Waves Price Analysis: WAVES sell-off gains traction, bears target at $5

- Waves is vulnerable to further losses with the critical bearish target of $5.

- A recovery above $8.7 is needed to invalidate the bearish forecast.

Waves has been one of the best-performing altcoins recently. The coin bottomed at $2 in early October and hit the highest level of 2020 at $9.37. However, the token has run out of luck. The price lost over 14% amid profit-taking and market positioning in less than a week and dropped below $8.

At the time of writing, the 30th largest digital asset is changing hands at $7.9, while technical indicators on the long-term time frames imply that the worst is not over yet.

Waves bears are here to stay

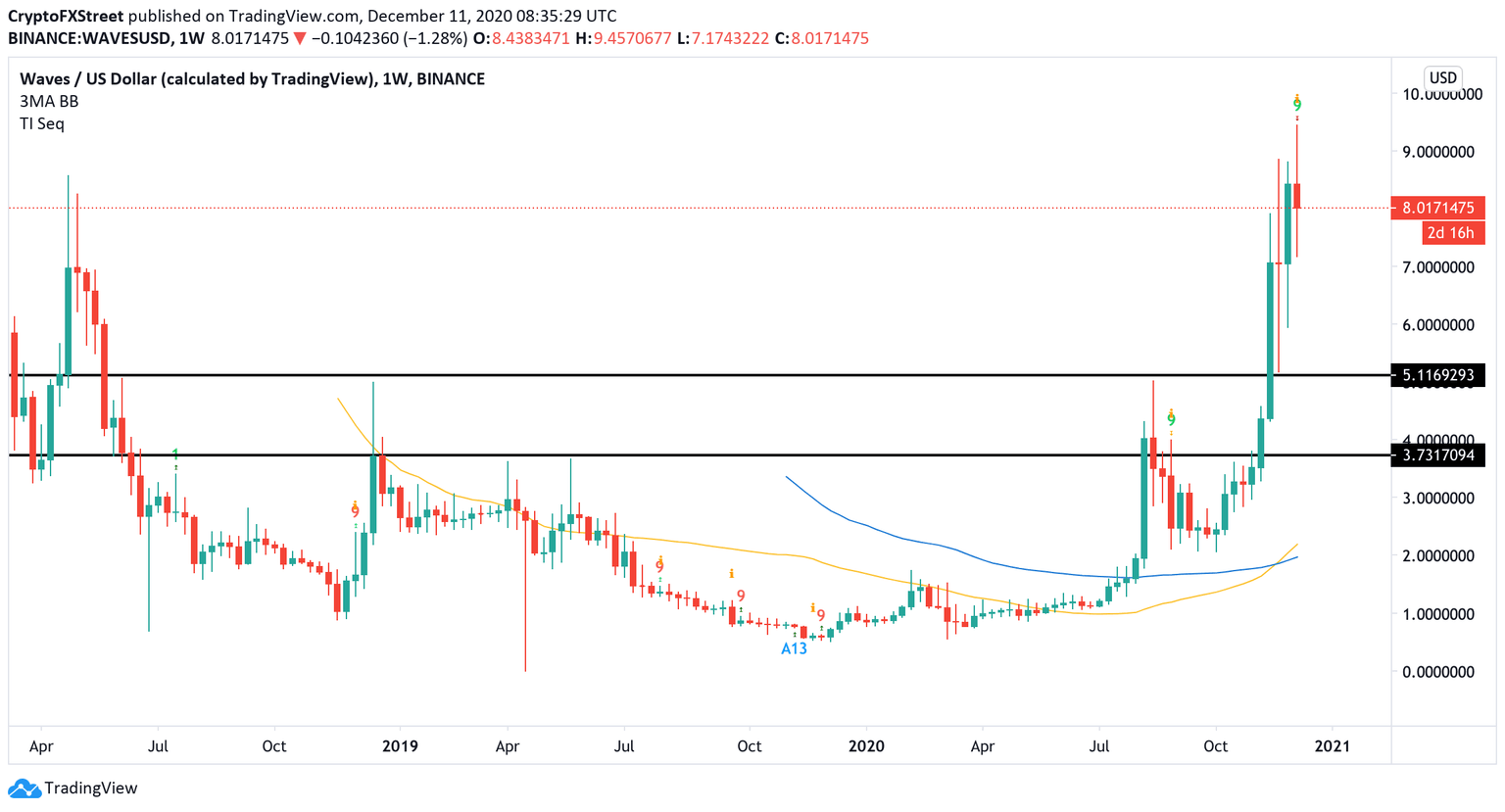

The TD Sequential indicator sends a sell signal on Waves weekly chart. The bearish formation presented in the form of a green nine candlestick implies that the growing selling pressure may see prices develop from one to four red candlesticks on the weekly chart with the initial target at $5. This former resistance was verified as a support at the end of November. A sustainable move below this area will be a catastrophe for the coin as there is no viable support until $3.7.

