Uniswap Price Forecast: UNI aims for V-shaped recovery towards $33

- Uniswap price defended a key support level at $19.

- The digital asset aims for a strong rebound towards its previous all-time high of $32.99.

- A crucial indicator has presented a buy signal on the 6-hour chart.

Uniswap price suffered a major 45% pullback in the past three days, dropping to a low of $18.1 from its all-time high of $32.99. The digital asset has defended a crucial support level and aims for a notable rebound.

Uniswap price can quickly jump to $32.99

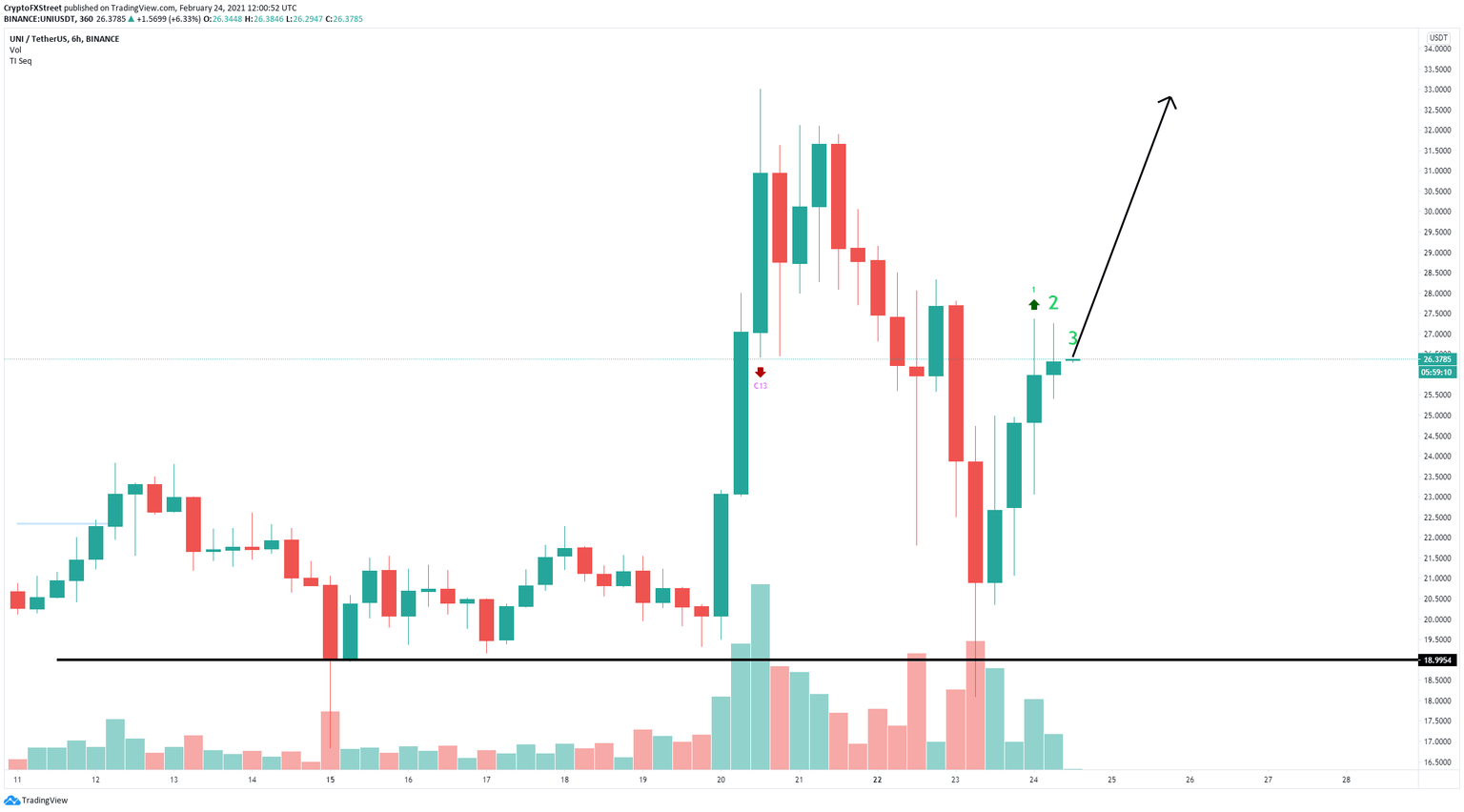

Uniswap has experienced a significant rebound from the critical support level at $19, climbing by more than 55% in the past 24 hours. On the 6-hour chart, the TD Sequential indicator has presented a buy signal which hasn't seen continuation just yet.

UNI/USD 6-hour chart

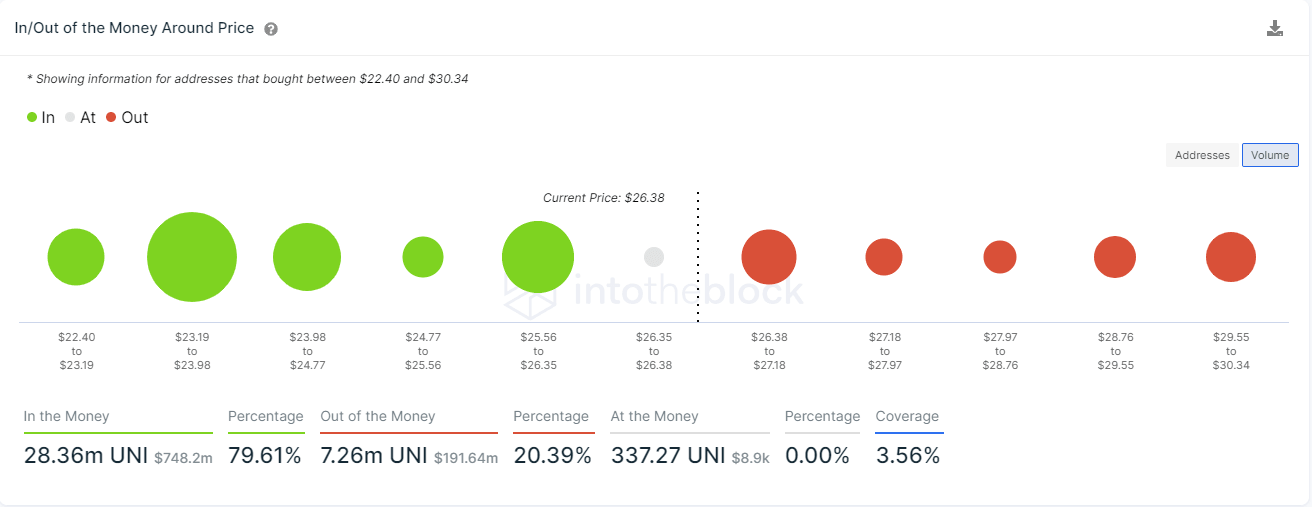

The In/Out of the Money Around Price (IOMAP) chart indicates that UNI bulls face very little resistance to the upside. The most significant barrier is located between $26.38 and $27.18, with a total volume of 3 million UNI tokens from 2,360 addresses. A breakout above this point should easily drive Uniswap price towards $33.

UNI IOMAP chart

On the other hand, the number of whales holding between 1,000,000 and 10,000,000 tokens has significantly decreased from 66 on February 13 to 61 currently, indicating that large holders have sold, a bearish development.

UNI Holders Distribution

The IOMAP model indicates that the nearest support area is between $25.5 and $26.3. Losing this significant range could push Uniswap price down to the next cushion at $23.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.05.01%2C%252024%2520Feb%2C%25202021%5D-637497652877380237.png&w=1536&q=95)