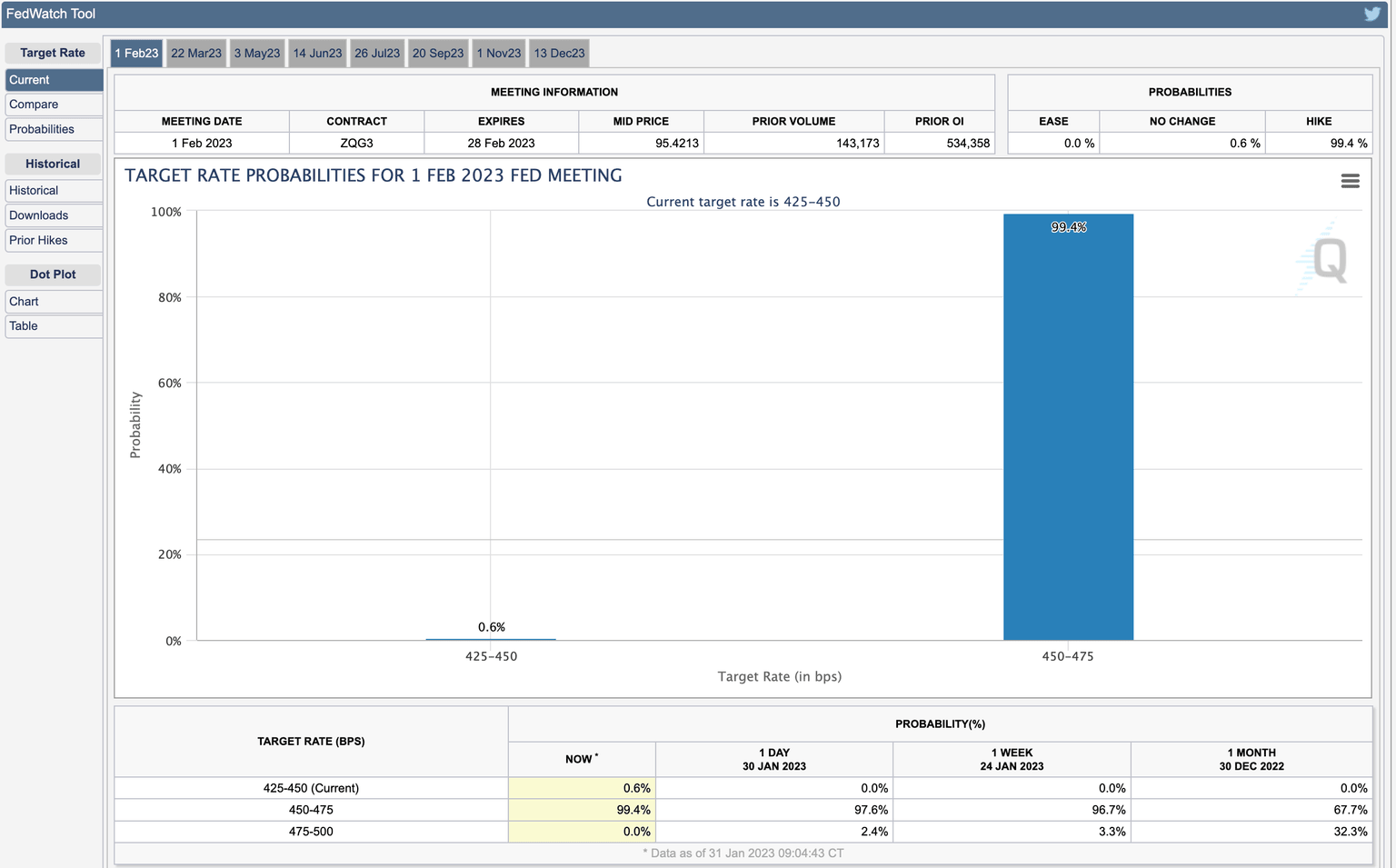

So far, the Fed has remained hawkish, leading to a spike in interest rates to the range of 4.25% to 4.50%. Wednesday’s interest rate decision is expected to deliver a raise of 0.25% or 25 basis points, and the markets have already priced that in. As seen in CME’s FedWatch Tool, there is a 99.4% probability for a 25 basis point hike, leaving 0.6% for a 50 basis point hike.

CME FedWatch tool

FOMC Meeting and its effect on Bitcoin price and stock markets

The most interesting event will be the Fed Monetary Policy Statement and then Fed Chair Jerome Powell's speech at 19.30 GMT, 30 minutes later than the rate decision and the statement are released. If Jerome Powell continues to remain hawkish, it trigger be a boost for the US Dollar due to the prospects of rising interest rates. As a result, investors will shy away from borrowing, and hence risk-on assets like Bitcoin or the stock market will likely notice a sell-off.

Cryptocurrencies, in particular, have enjoyed an unfettered bullish outlook since January 1, and some altcoins have more than doubled in this brief phase. Bitcoin price has rallied 45% and is already showing signs of exhaustion on the daily timeframe.

A minor push up to $23,500 seems likely, but a rejection at this level could trigger a correction that knocks the largest crypto by market capitalization down to the immediate support level at $22,300.

If bears continue to rampage, Bitcoin price can find solace at $21,232, which is the 50-day Exponential Moving Average (EMA)

BTC/USDT 1-day chart

While things are looking bearish for Bitcoin price, investors should note that if the $23,000 support level holds even after the FOMC Meeting, that is an opportunity for bulls. In such a case, BTC needs to bounce off the said level to tag the next hurdle at $30,236.

Closing thoughts

The interest rate hike of 25 basis points is already priced in and is not likely to induce a surge in volatility. However, the speech by Fed Chair Jerome Powell set to take place later will be crucial and will set the tone for the markets.

Based on Jerome Powell’s previous comments, the Fed is unlikely to pivot anytime soon. Yohay Elam, a senior analyst at FXStreet, notes that “additional cracks in the US economy would cause a rethink by officials.” However, Elam states that the shift from fighting inflation to fighting a recession may happen in the future but “not in the February 1 Fed decision.”

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.