Top 3 Price Prediction Bitcoin, Ethereum, Ripple: How to trap a hungry bear

- Bitcoin price tests the lower half of an ascending channel for the third time.

- Ethereum price continues displaying bearish divergence but underline market strength remains.

- Ripple price in a make-or-break situation.

The crypto market moves higher. Placing a countertrend short is still ill-advised. Higher targets remain possible for all assets.

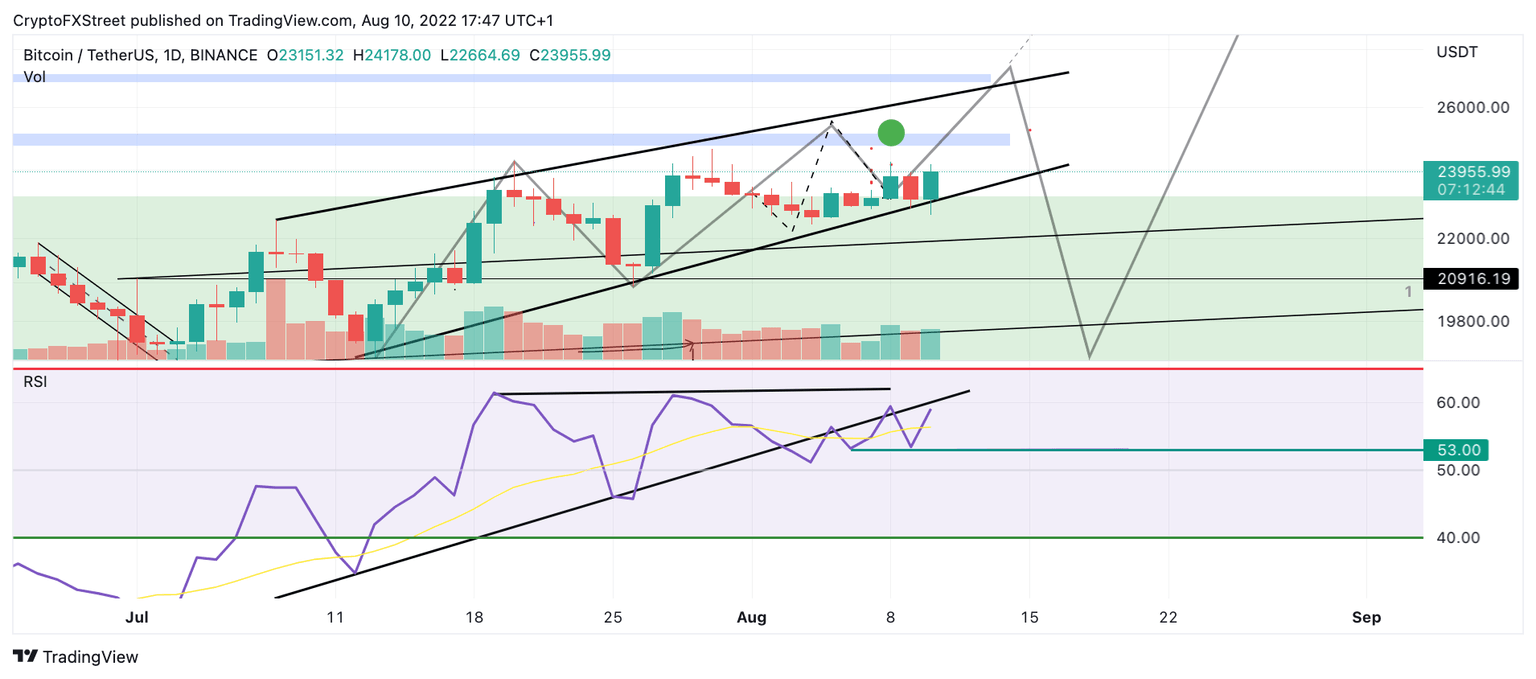

Bitcoin fools early bears

Bitcoin price tests an ascending trend line for the third time as day traders take advantage of the intra-hour bullish momentum. Previous outlooks have consistently advocated against being overly bearish as choppy out-of-nowhere price movements could likely ensue based on the ascending wedge formation around the Bitcoin price.

