Why MATIC price could fall swiftly to $0.50

- MATIC continues to face pressure against key resistance zones.

- Upside momentum paused as bulls and bears await a clear direction.

- Downside movement is the most likely direction.

MATIC price action has consolidated over the past three days. Further upside movement has been rejected against the Tenkan-Sen within the Ichimoku Kinko Hyo system. However, long and short opportunities now exist.

MATIC price remains bearish, but upside potential is very likely

MATIC price remains in a strong downtrend. Polygon is below the Ichimoku Cloud on the weekly and daily charts within the Ichimoku Hyo System. However, last week's sell-off put Polygon into major oversold conditions on various time frames, hinting that mean reversion or a broad trend reversal could likely occur. As a result, two trade setups have developed for bulls and bears.

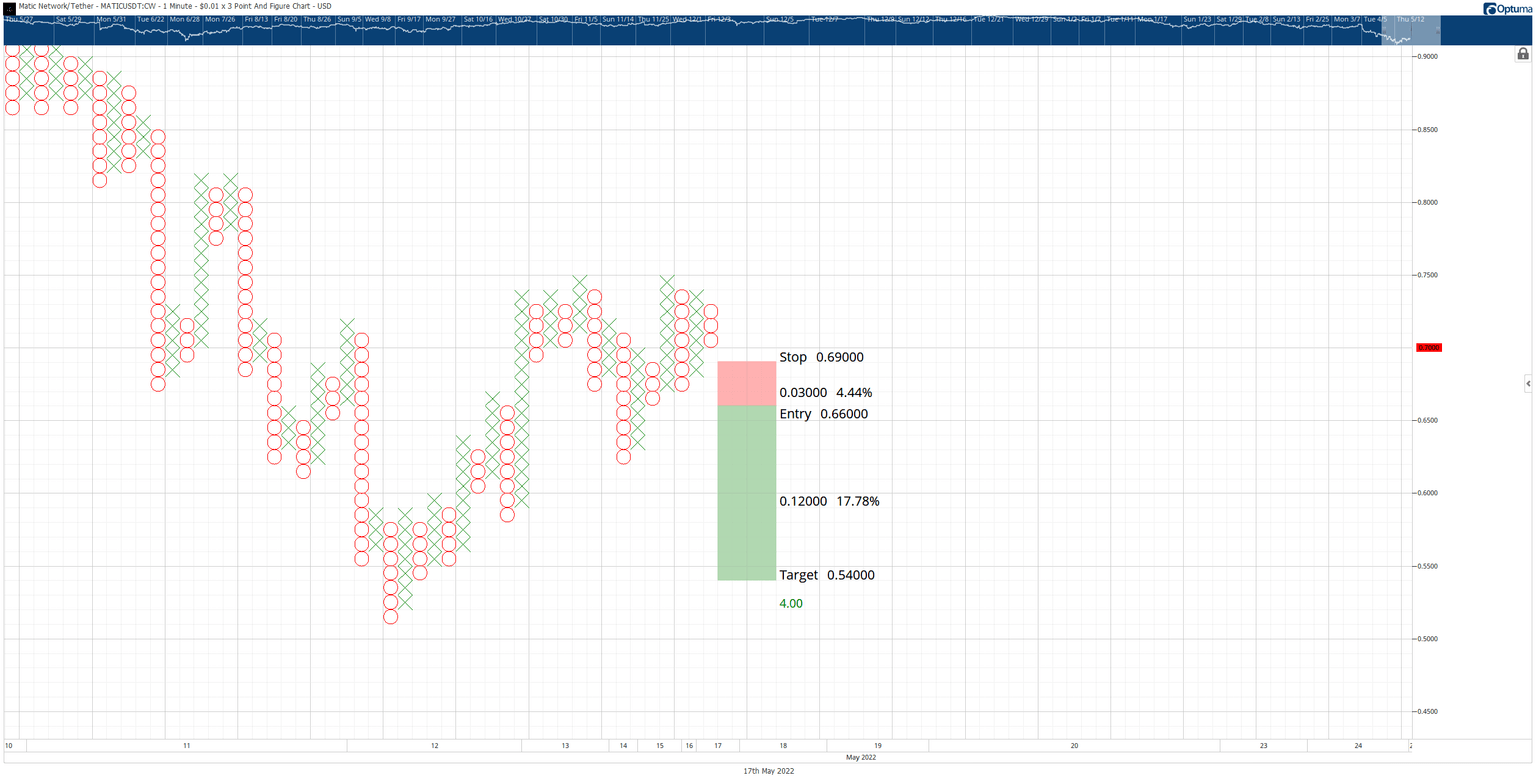

There is a theoretical short entry opportunity on the short side of the market with a sell stop order at $0.66, a stop-loss order at $0.69, and a profit target at $0.54. The setup is based on a breakout below a symmetrical triangle. The setup represents a 4:1 reward for the risk. However, the 2021 Volume Profile is exceptionally thin between $0.70 and $0.50, so a flash crash down to $0.50 is possible.

