Why the Uniswap price could be a token whales are still interested in hodling

- Uniswap price is down by 25% on the month.

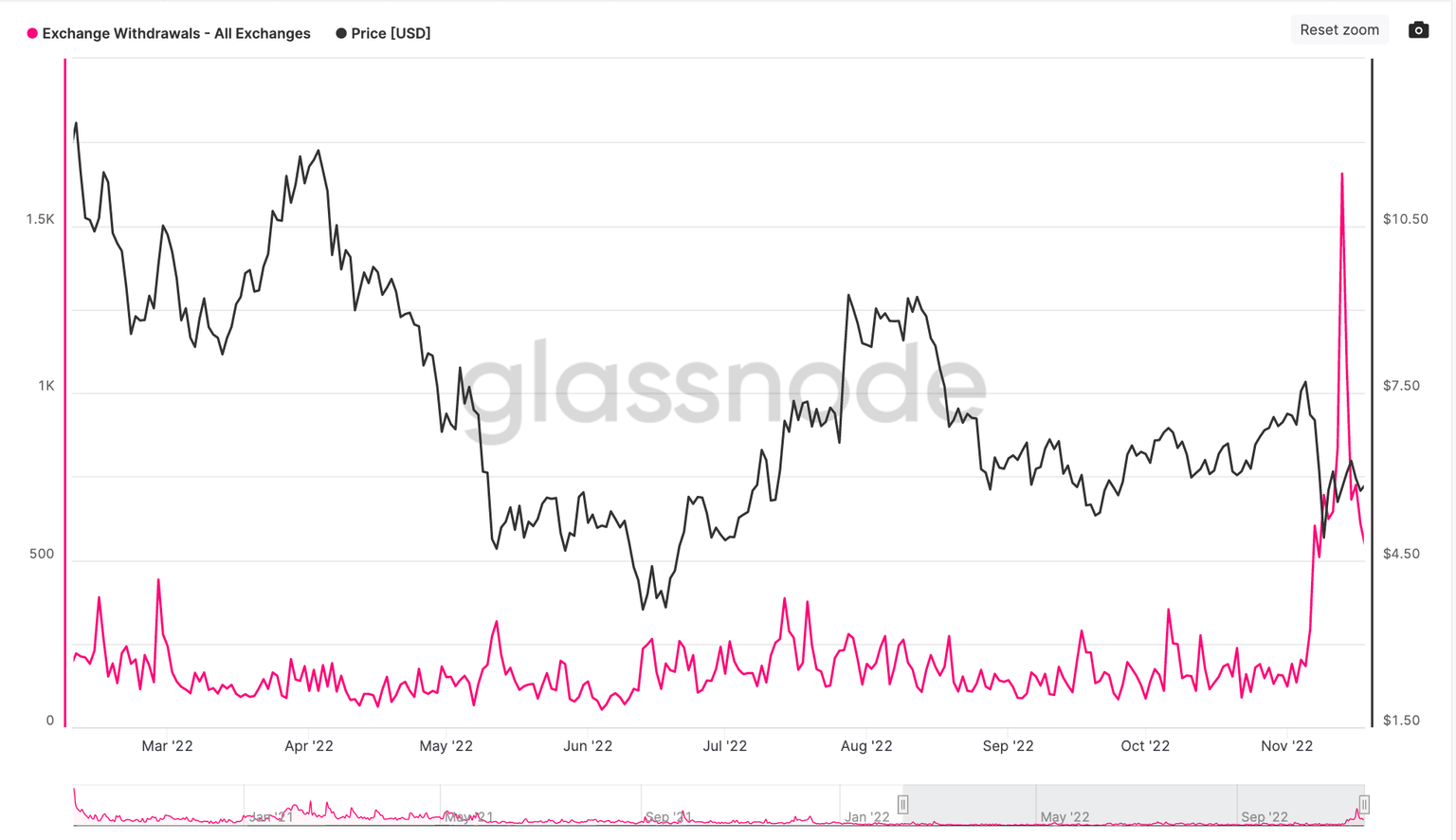

- On-chain metrics show the largest amount of withdrawals from all exchanges this year occurred on November 13

- Invalidation of the bullish thesis remains a breach below $4.60

Uniswap price shows optimistic signals as the third trading week goes into the weekend. One last exit-liquidity pump is possible for the decentralized dex token. Key levels have been defined to gauge UNI's next potential move.

Uniswap Inu price could make a move.

Uniswap price is worth keeping on your watchlist if you are looking for opportunities in the crypto market. Between June 14 and August 12, Uni swap produced a 200% rally. After the pump, the Ethereum-based swap token dipped 50% and has since traded within a range throughout the fall. The UNI price has made subtle strides higher within the newly established range. The stair-stepping price action could become the catalyst of a much larger rally towards $10 and potentially the $12.50 liquidity zone.

Uniswap price currently auctions at $5.84. Glasnode's Exchange Withdrawals compounds the idea that UNI could witness a pump as the largest uptick in withdrawals on all exchanges has occurred this year. According to the indicator, 1,656,000 transfers were made on November 13. The last time the indicator portrayed these comparable metrics was in September of 2021 when UNI traded at $20 just days before rallying 20% to $25. As the FTX disaster sheds light on centralized exchanges and their inefficiencies, Uniswap and decentralized tokens like it could be a temporary play for an influx of buying interest and liquidity in the coming weeks.

Glassnode's Exchange Withdrawals Indicator

Invalidation of the bullish outlook is possible if the bears tag the liquidity below $4.60. A sweep of the lows could induce an additional sellers' frenzy targeting the liquify levels from 2020 near $3. Uniswap price would decline by 45% if the bears were to succeed.

In the following video, our analysts deep dive into the price action of Uniswap, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.