Bitcoin price currently auctions at 23,905. There is a clear bearish divergence on the daily chart, prompting the sellers to aim for lower targets consistently. Still, the liquidity levels at $24,800 and $26,950 have not been breached. An ideal bearish scenario would be a breach into this level accompanied by a bearish volume profile pattern and RSI divergence.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

BTC/USDT 1-Day Chart

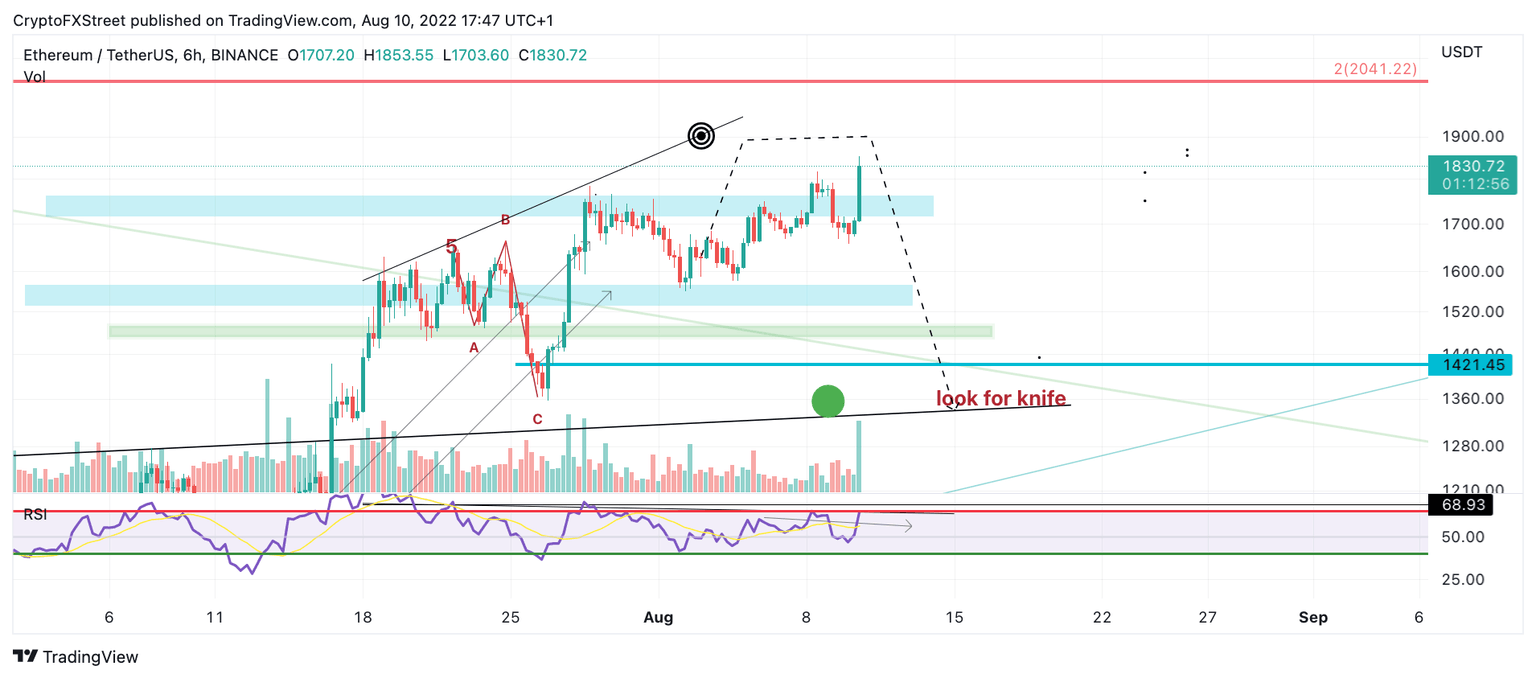

Ethereum price rallies as intended

Ethereum price shows its first smart money fake-out during August. Previous forecasts have continuously mentioned the likeliness of such a move as magnet-like liquidity levels lie within the $1,850 and $1,900 zone. Ethereum price breached through the $1,700 zone overnight, causing bears to advance with optimism. On August 8, 2022, the bears’ hopes were fully invalidated as a strong candle vengefully pierced through $1,700 and has since ascended the Ethereum price to $1,853.