WAVES weekly chart

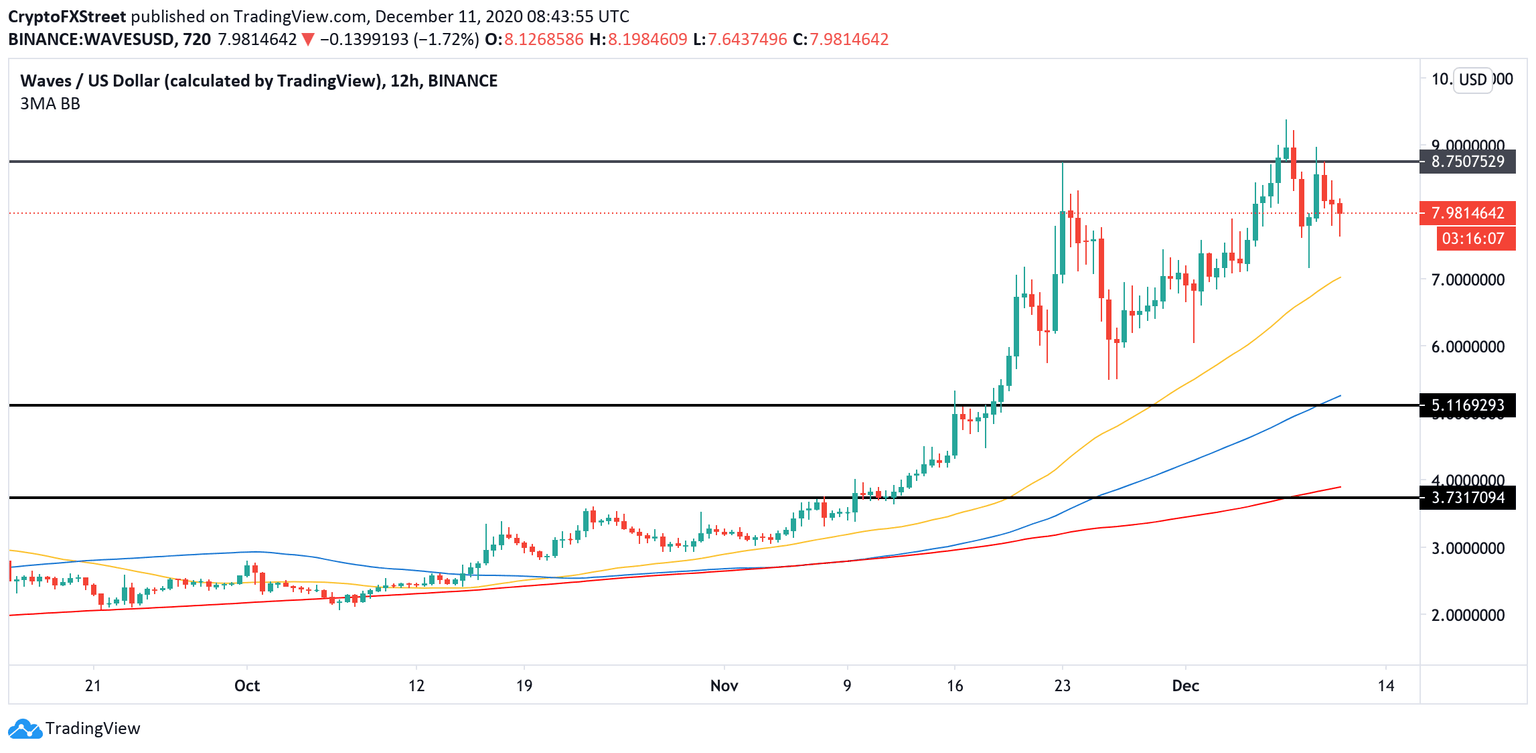

On the 12-hour time frame, there is local support around $7 created by the 50 EMA. If it gives way, the sell-off will continue towards the above-mentioned long-term target of $5, which is also reinforced by 12-hour 100 EMA.

WAVES 12-hour chart

On the upside, the local resistance comes on approach to $8.7. This barrier served as resistance on November 23 and also stopped the recovery attempt on December 10. The technical barrier may slow down the upside momentum and push the price back inside the current range. A sustainable move above this area will negate the immediate bearish forecast and bring the 2020 high at $9.37 back into focus.

Author

Tanya Abrosimova

Independent Analyst