- After upward attempts, it appears that the market is dropping and taking a break.

- XRP appears weaker than his analytical peers.

- ETH/USD does not impose its leadership and the market suffers.

The cryptocurrencies market starts the week with bull drums entering a public frenzy.

As we will see in the individualized analyses, the market is entering a phase of lateral bullish consolidation, and it is probable that we will see some strong rises incited by price reaction. This type of movement usually ends when less experienced traders have bought the short term highs, at the rhythm of the drums. After that, it is likely to consolidate. As far as the bullish end goes, it will mark the consolidation zone.

The minimum prices of December are already far away and with them the most attractive and safe prices. Now, any long-term position must take higher risks, and there are already market positions that rent more than 20% that are tempting to liquidate. It is a scenario prepared for increased volatility.

Do you want to know more about my technical setup?

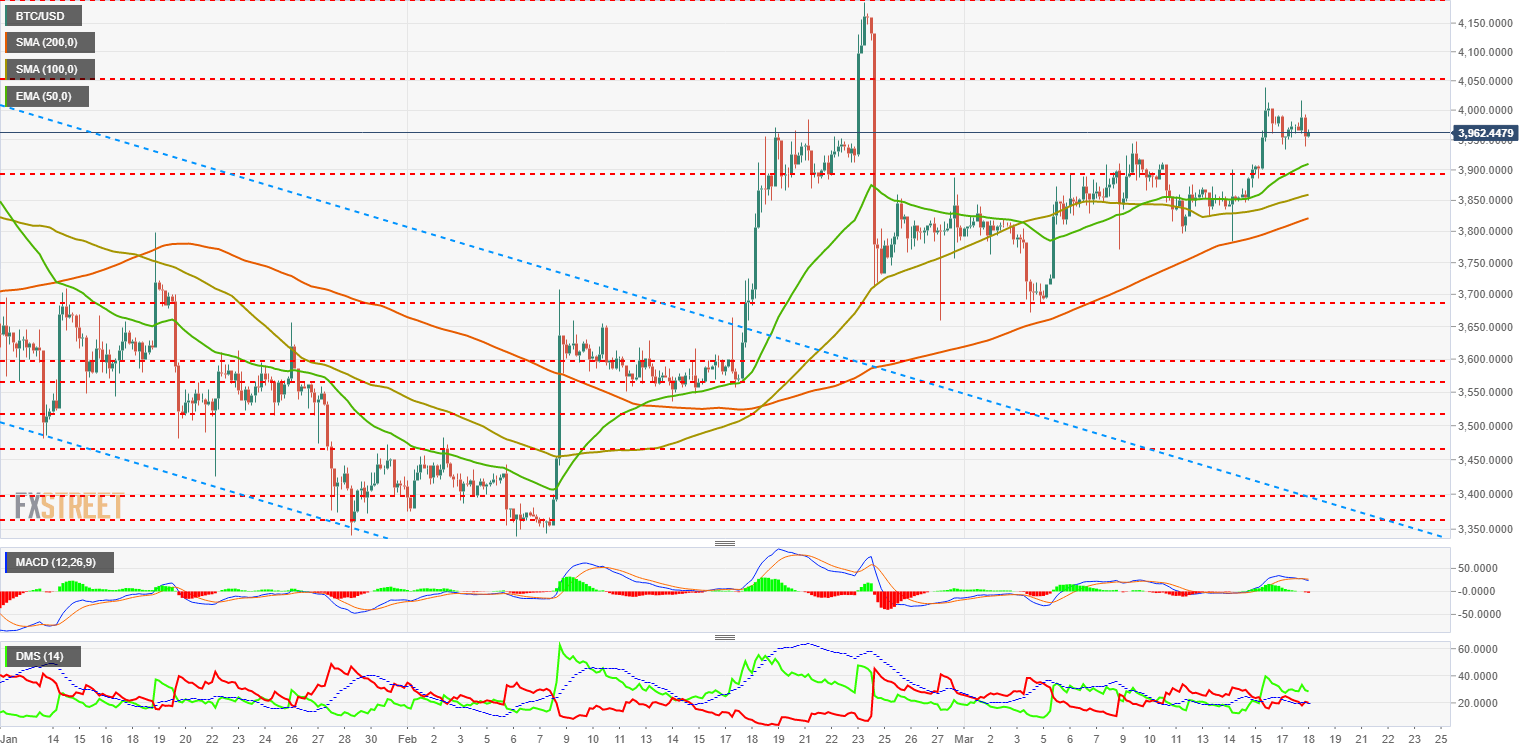

BTC/USD 240 Minute Chart

The BTC/USD is trading at the $3,966 price level after two attempts to break above the $4,000 level over the weekend. The current scenario on the 4-hour chart shows a developing bullish trend. After two attempts to cross the resistance zone, the first at the end of February and the one that is happening now, it appears to be draining the bullish energy.

