Why Tether will not lose its $1 peg like Terra’s UST did

- Tether plummeted to $0.94 on May 12, raising concerns among investors about the possibility of a depeg.

- Tether CTO Paolo Ardoino reveals USDT is backed over 100% and there is no possibility of the stablecoin losing its peg.

- The stablecoin has honored every exchange request for USD in exchange of USDT at $1, without facing challenges.

Tether price is drifting away from its peg raising fears it could uncouple, but Tether CTO has been quoted in an interview assuring investors that Tether is over 100% backed, and thatthere is no likelihood of USDT losing its peg anytime soon. Paolo Ardoino revealed that the firm is reducing its commercial paper reserves consistently.

Tether price unlikely to crash like UST

While UST’s colossal crash has pushed the algorithmic stablecoin to $0.10, investors are afraid Tether (USDT) could lose its peg. Several times over the past five years, authorities, regulators and critics have questioned Tether’s reserves and feared the depegging of the stablecoin.

However, Paolo Ardoino, CTO of Tether allayed investors’ fears by assuring them that Tether is backed over 100%. Interestingly, the stablecoin has reduced its commercial paper reserves over the past six months.

Ardoino told Scott Melker, crypto analyst and YouTuber,

At Tether we are more than 100% backed, all the reserves and all the earnings that Tether had so far have always been kept in the company, as additional backing.

Ardoino believes it is impossible for Tether to lose its stability as the company has more-than-necessary backing and additional reserves to honor every request for issuing $1 USD in exchange of every USDT.

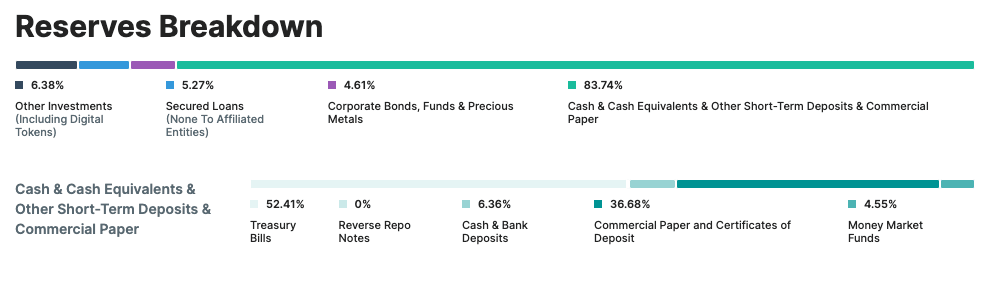

Below is a breakdown of Tether’s reserves based on data from Tether.io.

USDT Reserves

Ardoino told Scott Melker that Tether is facing extensive stress tests every week as algorithmic stablecoin UST crashed and other stablecoins lost their peg. Tether is under the pressure to provide liquidity to investors and USDT has emerged as the asset that Terra’s investors and holders use.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.