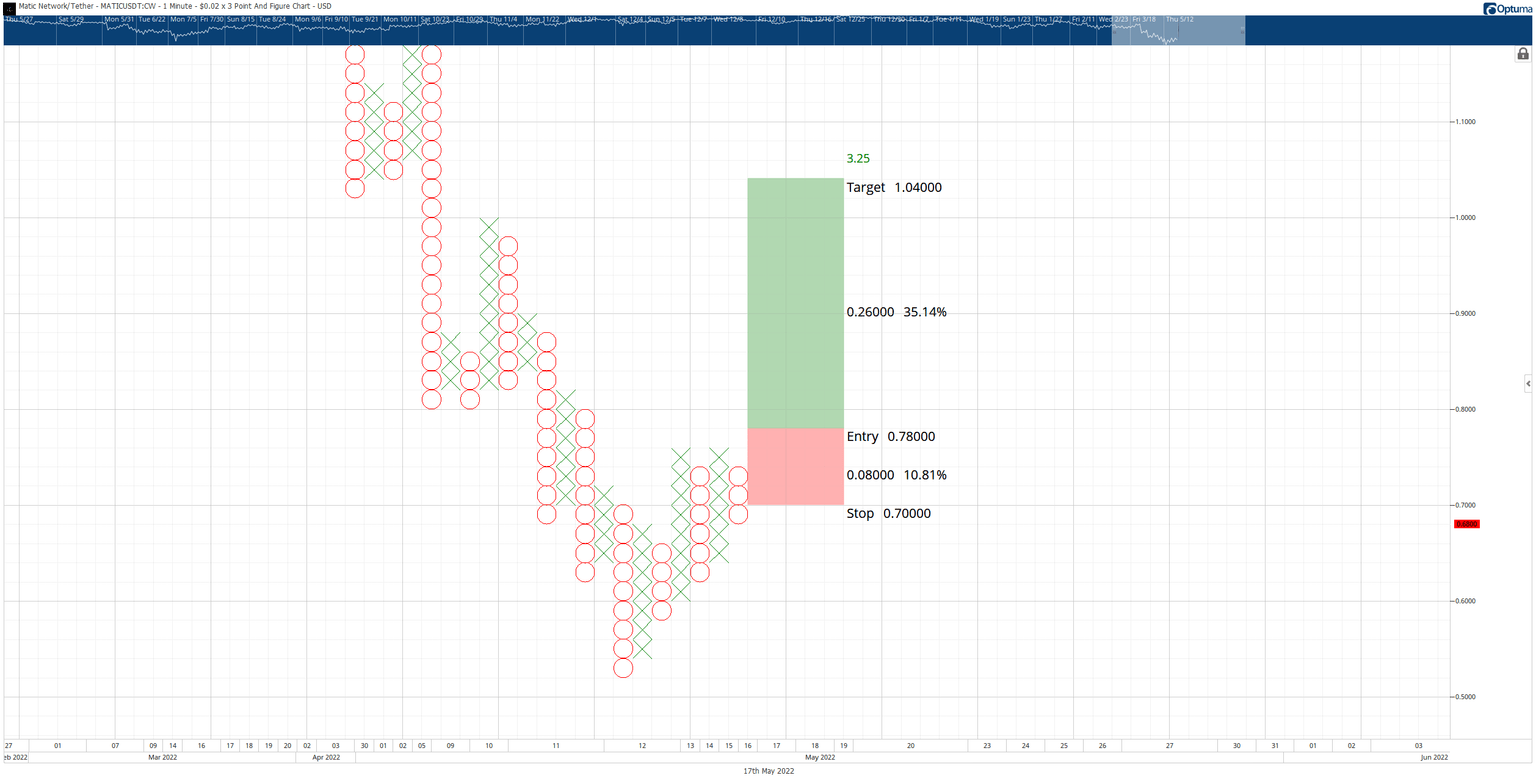

MATIC/USDT $0.02/3-box Reversal Point and Figure Chart

A two to three-box trailing stop would help protect against any whipsaws in price action made post entry. The theoretical short idea is invalidated if MATIC price moves to $0.75 before the short entry is triggered.

There is a hypothetical long setup on the long side of the market with a buy stop order at $0.78, a stop loss at $0.70, and a profit target at $1.04. The setup represents a 3.25:1 reward for the risk.

MATIC/USDT $0.01/3-box Reversal Point and Figure Chart

The profit target in long setup is one that may have difficulty reaching its profit target. Bulls should expect resistance near the high volume node at $0.84 and the Kijun-Sen at $0.90.

The long idea is invalidated if MATIC price falls to $0.60 before triggering.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.