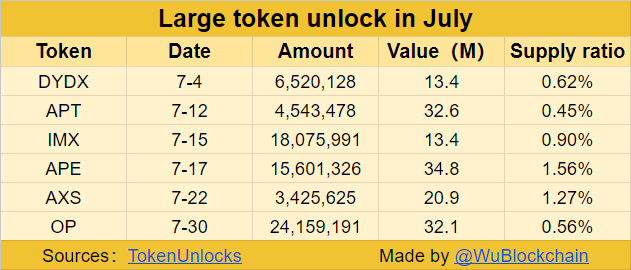

- Crypto tokens worth $147 million are set to unlock in July 2023 according to data from TokenUnlocks.

- DYDX, APT, IMX, APE, AXS and OP rank among the largest unlocks, supply ranging from 0.50% to 1.50%.

- Token unlocks typically increase the circulating supply of crypto across exchanges, resulting in selling pressure on assets.

While Bitcoin and Ethereum prices reel from the intense selling pressure in the crypto market, altcoins are likely to bleed further in July. The Securities and Exchange Commission’s request for more information in spot Bitcoin ETF filings sent Bitcoin and Ethereum prices lower overnight on Friday.

Altcoins on the other hand, are likely to experience higher selling pressure from the upcoming token unlocks scheduled for July. Nearly $147 million in tokens of key projects like DYDX, ApeCoin, Aptos, Axie Infinity and Optimism are set to join the circulating supply within the following weeks.

Token unlocks to watch out for in July

According to data from intelligence tracker TokenUnlocks, a large volume of tokens from different DeFi projects are gearing up for unlock in July. While crypto market participants reel from the selling pressure and pullback in asset prices as a result of SEC crackdown, unlocks could intensify it further.

As seen in the chart below, DYDX, Aptos (APT) and Immutable (IMX) are set to unlock in the first half of July. A total of 29.13 million tokens of these three projects will be unlocked, at a value of $59.4 million.

These token unlocks range between 0.45% and 0.90% of the supply of the assets. Typically less than 1% unlocks have less negative impact on asset prices.

Token Unlocks in July

In the second half of July, ApeCoin (APE), Axie Infinity (AXS) and Optimism (OP) unlocks are lined up. These unlocks range from 0.5% to 1.5% of the asset’s supply, implying a significant impact on asset prices and a likelihood of higher selling pressure.

Crypto market participants need to watch out for sell the news events where prices of these tokens rally in the weeks leading up to the unlock, and a mass sell off takes place on the day of the event. Moreover, APE, AXS and OP are likely to be hit by a double whammy, the SEC’s clampdown and the token unlock event.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink social dominance surged to a six-month peak on Friday as LINK holders increased their activity. LINK traders started taking profits, on-chain data trackers show. LINK price added 6% on Friday, extending its gains from mid-week.

Binance helps Taiwan crack a virtual asset money laundering case, BNB sustains above $570

Binance’s Financial Crimes Compliance (FCC) department joined forces with Taiwan’s Ministry of Justice and helped resolve a case of money laundering worth NT$200 million, or $6.2 million.

Bitcoin Weekly Forecast: Is BTC out of the woods? Premium

Bitcoin price shows signs of continuing its uptrend, providing a buying opportunity between $64,580 to $63,095. On-chain metrics forecast a bullish outlook for BTC ahead. If BTC clears $70,000, the chances of resuming the uptrend would skyrocket.

XRP trades steady at $0.50 as Ripple shares plan to expand services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US Securities and Exchange Commission and amid new commitments from the firm to expand its services in Africa.

Bitcoin: Is BTC out of the woods? Premium

Bitcoin (BTC) price action in the past two days has confirmed the resumption of the bull run. However, BTC needs to clear a few key hurdles before investors can go all-in.