Uniswap Price Prediction: UNI to retrace 15% as bulls take break

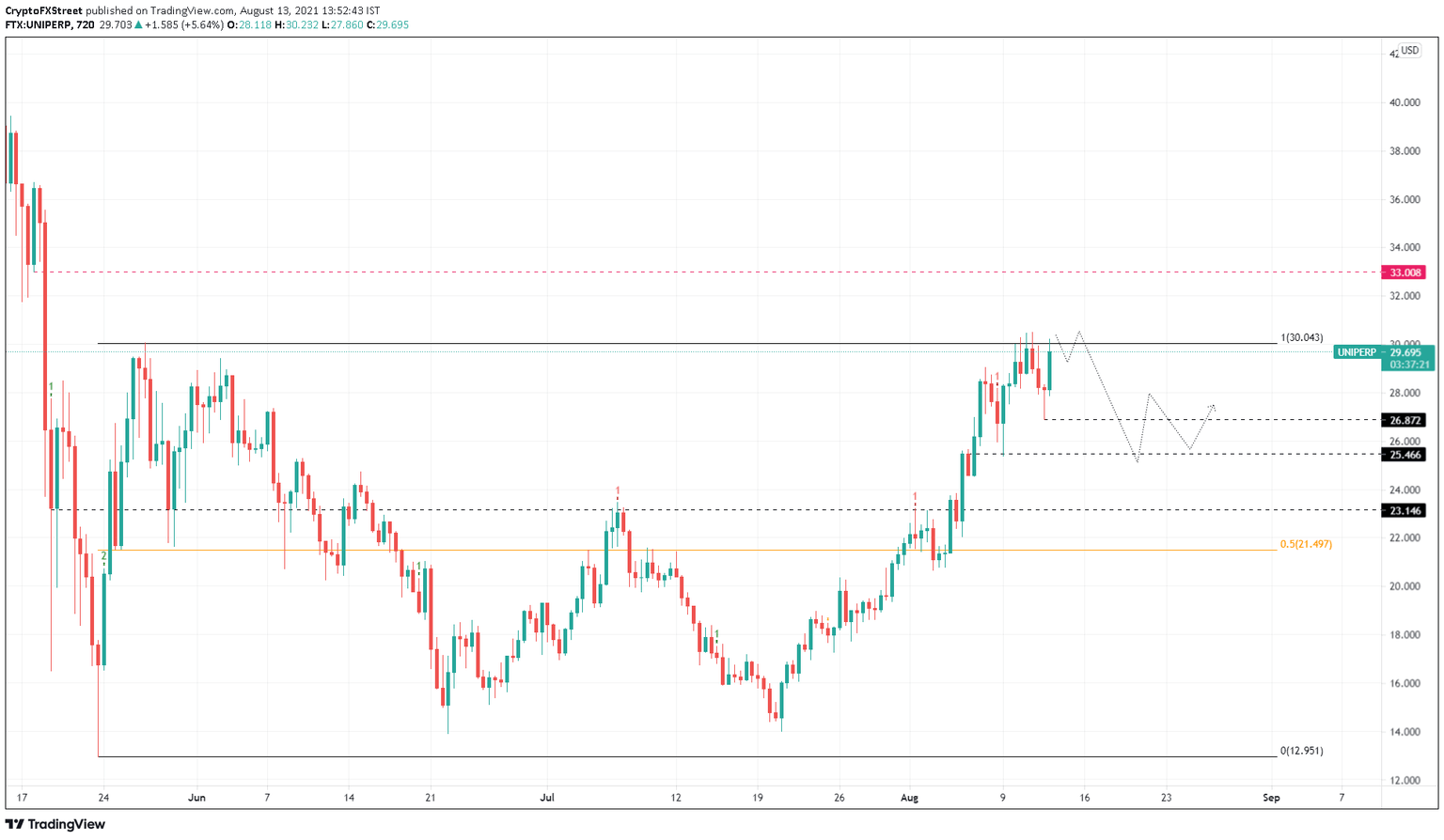

- Uniswap price is retesting the range high at $30.04, attempting to climb higher.

- A failure to successfully breach the said barrier might result in a 15% correction to $25.47.

- A breach of the $31.77 resistance level will invalidate the bearish thesis and trigger an uptrend.

Uniswap price is tussling with the range high and is likely to face rejection considering the general structure of the cryptocurrency market. Despite the recent upswing, investors should be wary of fakeouts.

Uniswap price awaits resurgence of buyers

Uniswap price first tagged the range high at $30.04 on August 10 and has been trying to push through for roughly four days.

Although Bitcoin price seems to be showing signs of a bull rally, it could be a fake run-up that might lure investors into being stuck with their long positions as market makers push the big crypto lower. This move will also knock down the already exhausted altcoins.

Uniswap price is also perfect for a minor pullback to the support level at $26.87. If the selling pressure continues to build up, UNI might drop to $25.47 and, in some cases, $23.15.

So long as Uniswap price remains above the 50% Fibonacci retracement level at $21.50, the upswing narrative will not face invalidation.

Therefore, market participants can expect a reversal above $21.50 as sidelined buyers continue to purchase UNI at a discount during the retracement, restarting a new rally.

UNI/USDT 12-hour chart

While the retracement narrative seems plausible, the bullish thesis will face invalidation if the Uniswap price produces a decisive 12-hour candlestick close above $31.77. This move will surpass the range high at $30.04 and set up a new swing high, signaling that the bulls are not exhausted.

In this case, investors can expect UNI to continue its ascent to retest the next significant resistance barrier at $36.56.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.