Above the current price the first resistance level is at $4,050 (price congestion resistance), then the second resistance level is at $4,200 (price congestion resistance and relative maximum). If the BTC/USD gets above this level, the price could skyrocket to the third resistance level of $4,574 (price congestion resistance).

The first support level for the BCT/USD pair is at the $3.910 (EMA50) price level reinforced by congestion support at $3.894. The second line of support is at the confluence of the SMA100 at $3,859 and the SMA200 at $3,821. If the price gets below this last price level, it will go straight to $3,689 (price congestion support).

The MACD on the 4-hour chart is cut down within the bullish region of the indicator. This type of structure usually causes lateral movements that end in a violent action when the lines reach the equilibrium level.

The DMI on the 4-hour chart shows the bulls with control of the market. The bears fight to stay above level 20, but they do not succeed and could start a long stretch below the level that indicates the existence of trend force.

ETH/USD 240 Minute Chart

The ETH/USD is trading at the $138.8 price level after trying twice to break above $142.5 over the weekend.

Below the current price, the ETH/USD has all three moving averages in a very narrow range just below the current price. The EMA50 forms this first level of support at the $137 level, then the SMA200 at $136.7 and finally the SMA100 at $135.4. The detail to highlight is how the 100-period average moves below the 200-period average, which conveys weakness in the structure. The second level of support is at $131 (price congestion support), and the third level of support is at $129 (price congestion support).

Above the current price, the first resistance level is at $142.5 (price congestion resistance), then the second resistance level is at $151 (price congestion resistance) and the third resistance level for the ETH/USD pair is at the level of $161.5 (price congestion resistance).

The MACD on the 4-hour chart is crossed down with much inclination so in case of a break in support levels the price could accelerate quite a bit. The pivot point is possibly at the midline level of the indicator.

The DMI on the 4-hour chart shows the bulls controlling the situation but with less conviction than in previous days. The bears for their part have been increasing their activity in recent hours but remain below the ADX line, so the trend remains bullish.

XRP/USD 240 Minute Chart

The XRP/USD pair is currently trading at the $0.3164 price level, continuing an orbital movement around moving averages.

Below the current price, the first support level is formed by the three moving averages, starting with the EMA50 at the $0.315 price level, then the SMA200 at $0.314 and thirdly the SMA100 at $0.314. The second level of support is $0.308 (price congestion support), and the third level is $0.305 (price congestion support).

I want to highlight the downward inclination of the SMA100, which although mild and short term, can cause us to see price weakness for a couple of days.

Above the current price, the first resistance level for the XRP/USD pair is at the price level of $0.3175 (price congestion resistance), then the second at $0.328 (price congestion resistance) and then the third at $0.335 (price congestion resistance).

The MACD on the 4-hour chart is crossed down, which reinforces the scenario of possible weakness in the XRP.

The DMI on the 4-hour chart shows that there is almost a tie between bulls and bears. Bullish traders have a slight advantage, but both sides of the market are above the 20 level showing strength. The ADX is at shallow levels and reflects the drop in volatility of the XRP/USD pair in the last few weeks.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRON gains 10% in 2024, supply of stablecoins reaches over $50 billion in Q1

TRON, a blockchain-based digital platform, has seen positive growth in the first quarter of 2024, as seen in a Messari report. TRON noted gains across several metrics like market capitalization, revenue and total value locked.

XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55. Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

Terraform Labs set to restrict access for users in the US after recent ruling in SEC lawsuit

Blockchain company Terraform Labs said Thursday that it will restrict access to some of its products and services for US-based users as it expects to receive a court order soon in light of its legal battle against the US Securities and Exchange Commission (SEC).

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

-636885032227367834.png)

-636885033068254346.png)