Waves Price Analysis: WAVES rises to new all-time highs despite growing number of sell signals

- Waves price is up by almost 350% in the past month despite the selling pressure.

- Several indicators show that Waves is on the verge of a pullback.

Waves has been outperforming the market in the past month growing by almost 350% and establishing a new two-year high at $9.32. The digital asset seems unstoppable but some indicators are showing concerning signs.

Waves price might be poised for a pullback in the short-term

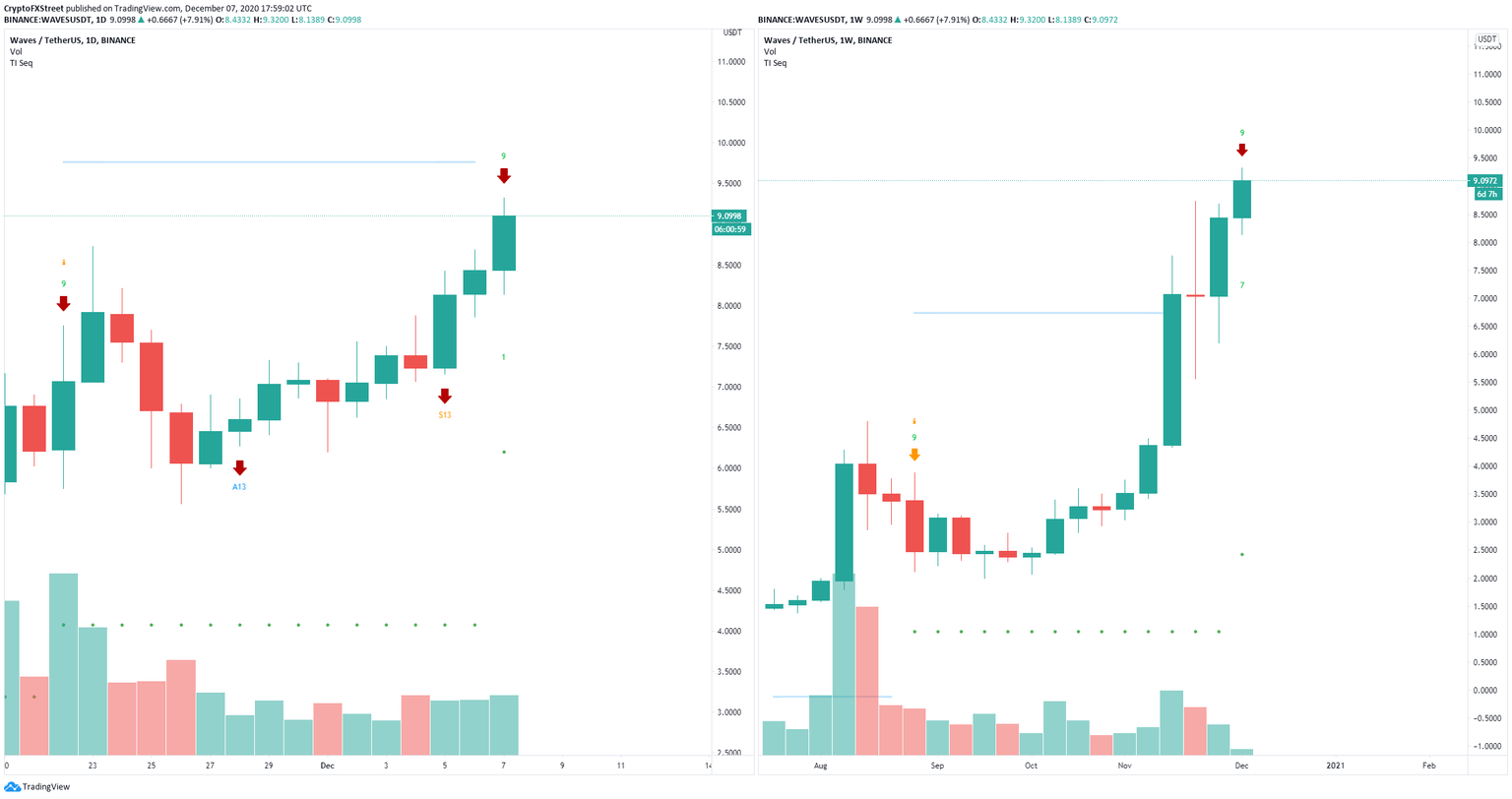

One of the most concerning signs for the bulls is the sell signal presented on the daily and weekly charts by the TD Sequential indicator. This is a major bearish indicator which could mean that Waves price is aiming for a pullback before resuming its strong uptrend.

WAVES/USD daily and weekly charts

It also seems that the trading volume of Waves is peaking again like it happened on November 21 before a significant crash and November 23 which pushed Waves price from $8.32 towards $6 just a few days later.

WAVES Trading Volume

The current rise in trading volume could potentially indicate that another local top is being formed. On the other hand, the current bullish momentum could simply continue pushing Waves to new highs as it faces very little resistance to the upside.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.03.20%2C%252007%2520Dec%2C%25202020%5D-637429612715574330.png&w=1536&q=95)