Why Tron price is due for a breakout

- Tron price trading in the least possible space of a pennant formation.

- TRX price will see a breakout unfolding soon, with possibly another drop towards $0.05.

- With this drop, another 16% of the value would be lost.

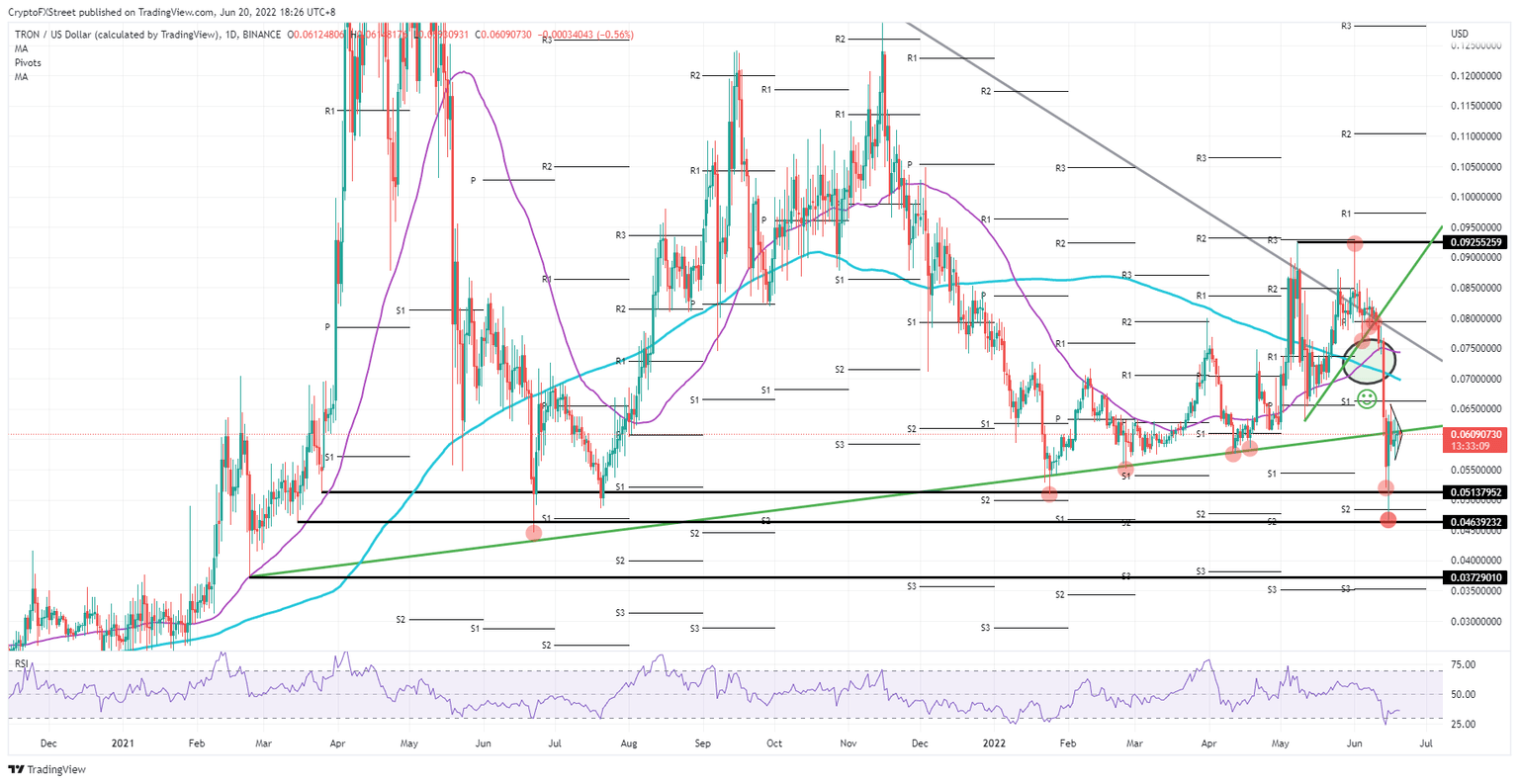

Tron (TRX) price is set to near its endgame as the pennant formation nears completion. Considering the current headwinds and global themes changing financial markets, expect a drop to the downside as the cash drain continues out of cryptocurrencies. TRX price is thus set to drop back to $0.050 or possibly even $0.046 as the pain trade continues.

TRX price set to wobble further

Tron price is set to break lower on completion of a pennant formation that materialised at the end of last week. Taking into account the current positioning of the markets and the cash drain that is going on in cryptocurrencies, expect for a bearish outcome. The supportive levels to the downside are $0.051 and $0.0046 – both of which are coming back into play.

TRX price could thus drop between another 18% to 25% as price action falls back to those support levels. If the lower level at $0.046 starts to break, expect to see another big area of losses open up, which could even amount to 38% from where TRX price is currently trading. That level falls in line with the low of February 23, 2021.

TRX/USD daily chart

Alternatively, the pennant breakout could turn into a squeeze against bears and result in TRX price exploding towards $0.070 for a test of the 200-day Simple Moving Average (SMA). A golden cross could support the spike, as the 55-day SMA still trades above the 200-day SMA. That, together with the dollar backing off a bit, could see a rally back up to $0.075 even.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.