Uniswap price could kick-start a 14% rally if it reclaims this level

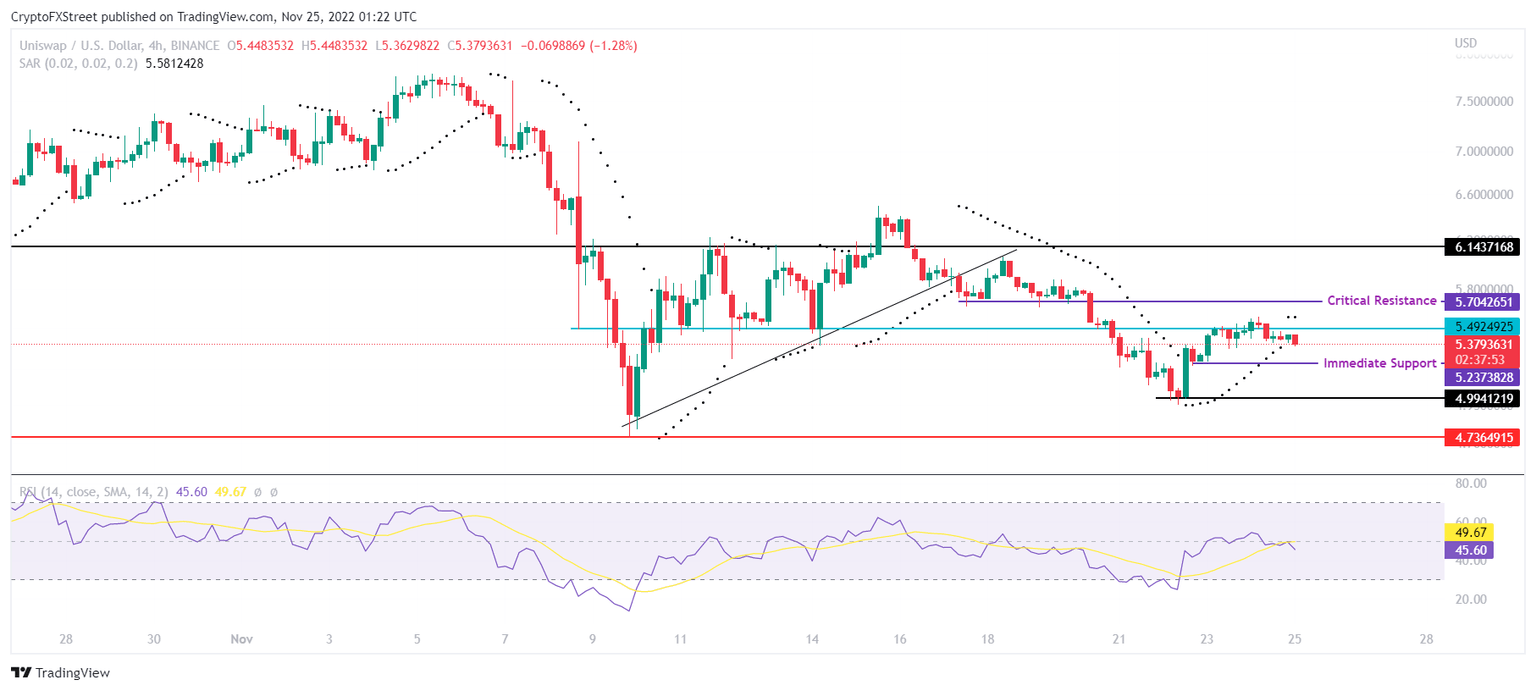

- Uniswap price is currently trading at $5.37 after failing to breach its immediate resistance at $5.49.

- UNI needs to flip the critical resistance at $5.07 into support in order to initiate a run up to $6.1.

- If the altcoin loses the support floor at $4.99, it would invalidate the bullish thesis resulting in a drop to $4.73

Uniswap price has been following the broader market bullish cues over the last few days sustaining its rise from 48 hours ago. Although the sentiment seems to have shifted slightly, UNI holders can still book profits if the Decentralized Finance (DeFi) token climbs to this level.

Uniswap price is yet to turn bullish

Uniswap price dipped to $5.37 at the time of writing after having almost breached its immediate hurdle at $5.49. The failure to close above this line initiated a downward momentum for the cryptocurrency. However, UNI might be able to negate this momentum if buying pressure takes precedence.

The Relative Strength Index (RSI) is still in the bearish, neutral zone, which indicates that the market is far from being overheated. If over the next few trading sessions, bulls take charge, Uniswap price could become bullish again.

This would enable the DeFi token to breach through $5.49 and run up toward its critical resistance at $5.70. Uniswap price would need to flip this level into a support floor in order to mark an upswing toward $6.14, tagging which would constitute a 14% rally for UNI.

UNI/USD 4-hour chart

However, the Parabolic Stop and Reverse (SAR) did turn bearish as the black dots of the indicator moved above the candlesticks. This change in position highlights an active downtrend for the cryptocurrency, which could keep control with the bears.

Should that happen, Uniswap price could end up falling through its immediate support level at $5.23 and tag the critical resistance at $4.99. A daily candlestick close below this price point would invalidate the bullish thesis pushing UNI down to the monthly lows of $4.73.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.