Ethereum price currently trades at $1,835. The large bullish engulfing candlestick will be a challenge for bears looking to hold on to their losing position. Traders trapped below $1,700 may have to wait on the sidelines and potentially mark their limits as $1,900, and $2,100 remain possible short-term targets.

ETH/USDT 6-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

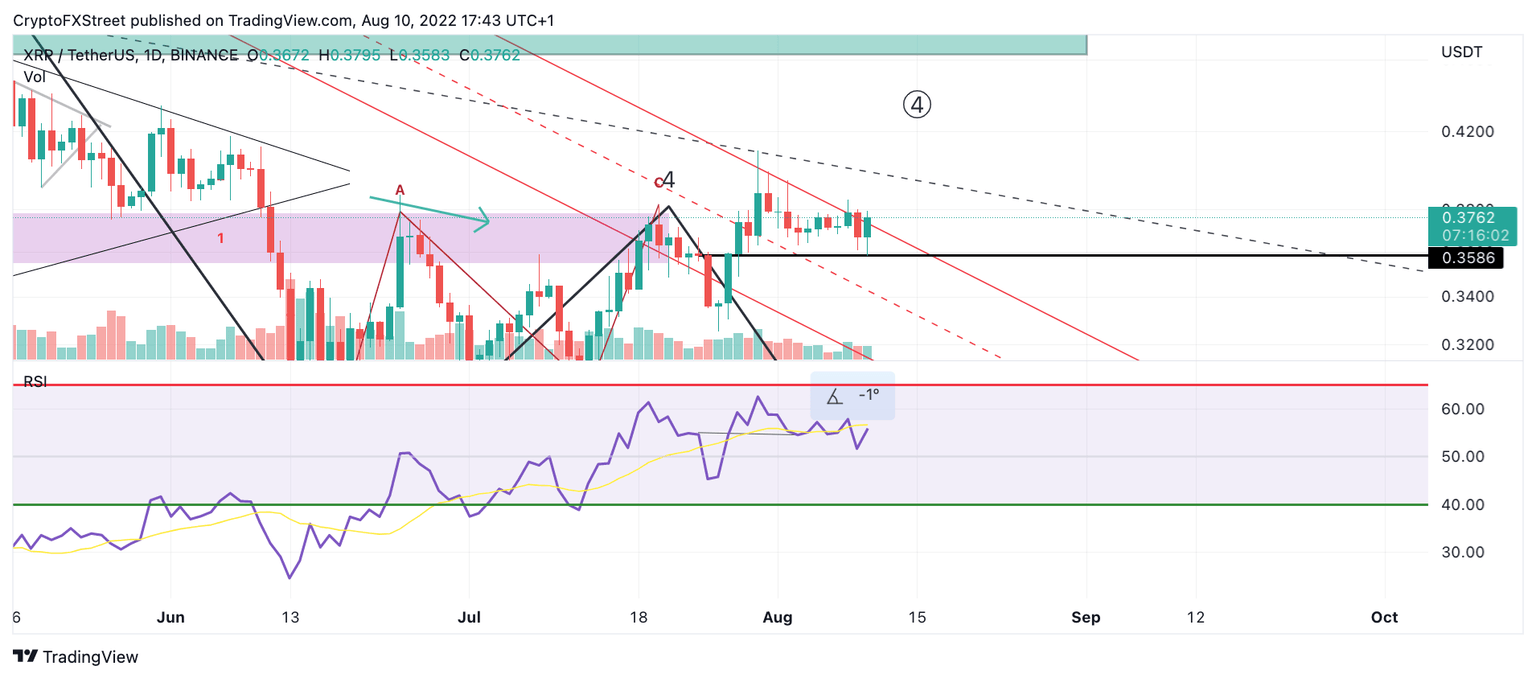

Ripple price is in a now-or-never predicament

Ripple's XRP price breaches an ascending parallel channel for the fourth time. A definitive candlestick above the barrier should be the catalyst for the Ripple price to rally to $0.435 in the short term for a 15% gain.

XRP price currently auctions at $0.37. If the bulls establish a successful daily close above the mentioned barrier, the bullish trade will be justifiable. Invalidation of the uptrend scenario would depend on $0.34 holding as support. Failure to hold above $0.34 would ensure a sweep the lows event, targeting $0.325 in the short term and potentially $0.24 for up to a 35% decline.

XRP/USDT 1-Day Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.