Uniswap open interest surges over 40% as it's set to integrate trading API into Ledger Live

- Uniswap has collaborated with Ledger to bring its trading API to the Ledger Live interface.

- UNI is up nearly 7% in the past 24 hours following the announcement.

- UNI's open interest growth points to a short-term bullish bias.

Uniswap (UNI) is up 7% on Tuesday after announcing a partnership with Ledger to integrate its Trading API onto the Ledger Live platform. Meanwhile, UNI's open interest has increased more than 40% in the past four days despite the lingering bearish sentiment that weighed down crypto prices.

UNI rises following open interest growth and partnership with Ledger Live

Uniswap Labs is set to integrate its trading API into Ledger's live platform to introduce seamless swapping of crypto assets on the self-custody wallet.

The partnership, which aims to boost DeFi accessibility across the Ethereum blockchain, will permit users to swap their tokens on Uniswap's protocol without needing to leave the Ledger Live interface while fully retaining control of their assets.

Ledger Live is a platform developed by Ledger that facilitates the buying, selling and swapping of digital assets through various third-party services while ensuring users retain full control over their holdings.

"We're excited that Ledger users can now go directly to the best of DeFi with Uniswap," said Mary-Catherine Lader, Chief Operating Officer of Uniswap Labs.

UNI is up over 7% following the announcement, trading above $13 as it looks set to recover from recent losses alongside other major crypto assets.

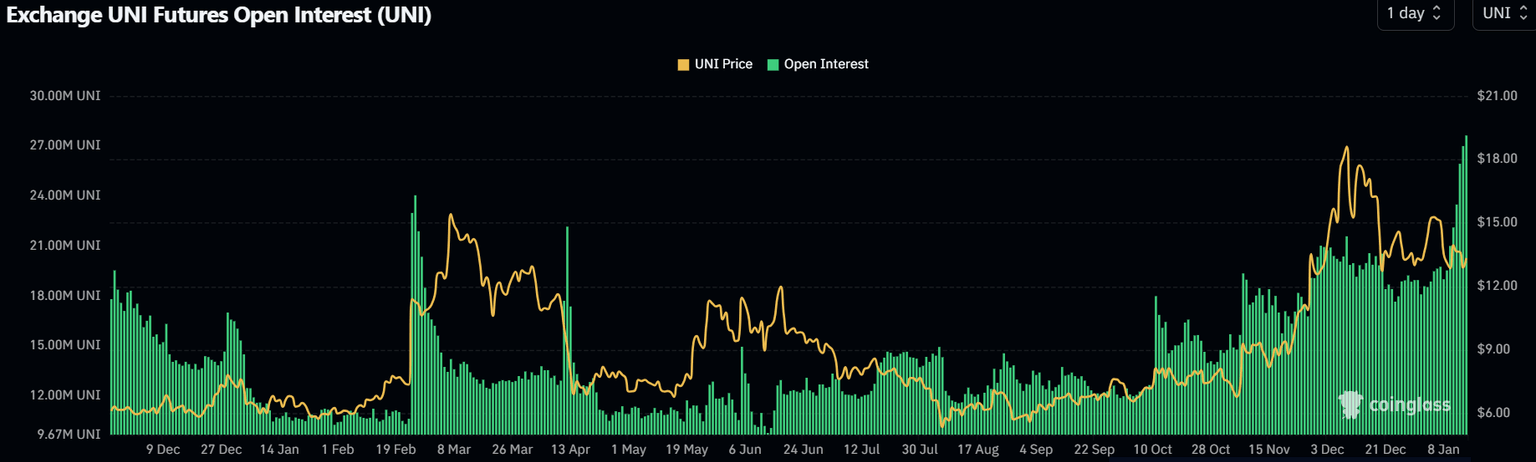

Notably, UNI's open interest has been on the rise in the past four days, increasing by over 40% from 19.53M UNI to 27.57M UNI. Open interest is the total amount of outstanding contracts in a derivatives market.

UNI Open Interest. Source: Coinglass

This surge in OI, alongside UNI's recent rise, points to a short-term bullish bias for the DeFi token.

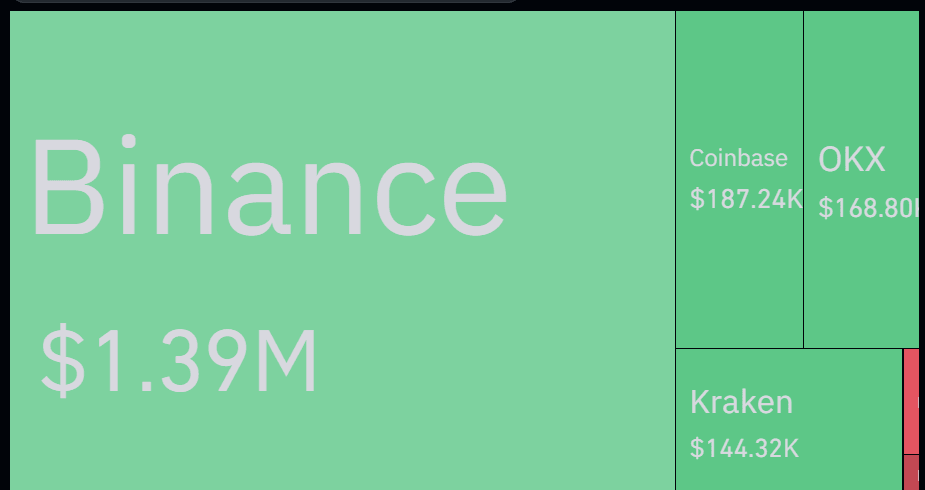

However, UNI's exchange inflows have increased in the past 24 hours, signaling that spot traders may be looking to book profits from the recent rise.

UNI Exchange Net Flows. Source: Coinglass

Meanwhile, in an X post on Friday, Uniswap noted it achieved a new milestone, crossing $500 billion in Layer-2 trading volume, with Base as the second L2 to cross the $100 billion swap volume via the protocol.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi