Weekly Recap: Bank runs, stablecoin drama, Voyager bankruptcy hearing, threat to DOX Shiba Inu founder

- The depegging of the USDC stablecoin was followed by $3 billion in capital outflows and rise in adoption of its rival project TUSD.

- A New York bankruptcy judge denied the US government’s request to delay Binance’s $1 billion acquisition of bankrupt Voyager’s assets.

- BitBoy crypto creator Ben Armstrong threatened to DOX Shiba Inu lead developer Shytoshi Kusama.

US bank runs sent shockwaves through market participants, traders turned to Bitcoin and the “safe haven” narrative made a comeback. Binance’s $1 billion acquisition of bankrupt crypto lender Voyager is back on track with a ruling from a New York bankruptcy judge.

Binance CEO Changpeng Zhao picked TUSD to offer fee-free trade on the BTC/TUSD pair, fueling explosive growth in the stablecoin’s market capitalization. The week’s events took a serious turn with YouTube creator Ben Armstrong threatening to DOX Shiba Inu’s lead developer.

Also read: Bitcoin reserves on exchanges continue climbing amidst rising inflows, is this a sell signal?

US bank runs escalate FUD among market participants

The US bank run saga started on March 10, with the collapse of one of the most tech-friendly banks, Silicon Valley Bank. Federal regulators stepped in to allay fears and limit the risk of contagion. Find a timeline of major events below:

- March 8- Crypto-friendly bank Silvergate capital announced its voluntary liquidation, SVB announced it needed to shore up its balance sheet and sold bond portfolio at a $1.8 billion loss. Also read: Cryptocurrency exchanges reassure saftey after Silvergate bank shuts down

- March 10- SVB failed after a run on deposits. The bank reportedly worked with financial advisers until the morning to find a buyer. By midday, regulators took over the nation’s 16th-largest bank, and the Federal Deposit Insurance Corporation was named the receiver. The failure of the 40-year-old institution became the largest bank crash since the 2008 financial crisis, and it put nearly $175 billion in customer deposits under. First Republic, Signature Bank and Western Alliance felt investors’ uncertainty, and large banks appeared to be insulated from the fallout.

- March 12- Regulators seized Signature bank to curb the spread of the contagion. The Federal Reserve, the Treasury Department and the F.D.I.C. announced jointly that “depositors will have access to all of their money starting Monday, March 13.” The Fed announced its emergency lending program with approval from the Treasury. Also read: Affected by Signature Bank collapse, Okcoin pauses USD wire and ACH deposits, among other services

For more: Can the collapse of Silicon Valley Bank fuel the China coin narrative?

- March 16- The Federal Reserve announced that, as of Wednesday, banks had borrowed $11.9 billion from the emergency loan program. Janet L. Yellen testified before the Senate’s Finance Committee and reassured the public that America’s banks are “sound.” Also read: Former President of FTX.US believes bank meltdowns can reshape crypto for traders

New York bankruptcy judge denied US government’s request to delay Voyager’s asset acquisition

While US regulators continue their crackdown on cryptocurrency firms and institutions, a New York bankruptcy judge denied the US government’s request to delay the $1 billion acquisition of Voyager.

Michael Wiles, a judge in the Southern District of New York said that waiting longer would harm Voyager’s clients and Binance’s $1 billion purchase of Voyager’s assets is set to come into effect on March 20.

Find out more: US government’s request to halt Binance’s acquisition of Voyager turned down, what does this mean for BNB?

When BitBoy Crypto threatened to DOX Shytoshi Kusama

Shiba Inu’s development team recently announced the launch of its layer-2 scaling solution Shibarium’s public beta. While SHIB holders rejoiced, drama unfolded when YouTube content creator Ben Armstrong threatened to DOX lead developer Shytoshi Kusama.

Wait until I dox the founder of $SHIB it’s coming this week. Heck maybe tmrw https://t.co/aAKW39I92G

— Ben Armstrong (@Bitboy_Crypto) March 16, 2023

A tweet that surfaced on crypto Twitter accused Shibarium of being a rip-off of Rinia, sharing screenshots as evidence.

HOLY SHIT. Serious escalation in official $SHIB discord.

— Rancune (@Rancune_eth) March 16, 2023

Shibereum is a ripped chain from Rinia, they forgot to change chain ID.

