Terra closes up shop after LUNA price hits near zero

- Terra's Korean community of thousands of traders, which started in 2019 has been officially shut down.

- Do Kwon and Luna Foundation Council's efforts to recover Terraform Lab tokens LUNA and UST have failed.

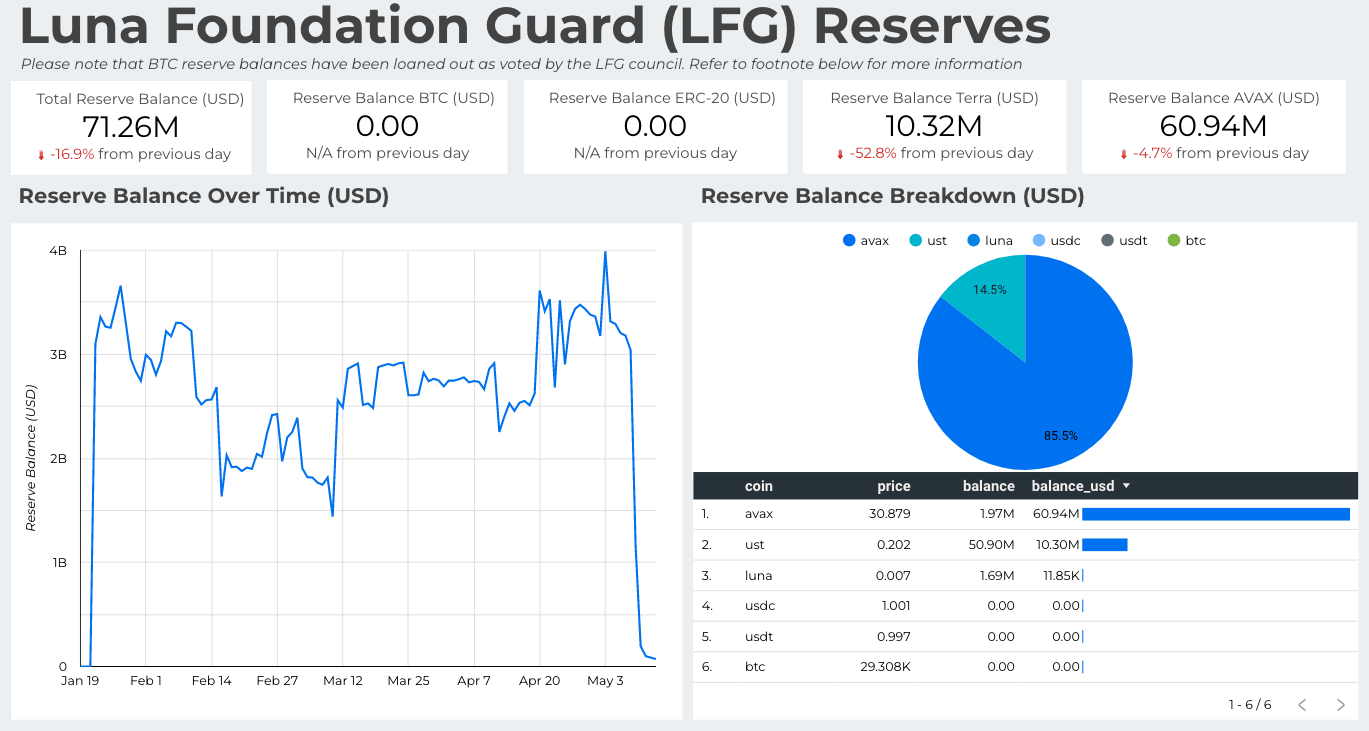

- Luna Foundation Guard reserves have plummeted to $60.94 million in Avalanche tokens and $10.31 million in UST.

The Terra blockchain has been halted several times since May 11 in light of the de-pegging of TerraUSD (UST) and instability in liquidity across exchanges. LUNA crashed to near zero, despite Do Kwon's recovery plan and massive burn of UST.

Terra's LUNA on the path to zero as blockchain halts

LUNA, the sister token of the controversial stablecoin TerraUSD (UST), crashed to near zero as the Terra blockchain was halted several times since May 11, 2022. Several exchanges and platforms like Binance Futures, Bybit, and eToro have delisted LUNA in light of the instability and unstable liquidity.

Terra's unofficial Korean community, which first started in 2019 and comprised thousands of investors, has been shut down. The admin's final words before shutting the community were:

This is really over... Validators are leaving too... He's going to sell the house and run

Do Kwon, the CEO of Terraform Labs, has been inactive on Twitter since May 11, 2022. Kwon has disappeared after revealing a detailed step-by-step plan to burn UST at 4x the current rate and reduce its supply to restabilize its peg.

The Luna Foundation Guard (LFG) council's recovery of Terraform lab's LUNA and UST has nearly failed as reserves plummet to $71.26 million, and the two tokens fail to recover.

The current reserves of the foundation consist of $60.94 million in Avalanche tokens and $10.32 million in UST.

Luna Foundation Guard (LFG) Reserves

Interestingly, GAM Holding, an independent asset management firm based in Switzerland, has offered to rescue Terra's UST. The firm is currently in talks with the management of Terra and has offered between $2 billion and $3 billion to absorb the excess supply of UST in the current market-wide sell-off.

The asset manager's move could reestablish UST's peg to $1. Peter Sanderson, the CEO of GAM, says,

Our interest in supporting UST reflects our interest in supporting a vibrant, innovative, and resilient crypto market. We firmly believe in Terra's ecosystem. Just as importantly, we believe in UST's algorithmic approach to valuation…[]...We see opportunity in UST's recent activity and continue to see promise in Terra's broader strategy.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.