Triple-digit gains make Dogecoin and Ethereum Classic the top performers of Q2

Bitcoin and Ethereum were the center of attention in Q1 but data shows DOGE, ETC and MATIC were the top performers of Q2.

In early 2021 Bitcoin and Ether price was the center of attention as each asset seemed to hit a new all-time high every 24-hours and traders called for $100,000 BTC and $5,000 ETH. Fast forward to the present and both assets are still more than 40% down from their all-time highs and the bulls calling for unbelievable price targets are nowhere to be found.

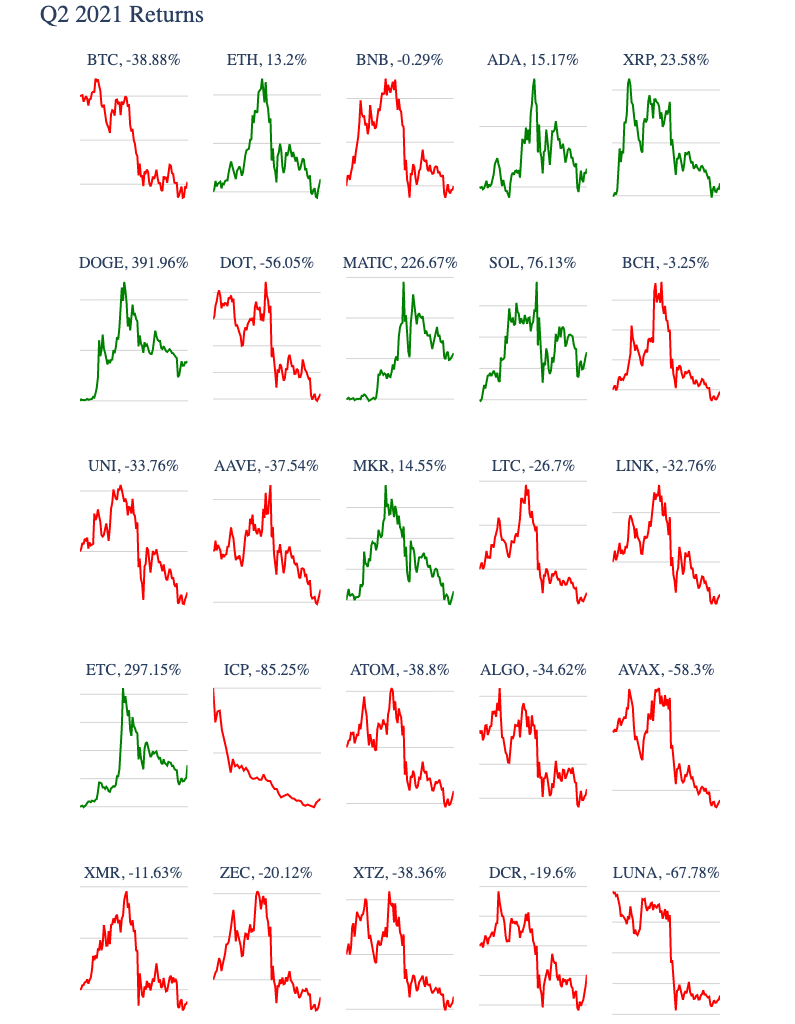

A recent report from CoinMetrics reviewed the performance of Bitcoin and altcoins during Q2 2021 and the analysts found that even with the sharp May 19 market correction many assets finished the quarter in the green with Dogecoin (DOGE) coming out on top with a 392% gain.

Ethereum Classic (ETC) and Polygon (MATIC) were the other two breakaway stars of Q2, with each gaining 297% and 227% respectively despite a nearly 39% decline in the price of Bitcoin.

Ethereum network shows strength

One of the biggest developments during Q2 was the Ether price breakout from $1,971 on April 1 to a new record high of $4,362 on May 11 before the market-wide sell-off resulted in a quarterly close at $2,240, which represents a 13.2% gain.

