Valkyrie spreads risk, diversifies custody for its BRRR Bitcoin ETF between BitGo and Coinbase

- Valkyrie has become the first issuer to diversify custody services for its BTC ETF.

- Coinbase and BitGo will custody the BRRR henceforth as counterparts stick to singular custodial services.

- The move could inspire confidence among investors by reducing custodial risk.

Valkyrie Fund has taken a different approach to bolster its position in the spot Bitcoin exchange-traded fund (ETF) market. While market peers such as Bitwise, VanEck, and Hashdex focus on commercials, the firm has opted to reassure customers with reduced custodian risk.

Also Read: BlackRock, Franklin Templeton, VanEck among issuers advertising spot BTC ETF on Google

Valkyrie chooses different path in BTC ETF marketing wars

Valkyrie Bitcoin Fund (BRRR) will henceforth be custodied by both BitGo and Coinbase, a paradigm shift from what other players in the spot Bitcoin ETF market are doing.

Very interesting move -- @ValkyrieFunds moving to use @BitGo for custody of their #Bitcoin in $BRRR via filing today. https://t.co/XWH3hCuQT9 pic.twitter.com/gWsT6lO2cO

— James Seyffart (@JSeyff) February 1, 2024

It comes after a Thursday filing, with the firm revealing the move, noting that BitGo will be providing custody and safekeeping services for the trust’s BTC holdings. Among other benefits, the move will help boost investor confidence as it points to reduced custodial risk, with two entities handling safekeeping.

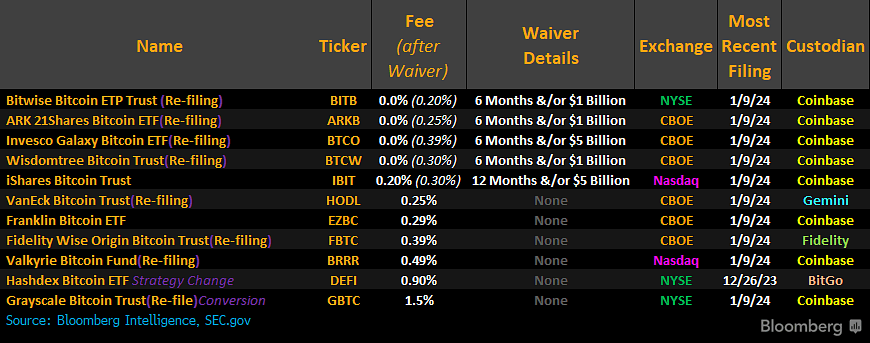

As indicated, this is a paradigm shift, considering Valkyrie’s peers in the ETF market have singular custodians. Coinbase was recorded as the leading custodian for eight out of the 11 (8/11) applications, with VanEck, Fidelity, and Hashdex choosing otherwise. With the latest development, Valkyrie joins Hashdex, which also has BitGo as its custodian alongside Coinbase.

Spot BTC ETF issuers and custodians

ETFStore founder Nate Geraci anticipates more diversity in custodial services soon, saying, “I would be surprised if most of them do not have multiple custodians over the next quarter.”

“I would be surprised if most of them do not have multiple custodians over the next quarter.”

— Nate Geraci (@NateGeraci) February 1, 2024

ETF issuers talking to BitGo, Gemini, Kraken, etc to serve as secondary custodian for spot btc ETFs.

Diversifies risk & can pressure down custody fees.

via @olgakharif @Yueqi_Yang pic.twitter.com/rCRQwhtp4b

The predominance of Coinbase as a primary custodian comes on the back of its helm as the largest US-based exchange.

Meanwhile, reports indicate that while all of the new ETFs are doing well, four have managed to outdo themselves. These are BlackRock (IBIT), Fidelity (FBTC), Ark/21Shares (ARKB), and Bitwise (BITB).

Noteworthy spot bitcoin ETF stats via @JSeyff...

— Nate Geraci (@NateGeraci) February 1, 2024

IBIT, FBTC, ARKB, & BITB have all posted inflows on *each* of their first 14 trading days.

By contrast, GBTC w/ outflows *every* day since converting into an ETF. pic.twitter.com/ZFy31V8sSl

With BlackRock in the lead, the fund manager has since taken its spot BTC ETF product on Wall Street, projecting its ETF product on the wall.

BlackRock Bitcoin ETF Ad

— Altcoin Daily (@AltcoinDailyio) February 1, 2024

Projected on Building Near Wall Street pic.twitter.com/HYId4Aeqjj

As reported, issuers are already showcasing their offerings on Google, with BlackRock, Fidelity, Franklin Templeton, and VanEck among issuers advertising spot BTC ETF on the giant search engine.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.