Why do whales accumulate millions of Arbitrum?

- Dormant whale wallet addresses scooped up $1.43 million worth of Arbitrum tokens early Tuesday.

- Whale accumulation is considered a typical sign of a price rally in a token.

- ARB price climbed 6% since Monday, and more than 11% over the past week, signaling a bullish trend reversal.

Large wallet addresses in the Arbitrum network are buying millions of tokens, signaling a possible bullish catalyst for the asset after its price broke a multi-month downtrend.

Activity from large wallet investors, popularly known as whales, is one of the strongest indicators of trend reversals and price rallies among crypto assets. Therefore, recent moves by two of the largest whales is key to predicting ARB price trends in the short term.

Also read: XRP sees inflow of $240,000 in a week as crypto funds record largest influx of capital in 2023

Two dormant whales accumulate $1.43 million worth of ARB tokens

Based on data from crypto intelligence tracker Lookonchain, Arbitrum network’s large wallet investors are rapidly accumulating ARB tokens. Two whale wallet addresses scooped up $1.43 million worth of ARB tokens early on Tuesday.

One large wallet investor purchased 321,934 ARB tokens at $1.16 using $375,000 in Ether. The other spent 1,058,665 USDC to acquire 937,176 ARB tokens at $1.13. Both transactions occurred less than 12 hours apart.

Whale transactions of Arbirtrum

Three reasons why whales are accumulating ARB

Accumulation of the Layer 2 scaling solution is considered bullish for Arbitrum price. This behavior can be explained by the three catalysts which likely drove ARB price higher over the past week.