CoinMetrics highlighted that Ether price “benefited from a renewed surge of retail interest which was partially driven by the rapid rise of NFTs.”

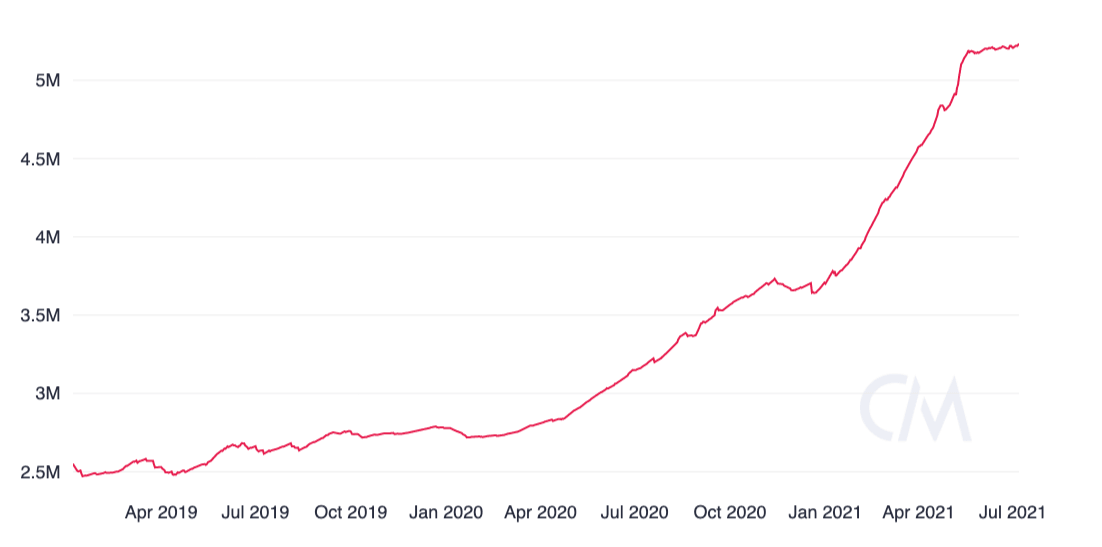

Number of Ethereum addresses holding at least 0.1 Ether. Source: CoinMetrics

As a result of the retail surge, the number of addresses holding at least 0.1 Ether increased from 4.58 million to more than 5.20 million.

Ether’s positive finish, when compared to the significant decline in Bitcoin, is also indicative of the increased attention the top-ranked altcoin is receiving from institutional investors looking to diversify away from BTC.

Altcoin gains triggered a decline in Bitcoin Dominance

As mentioned earlier, the best performance in Q2 came from DOGE, which managed to finish the quarter up 392% despite a 66% decline from its $0.74 all-time high set back on May 8.

