Why a slow descent for Shiba Inu is likely after 355% rally

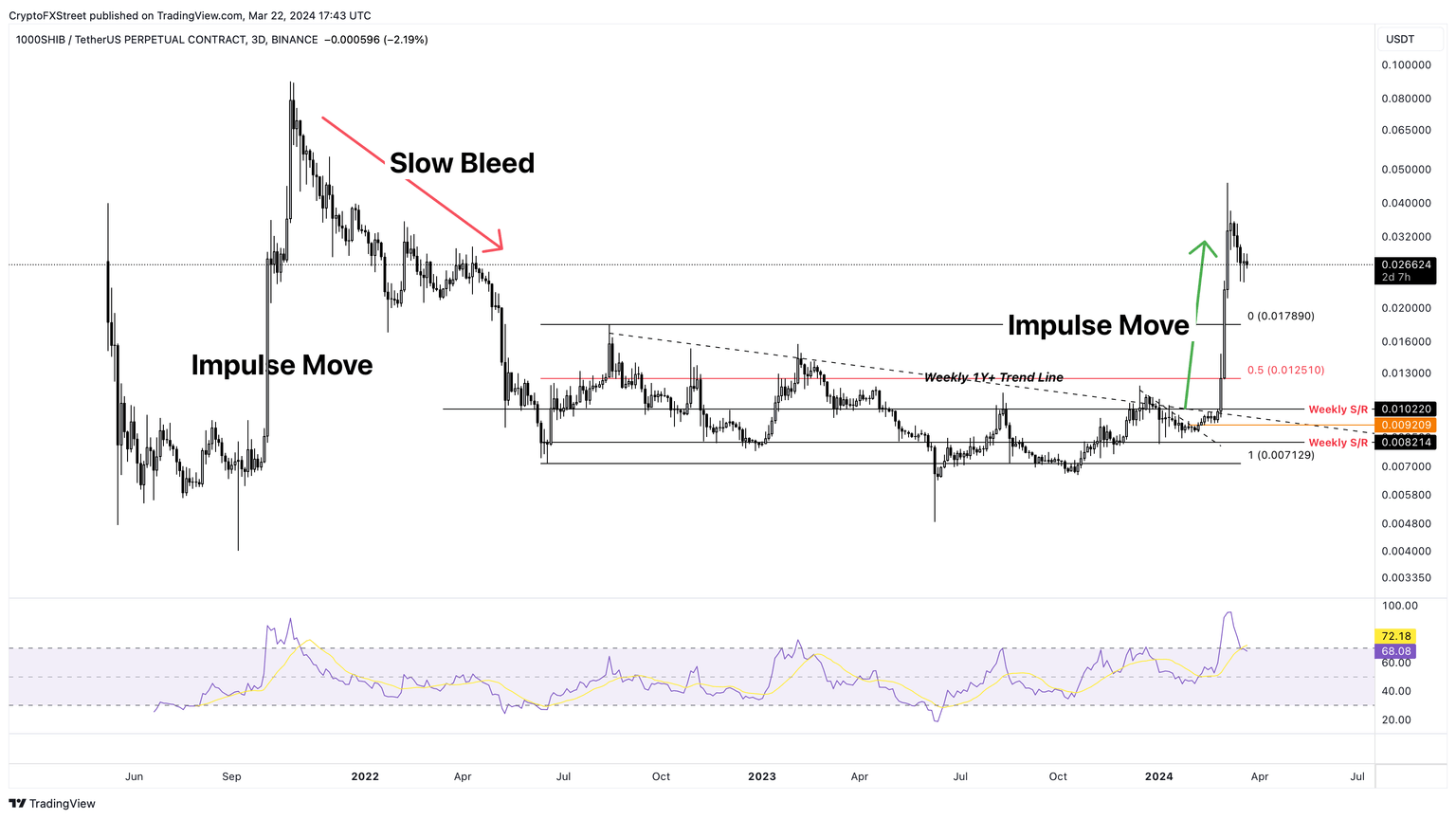

- Shiba Inu price registered a 354% gain between February 27 and March 4 after breaking out of its 652-day consolidation.

- SHIB has already shed 42% and is currently trading at $0.0000264.

- Investors can expect the meme coin to drop another 32% and retest $0.0000178.

Shiba Inu (SHIB) price consolidation from May 13, 2022, ended on February 27, 2024, when SHIB saw a massive breakout rally. However, as investors continue to book profits, a slow bleed seems likely for the meme coin.

Also read: Shiba Inu holders take profits, pushing SHIB price nearly 45% below its 2024 peak

Shiba Inu price ready to slide lower

Shiba Inu price surged 354% between Feburary 27 and March 4, ending its two-year consolidation. While this move might seem impressive to new investors, meme coins, especially Dogecoin (DOGe) and SHIB, tend to do this more often.

The Shiba Inu price action noted a four-month consolidation in 2021, which ended in October 2021, as SHIB rallied 1,162%. What’s interesting is not the impulsive move but the price action that ensued—a slow bleed, where SHIB undid all the gains in the next eight months.

If history repeats, a similar price action could unfold for Shiba Inu price after the 354% rally. Therefore, investors should note that SHIB could drop at least 30% and retest the range high of $0.0000178.

It wouldn’t be surprising if Shiba Inu price flips the aforementioned level and tags the range’s midpoint at $0.0000125. This correction, however, would constitute a 52% decline.

Read more: Shiba Inu Price Prediction: SHIB might drop 10% for a liquidity sweep before next leg up

SHIB/USDT 3-day chart

On the contrary, Shiba Inu price could bounce off the range high at $0.0000178 and kickstart another leg up. This move would align with the broader market sentiment, which is bullish and invalidate the deeper correction outlook noted above.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.