Uniswap to conduct on-chain voting on May 31 despite SEC Wells notice, UNI could extend gains over 20%

- Uniswap plans to conduct on-chain voting to automate fee collection and distribution on May 31.

- The DeFi project is pushing forward despite the SEC Wells Notice received in April 2024.

- UNI could extend gains and rally 20%, erasing losses from April.

Uniswap (UNI) is the governance token of the decentralized exchange platform. The project received a Wells Notice in April 2024 and responded to it in May. Despite the Securities and Exchange Commission’s move, the DeFi project is moving on with its on-chain vote to lay the groundwork for automating fee collection and distribution.

Voting commences on May 31, per an official post in the Uniswap governance forum.

UNI price added 5% to its value on Saturday and sustained weekly gains of 43.27% on Binance.

Uniswap gears up for on-chain voting on May 31

Uniswap responded to the Wells Notice, a notification issued by regulators to inform that infarctions have been discovered, in May 2024. Marvin Ammori, Chief Legal Officer at Uniswap Labs tweeted about the response and said that the project is in full compliance with US law and that the SEC is targeting assets and people in nations “well beyond its authority.”

Ammori explains that an estimated 75% usage of Uniswap’s services is outside the US and nearly 90% of the volume traded on the DEX is outside the SEC’s jurisdiction. Uniswap’s CLO notes that the DEX provided their views on SEC’s allegations and will litigate if required.

Today, @Uniswap has submitted our response to the SEC Wells notice we received in April.

— Marvin Ammori (@ammori) May 21, 2024

The Uniswap protocol represents an innovation in commerce that solves long-standing problems– with near-instant, intermediary-free, secure trading of any assets. It is the first widely used…

The protocol therefore responded to the Wells Notice and is preparing to conduct on-chain voting on May 31. The vote will help automate fee collection and distribution and UNI holders who wish to participate in the vote are required to delegate their tokens prior to the date of the vote.

The DEX believes that the novel mechanism for voting in the future will reduce the burden on Uniswap Governance while maintaining the DeFi protocol’s credibility.

Uniswap governance discussion

UNI sustains weekly gains, eyes 22% rally

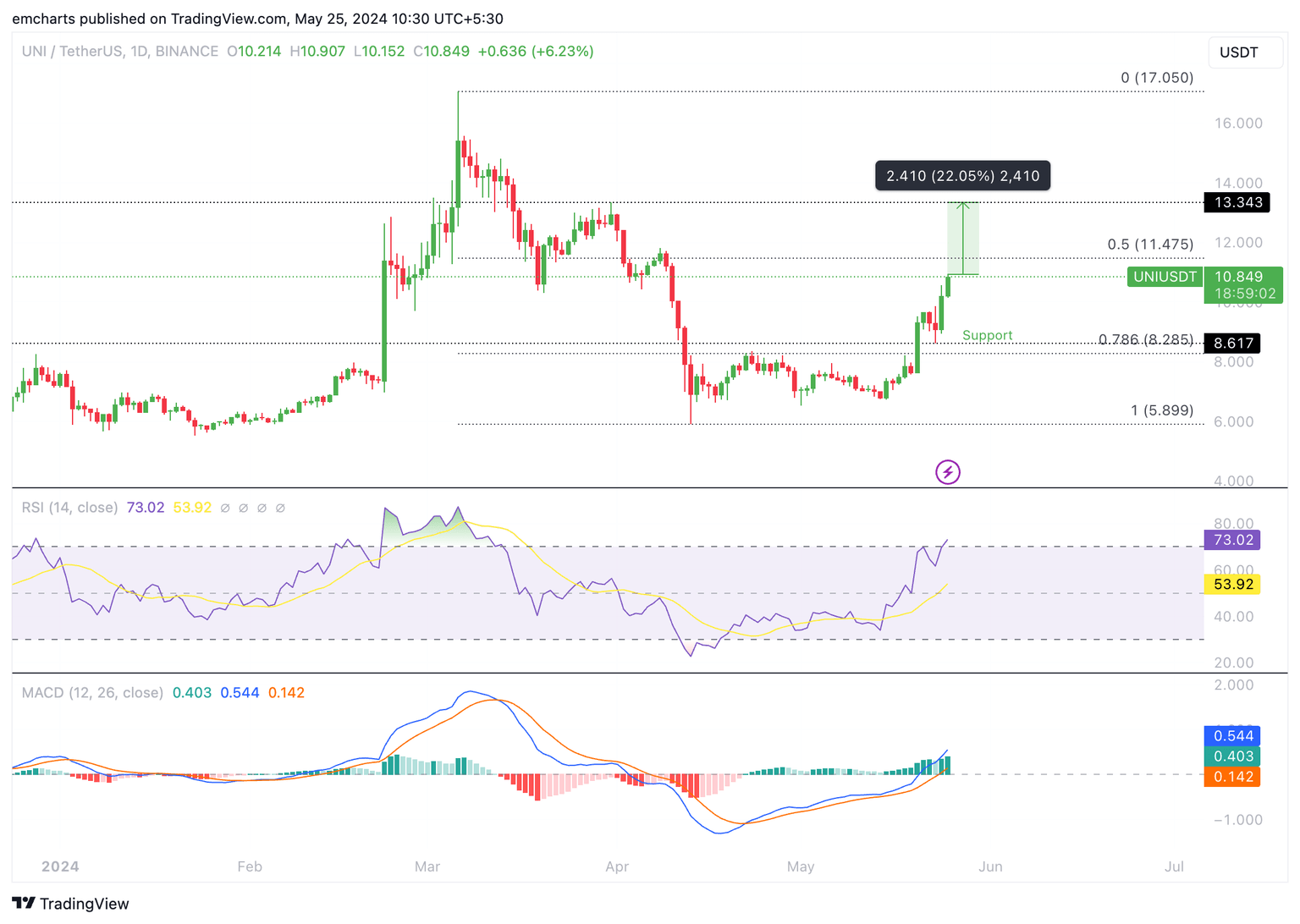

Uniswap extended its gains by nearly 6% on Saturday and sustained weekly gains of nearly 45%, on Binance. The DeFi token could extend its rally further and target the March 31 high of $13.343 as seen on the UNI/USDT 1-day chart.

UNI suffered a steep decline between March 6 (high of $17.040) and April 13 (low of $5.899). UNI price has sustained above the 78.6% Fibonacci retracement level of this decline, at $8.285 for nearly five days now.

Uniswap could extend its rally to March 31 high, marking 22% gains for holders.

The momentum indicator Moving Average Convergence Divergence (MACD) supports the bullish thesis with its green histogram bars above the neutral line and its crossover above the signal line observed on April 22.

Another momentum indicator, the Relative Strength Index (RSI) reads 73.02, while UNI is in the overbought zone above 70, there is positive momentum in its uptrend. With RSI in overbought, traders need to be cautious when opening a long position in the asset.

UNI/USDT 1-day chart

Looking down, UNI could find support at the May 23 low of $8.617. Another support for the asset is the 78.6% Fibonacci retracement of the decline between March 6 and April 13, at $8.28.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.