-

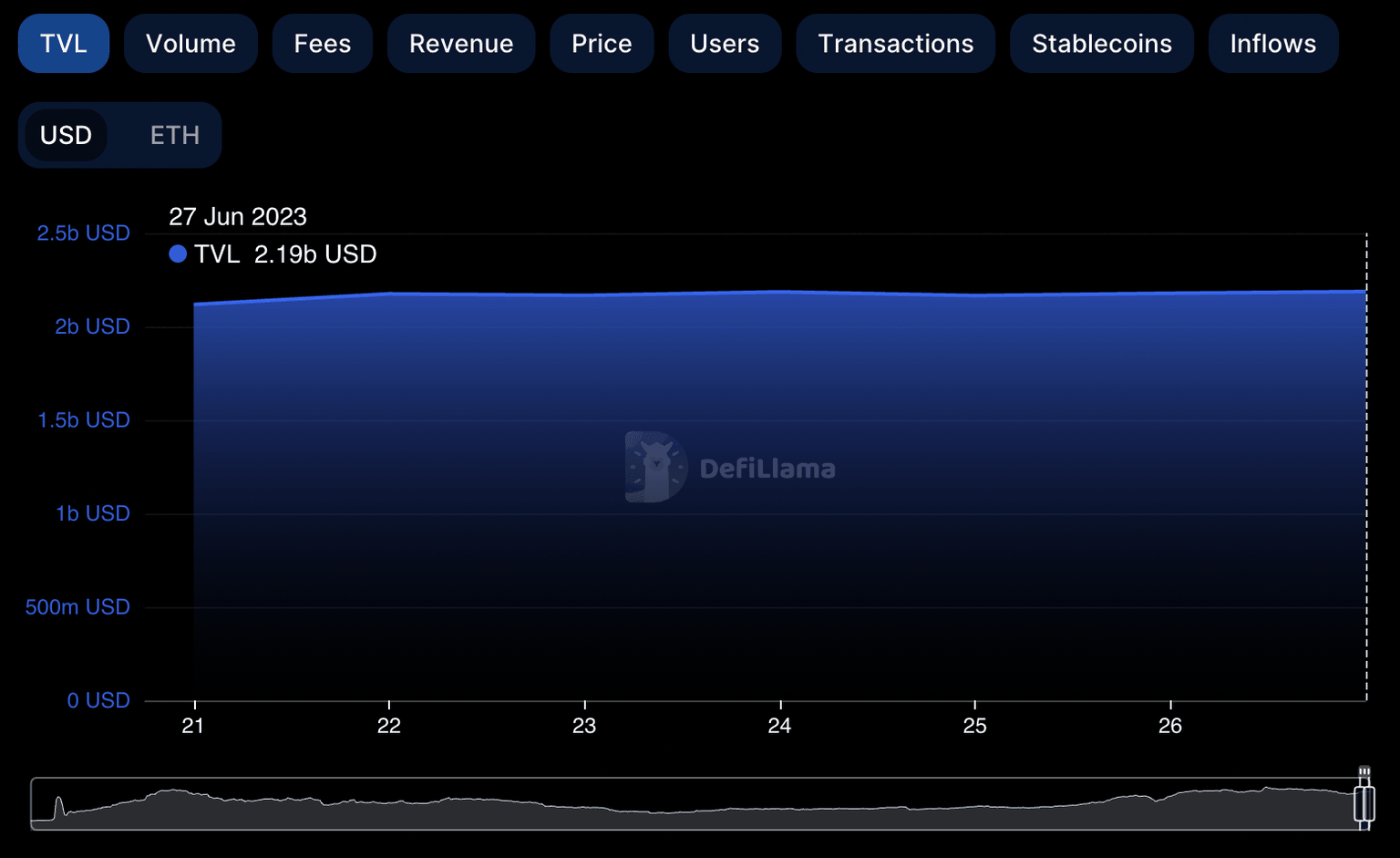

Total Value Locked (TVL) in ARB climbed

The TVL of Arbitrum network climbed from $2.05 billion on June 20 to $2.19 billion early on Tuesday. This is a significant increase in the value of crypto assets locked in the Arbitrum ecosystem, 6.8% spike within a week.

This metric implies a rise in adoption and dominance of the token among Layer 2 projects.

TVL in Arbitrum

-

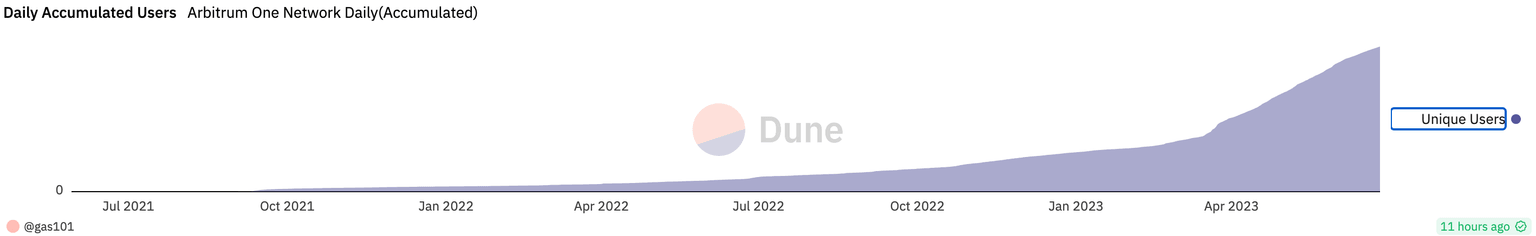

Daily accumulated users are on the rise

This metric represents the total number of users on the Arbitrum network. Based on data from crypto tracker Dune Analytics, there is a consistent increase in the daily accumulated users of ARB.

Daily accumulated users

The on-chain metric points to increasing network growth and adoption given Arbitrum’s dominance among Ethereum Layer 2 scaling solutions.

-

Arbitrum ecosystem-related projects grow

Arbitrum has listed several projects in the ARB ecosystem. Counter Fire, an Anime blockchain game, was launched recently.

@_CounterFire has landed to the Arbitrum ecosystem

— Arbitrum (,) (@arbitrum) June 26, 2023

Welcome to the first anime #MOBA + #BattleRoyal game on blockchain https://t.co/ETrtDohp6P

Sharp Labs, a project that builds DeFi protocols, was also recently rolled out.

Exciting updates from @Sharp_Labs https://t.co/yWp1qhfSUK

— Arbitrum (,) (@arbitrum) June 26, 2023

The release of new projects on Arbitrum’s blockchain is bullish for the adoption of ARB in the long term.

ARB price analysis

Arbitrum price climbed from $1.08 on June 20, to $1.20 as of early Tuesday. This marks an 11.11% increase in ARB price over the past week. The Layer 2 scaling token was in a multi-month downtrend between April 14 and June 21.

ARB/USDT one-day price chart Binance

ARB price recently broke out of its downtrend with a definitive close above the trendline as seen in the price chart below. The 50-day Exponential Moving Average (EMA) at $1.13 and the 10-day EMA at $1.10 are two key support levels for ARB. The next key resistance is the monthly high of $1.39, as seen in the chart.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.