Why Dogecoin price could outperform every other Crypto this month

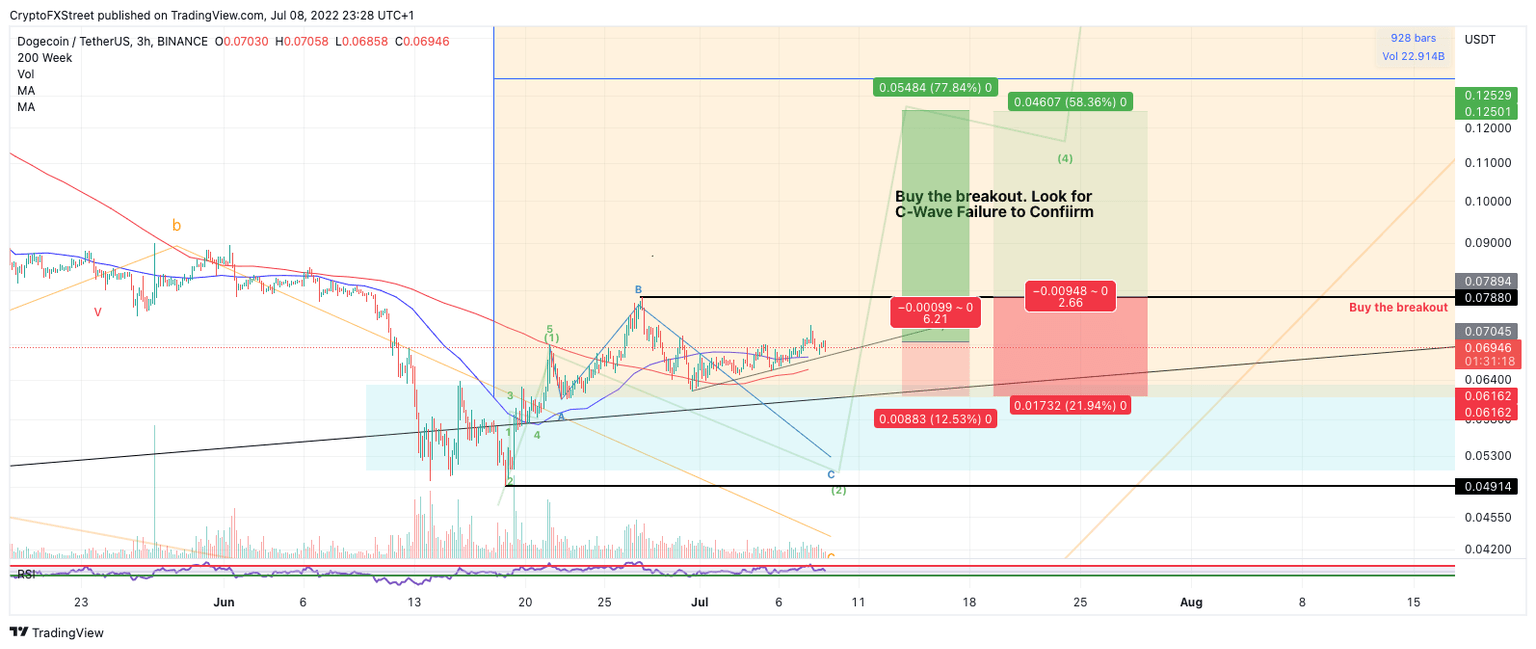

- Dogecoin price shows compression of 8- and 21-day simple moving averages below the current market value.

- DOGE price shows a substantial difference between early risk-takers and the more conservative bulls.

- Invalidation of the bullish thesis remains below $0.04914. However, traders willing to take a risk could place an early entry with a tighter invalidation level at $0.06162.

Dogecoin price shows eye-candy-like risk-to-reward setups. Being an early bull could yield nearly three times as much as the more conservative trade setup.

Is the Dogecoin price too good to be true?

Dogecoin price could be on its way towards $0.12 in the very near future. Traders familiar with the popular meme coin will attest that the Dog is notorious for out-of-nowhere rallies and FOMO-induced madness. The technicals suggest DOGE price will rise, but it is still hard to detect if a definitive bottom has occurred.

DOGE price currently trades at $0.07 as the bulls have been able to reconquer the 8- and 21-day simple moving averages. Compression of the SMA’s below the current market value is a positive sign and could become the catalyst to trigger the anticipated bull run in the coming days.

From a reward-to-risk perspective, being an early buyer at the $0.07 level could yield nearly three times as much as the more conventional trade setup, which is to buy the breakout at $0.078. Still, traders should be aware that there is still the chance of a liquidity hunt targeting the $0.05 area.

Thus invalidation of the bull trend remains at $0.04914. However, traders willing to take a risk could place an early entry with a tighter invalidation level at $0.06162. If $0.6162 is breached, look for a knife-catching opportunity in the $0.05 region while maintaining the $0.04914 as the bullish invalidation point.

If $0.04914 is breached, traders should immediately release their positions as the DOGE price could fall as low as $).02 resulting in a 70% decrease from Doge’s current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.