Weekly recap: TRON expands to Ethereum, XRP social volume spikes, Credit Suisse-backed firm integrates Polygon

- TRON is now accessible on the Ethereum network through the BitTorrent Bridge.

- XRP observed a large increase in social volume in May, setting the stage for price recovery ahead of the SEC vs. Ripple verdict.

- Credit Suisse-backed firm Taurus integrated Polygon on its tokenization and custody platforms, boosting the Layer-2 scaling solutions adoption.

This week, Bitcoin and altcoins in the top 30 assets continued their decline. XRP decoupled from the rest of the altcoins and observed a rise in social volume. MATIC’s blockchain continues to bag partnerships and integrations with giants like Credit Suisse-backed Taurus.

Also read: Bitcoin price struggles after mixed US NFP data

Justin Sun’s TRON expanded to the Ethereum network with the BitTorrent Bridge

TRON expanded to the largest altcoin network, likely to drive the token’s adoption higher with exposure to the Ethereum blockchain. Justin Sun, the founder of TRON, announced that the token is fully accessible within the Ethereum ecosystem.

The decentralized social network token will use the BitTorrent Bridge to expand its reach and boost its liquidity on the Ethereum network. TRON price is up nearly 2% since Thursday, trading at $0.0762 at the time of writing.

Also read: Justin Sun’s TRON hits all-time high of 10.9M daily transactions, braving crypto winter

XRP decoupled from altcoins in the crypto ecosystem with rising social volume

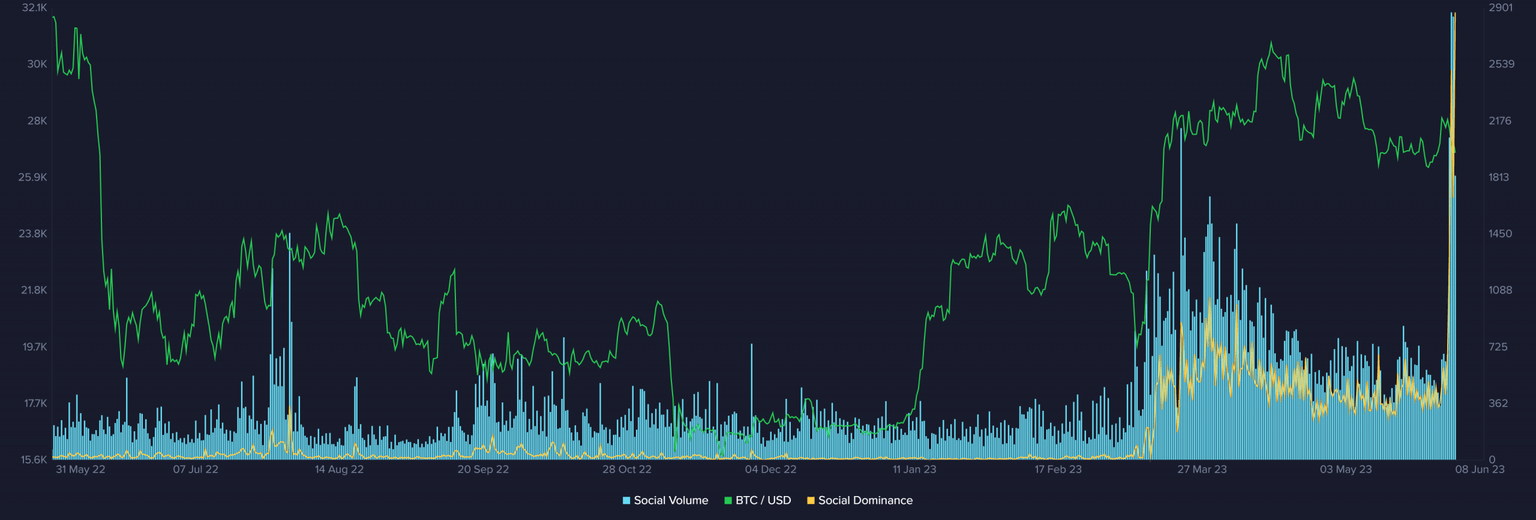

Based on data from crypto intelligence tracker Santiment, XRP observed a surge in social volume in online discussions across several platforms. The social volume chart indicates that there were upwards of 3,000 mentions of XRP on May 31.

XRP social dominance and volume as seen on Santiment

At the time of writing, the volume sustained above 2,000 mentions as XRP decouples from the rest of the altcoins and cryptocurrencies.

Read more: XRP unlocks tokens worth $500 million as SEC vs. Ripple verdict looms

Polygon makes strides with its partnerships and integrations with giants

Credit Suisse-backed Taurus deployed on the Polygon blockchain, opening the door to the issuance and custody of tokenized assets for banks and brands. The FINMA-regulated European leader in payments has announced complete integration with Ethereum’s Layer-2 scaling solution.

Banks, brands and issuers can now access tokenized assets on Taurus, supported by the Polygon blockchain, including its native token MATIC and Polygon-based smart contracts. Interestingly, Taurus is a European giant with upwards of 60% market share in Switzerland.

Read more about Polygon’s partnerships here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.