Tron price action is set for a breakout as consolidation nears a critical point

- Tron price action has seen its volatility diminish significantly since last week.

- TRX price action looks set for a breakout as bears and bulls are getting pushed toward each other.

- Expect a bearish outcome as price action slips below a key moving average.

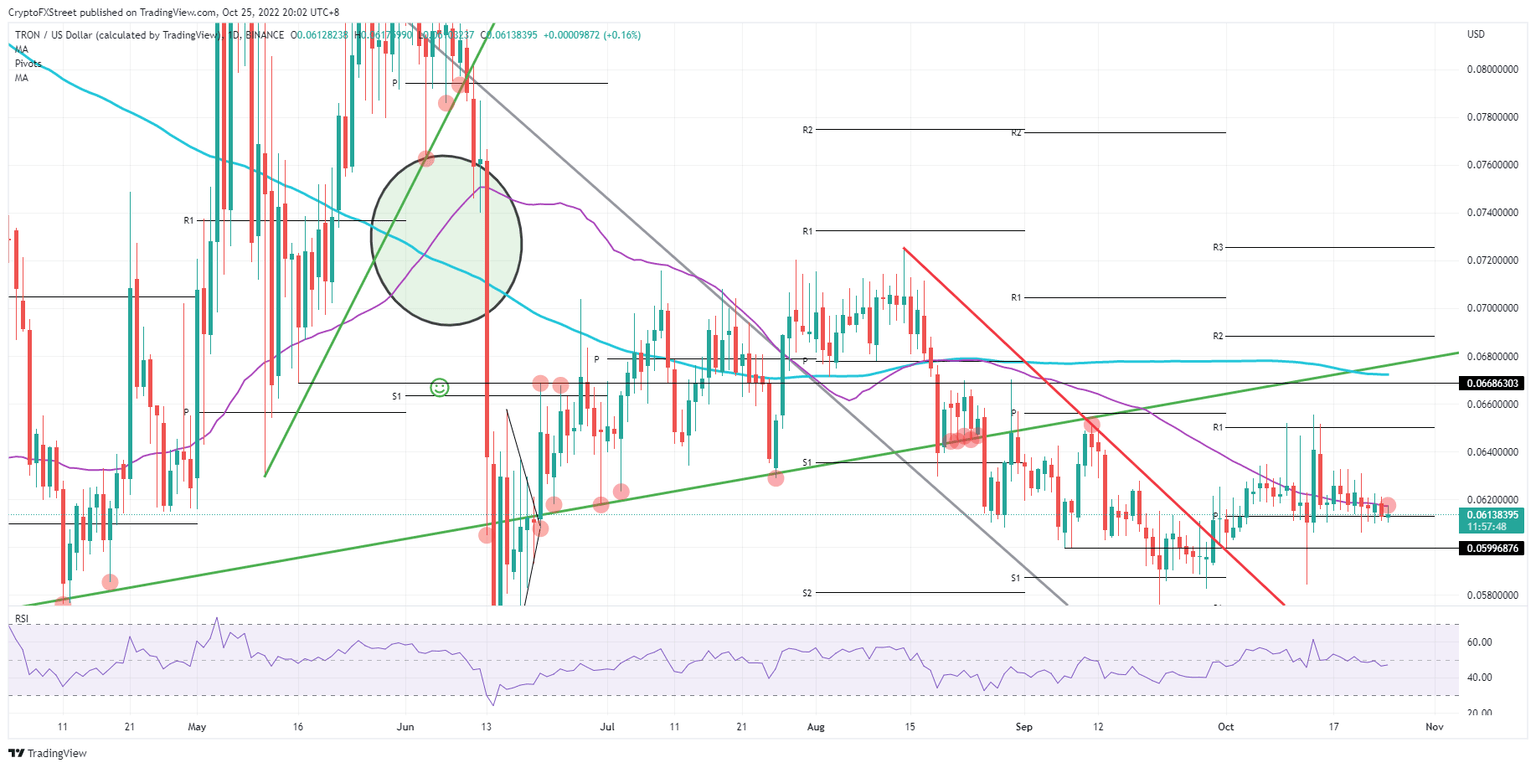

Tron (TRX) price action sees bulls trying to keep price action above the monthly pivot at $0.06. Their efforts could be all for nothing, however, if they cannot push price action above the 55-day Simple Moving Average (SMA). Overall, bears and bulls are trading closer to each other in a face off, which means consolidation is happening, and a breakout is due at any moment.

TRX price consolidates as the worst possible place

Tron price action consolidating is not a bad thing for traders since it is usually followed by a volatile breakout. What normally happens is that the intraday volatility starts to diminish, and a breakout happens once either bears or bulls get the upper hand. Seeing the positioning at the moment, the ball is in the court of the bears.

TRX price action is consolidating with the 55-day SMA acting as a cap to the upside. Price action is being pushed to the downside towards the monthly pivot at $0.061, which looks set to crack under pressure. Taking the above two elements into account, a break to the downside is likely to be the outcome of this consolidation, towards $0.059 or even $0.058.

TRX/USD Daily chart

With consolidations and the breakouts that follow, the outcome is often quite binary. In this situation it could also be that bulls push price action to the upside. That could mean a break above the 55-day SMA and $0.062, with a rally towards roughly $0.065 at this month's monthly R1 resistance level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.