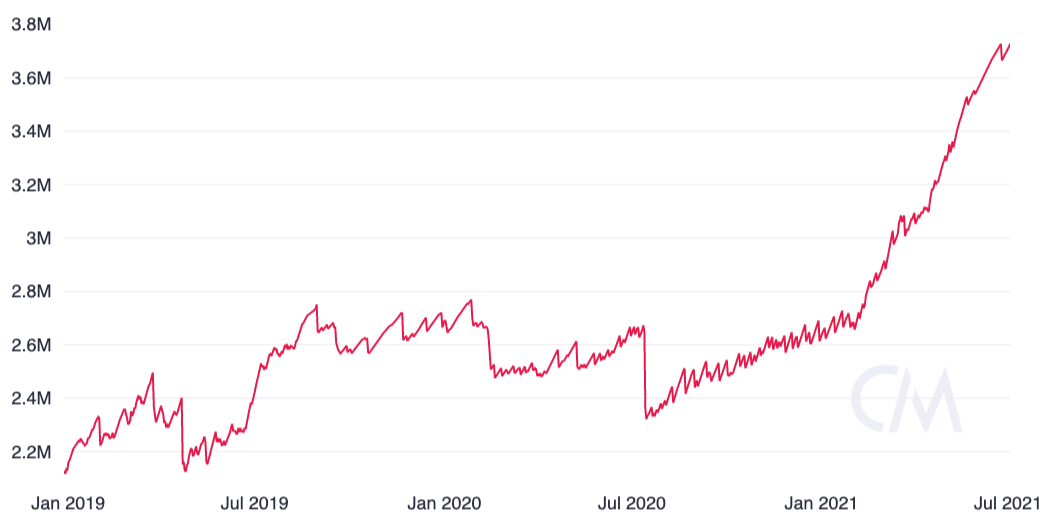

Number of Dogecoin addresses holding at least 1 DOGE. Source: CoinMetrics

According to the report, the number of addresses holding at least 1 DOGE increased from 3.09 million on April 1 to 3.7 million addresses on June 30. DOGE addresses continued to increase in the month of June while new Ether addresses essentially flatlined at the end of May.

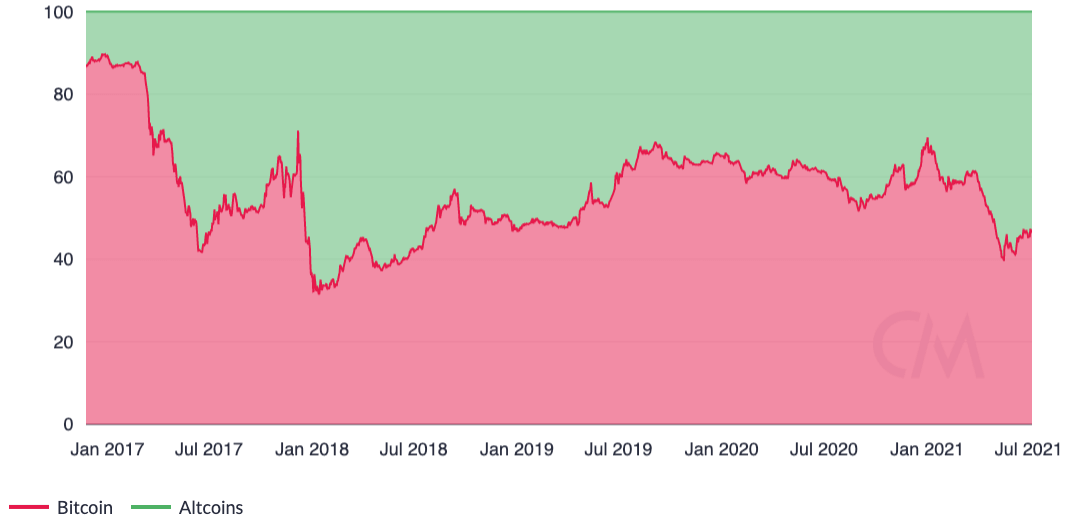

As a result of the gains made by altcoins, Bitcoin dominance fell to 45% on June 30, its lowest level since July 2018.

Bitcoin dominance. Source: CoinMetrics

CoinMetrics pointed out that the significant headwinds BTC faced were partially a result of China’s crackdown on cryptocurrency mining, which resulted in a 50% decline in hash rate in Q2 to its lowest level since late 2019.

This decline is likely temporary and the hash rate “should eventually recover once miners start to power back up in their new locations,” but CoinMetrics warned that this “won’t happen overnight since it will take time to build and set up enough facilities to accommodate the sudden influx of new demand.”

Overall, CoinMetrics and other analysts see the development as a long-term positive development for the Bitcoin ecosystem headed forward.

CoinMetrics said:

Over the long-term this mass migration should be largely beneficial as it will help Bitcoin hash rate get further distributed around the world, and remove the previous concentration in China. It could also help improve Bitcoin’s environmental impact since miners in some regions of China relied on coal.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.