Why ApeCoin price will not monkey around anymore

- ApeCoin price is making some big moves as it breaks above a two-month-old declining trend line, suggesting a bullish resurgence.

- Investors can expect a 20% upswing after another confirmation.

- A four-hour candlestick close below $4.28 will invalidate this bullish outlook for APE.

ApeCoin price shows that it is ready for more gains after months of consolidation. This move, while bullish, needs another supporting breakout to kick-start the potential rally for APE.

ApeCoin price ready for more gains

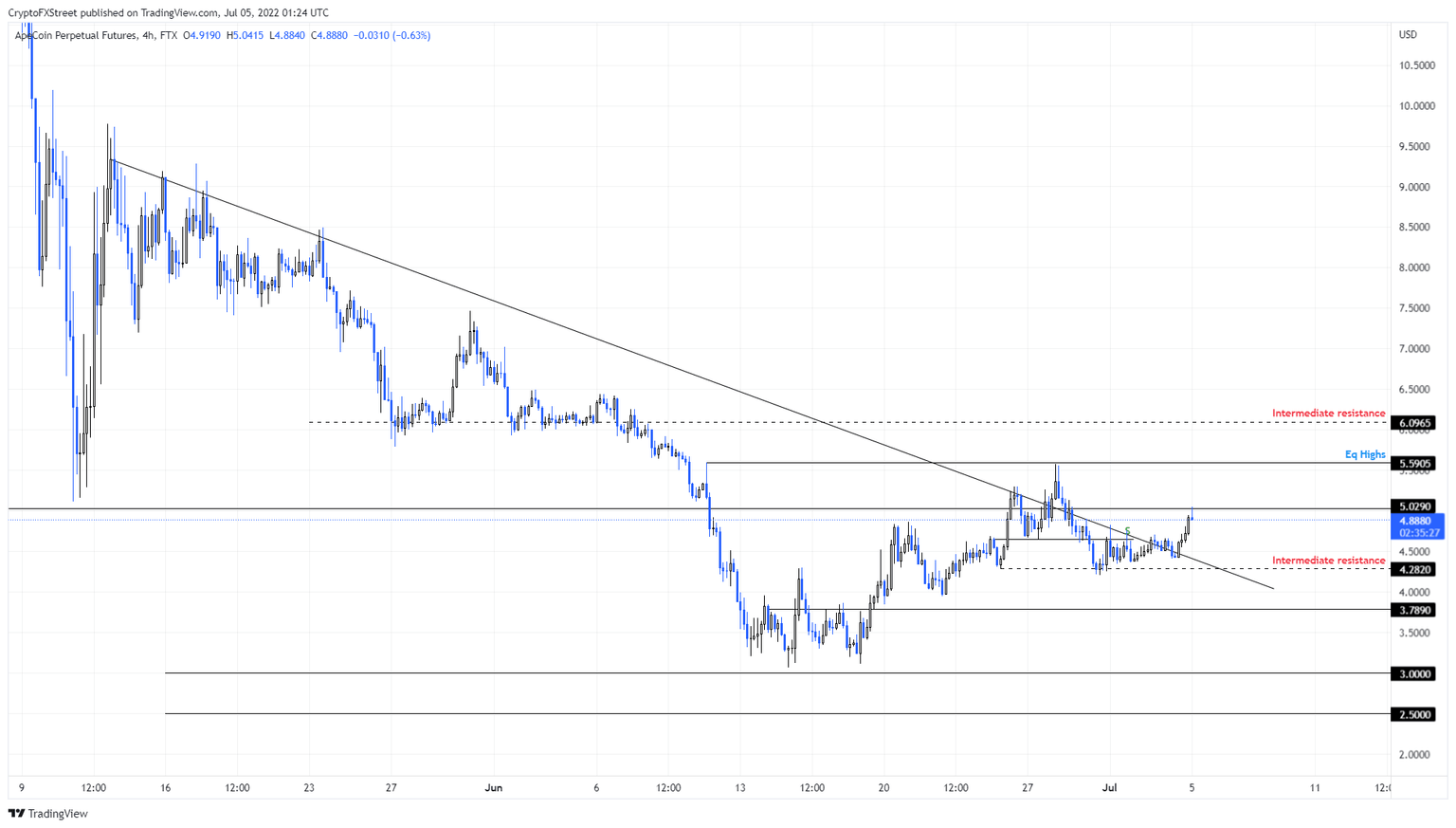

ApeCoin price has rallied 13% over the past 24 hours and shows signs that it wants to rally higher. The recent uptick has pushed APE to break above a two-month declining trend line, indicating that the bulls are back.

However, the journey north is not a cakewalk as ApeCoin price will need to overcome the immediate resistance barrier at $5.02. This level is key to triggering a further uptrend for APE. Clearing this hurdle will allow the market makers to push the altcoin above $5.59 to collect the liquidity resting above the equal highs.

This retest or sweep is the first resting point for ApeCoin price. If bullish momentum persists, there is a high probability that APE continues on its path and retest the $6.09 resistance level. In total, this run-up would constitute a 20% ascent and is likely where the short-term upside is capped for the altcoin.

APE/USDT 4-hour chart

Regardless of the bullish outlook for ApeCoin price, investors need to note that the uptrend is highly reliant on a breakout above the $5.02 hurdle. Even after that, there is no guarantee that the uptrend will extend beyond $5.59.

Furthermore, if Bitcoin price tanks before APE reaches the $5.02 barrier, it couldundo the bulls’ hard work. The worst-case scenario would be if ApeCoin price produces a four-hour candlestick close below $4.28; this development will create a lower low relative to the swing lows formed after June 25 and therefore invalidate this bullish outlook.

In such a case, APE.could crash 13% to $3.78 to find a stable support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.