Mod tells us about manipulation and silencing. $bone $shib $leash## pic.twitter.com/Lw8IDidDqA

Also read: Anxiety in SHIB’s official discord on allegations that Shibarium stole code for their chain

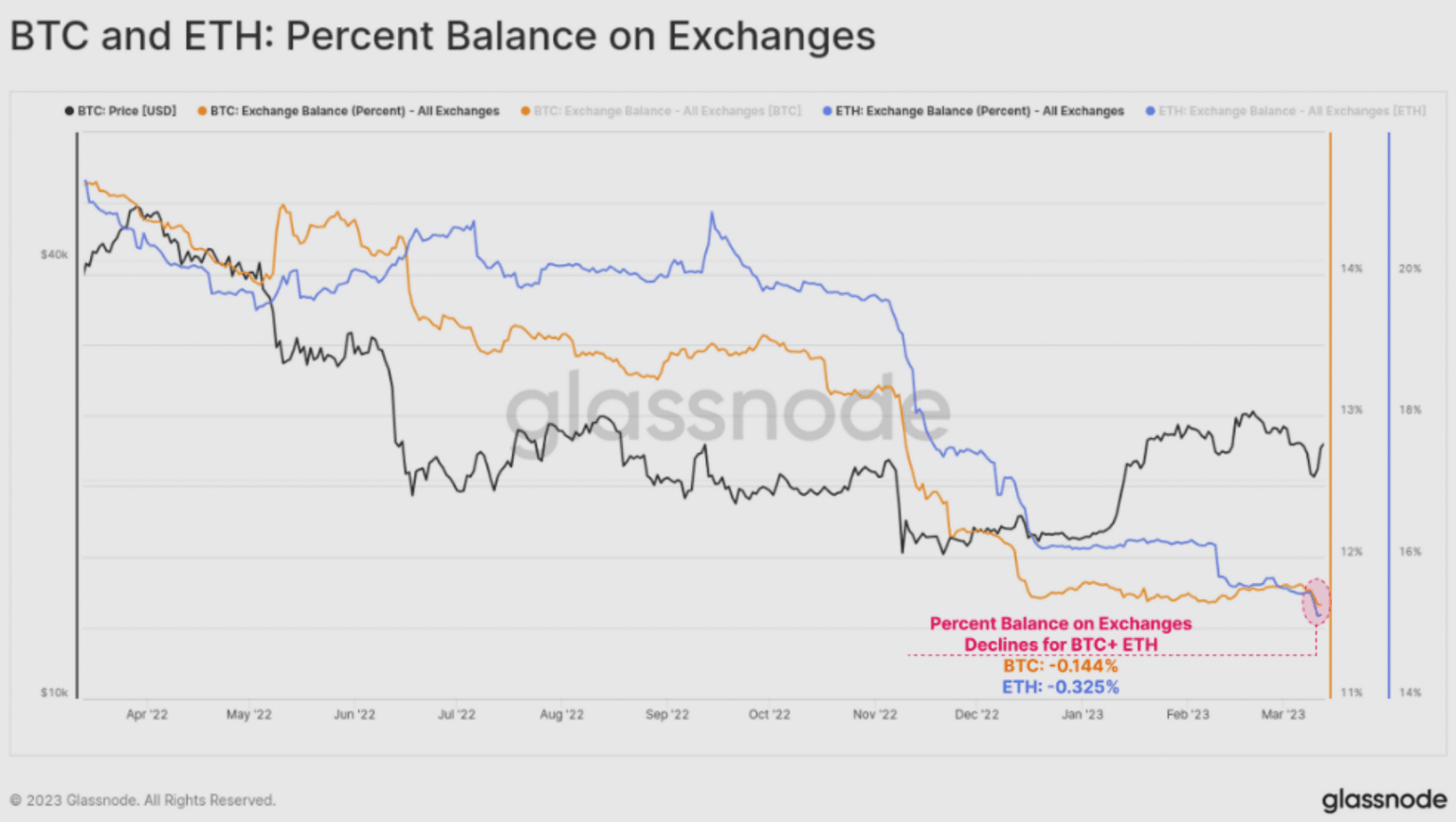

Based on on-chain data from crypto intelligence tracker Glassnode, three major events emerged as a theme this week. The de-pegging of stablecoins, massive exchange outflows and Bitcoin price hitting a nine-month high despite rising BTC reserves on exchanges.

Approximately 0.144% of all BTC, and 0.325% all ETH in circulation was withdrawn from exchange reserves. This resembled the aftermath of the FTX exchange collapse.

BTC and ETH: Percent Balance on Exchanges

On a USD basis, the last month saw over $1.8 billion in combined BTC and ETH value flow out of exchanges.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.