Will Dogecoin price take a hit as Twitter looks to sue Elon Musk

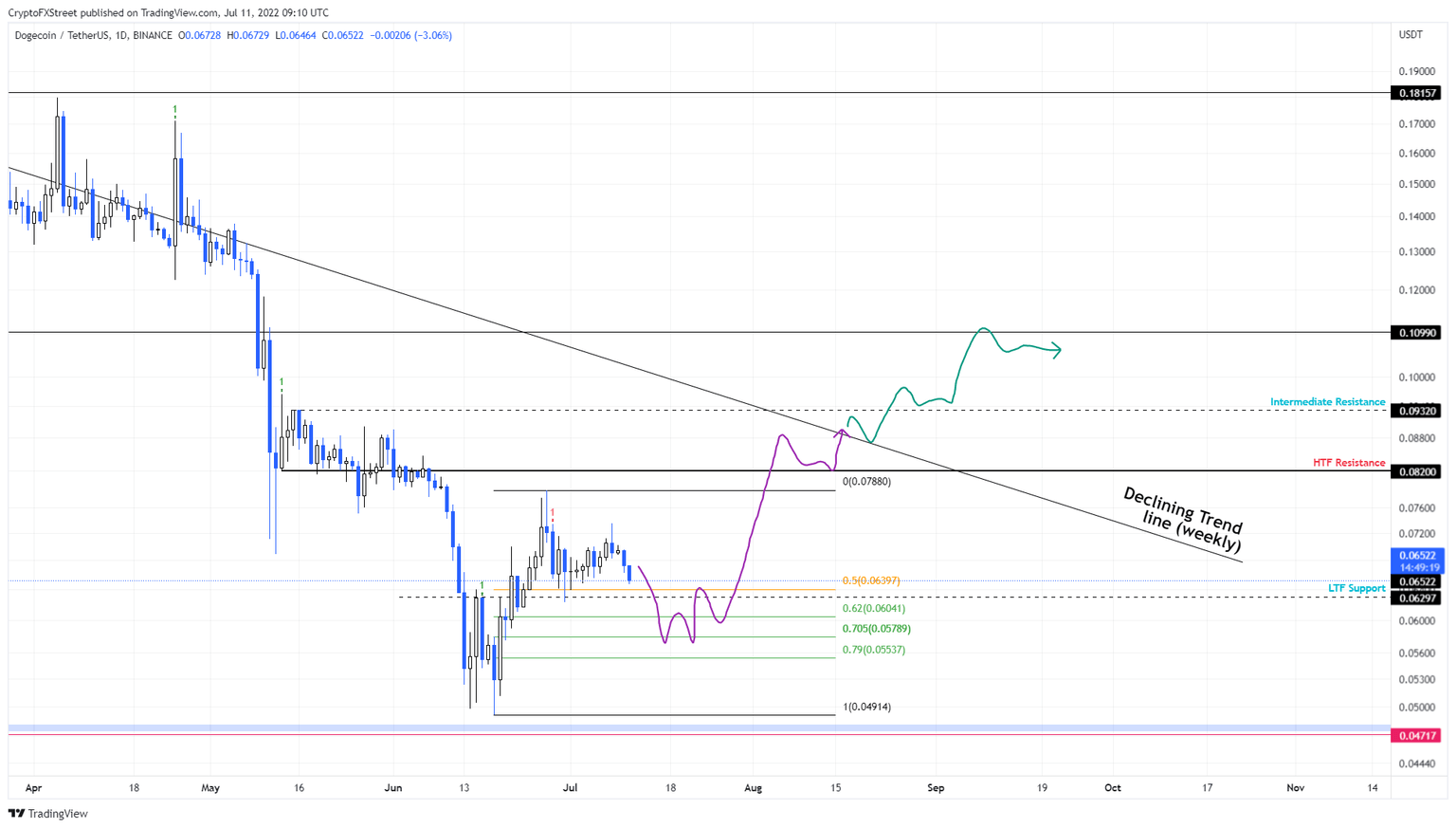

- Dogecoin price prepares for the next leg by retracing lower to find stable support levels between $0.055 to $0.060.

- A bounce in this area could trigger a 40%-to-90% upswing for patient DOGE investors.

- If the meme coin produces a daily candlestick close below $0.049, it will invalidate the bullish thesis.

Dogecoin price shows a chance for reversal while one of the meme coin’s biggest proponents – Elon Musk – is likely to be stuck in a lawsuit.

Elon Musk in regulators' crossfire again

Recent reports inform that Tesla CEO Elon Musk might catch himself in the midst of a legal battle with Twitter Inc. After Musk reached an agreement to buy Twitter, a social media platform, the Tesla boss and notable Dogecoin backer has since backed down.

The reasons for the Dogecoin proponent come as Twitter failed to disclose statistics about the problem plaguing its platform – bots that spam the network. The social media giant is reportedly hiring Wachtell, Lipton, Rosen & Katz to pursue this lawsuit.

Twitter chairman Bret Taylor tweeted on July 9 that the,

Twitter Board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery.”

Elon Musk responded earlier via Tweet,

— Elon Musk (@elonmusk) July 11, 2022

As for the Dogecoin price, investors have nothing to worry about since the markets are becoming less reactive to Musk’s tweets or mentions about DOGE. Perhaps, his SNL appearance in May 2021 ended his sway over the markets, which roughly coincides with the local top formed by Dogecoin price.

Regardless, DOGE seems to be in a position to trigger a recovery rally according to technicals.

Dogecoin price reveals its motives

Dogecoin price range, extending from $0.049 to $0.078, is likely to be breached after the ongoing retracement. After rallying roughly 60% and exhausting the bullish momentum, DOGE started to retrace and lost 20% of its value to bounce off the range’s midpoint at $0.063.

The rally that emerged from this bounce showed weakness and prematurely retraced to find a stable support level. In its quest to find a firm footing, Dogecoin price is likely to head into the deep-discount mode, extending from $0.055 to $0.060.

The resulting upswing is likely to trigger a 40% bounce from the $0.057 level to $0.082. This level is where DOGE could form a local top. However, if bulls continue to maintain the momentum, the meme coin could extend the upswing to $0.093 and $0.109.

In total, this move would allow patient investors to gain a total of 90% from the start point – $0.057.

DOGE/USDT 1-day chart

Regardless of the optimistic outlook, if Dogecoin price produces a daily candlestick close below the range low at $0.049, it will create a lower low and invalidate the bullish thesis.

Such a development could trigger a 5% to the $0.047 immediate support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.