Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos prepare to rally after punishing early buyers

- Bitcoin price retests the parallel channel’s lower trend line, threatening a make-or-break scenario.

- Ethereum price invalidates the $2,800 to $3,000 support cluster, hinting at a crash to $2,541,

- Ripple price digs deeper into the $0.626 to $0.689 buy zone, indicating that bulls are slowly losing control.

Bitcoin price approaches close to the last defensive support level, putting the fear back in retail traders’ minds. Likewise, Ethereum and Ripple have also crawled closer to significant barriers, suggesting that they are ready to follow suit.

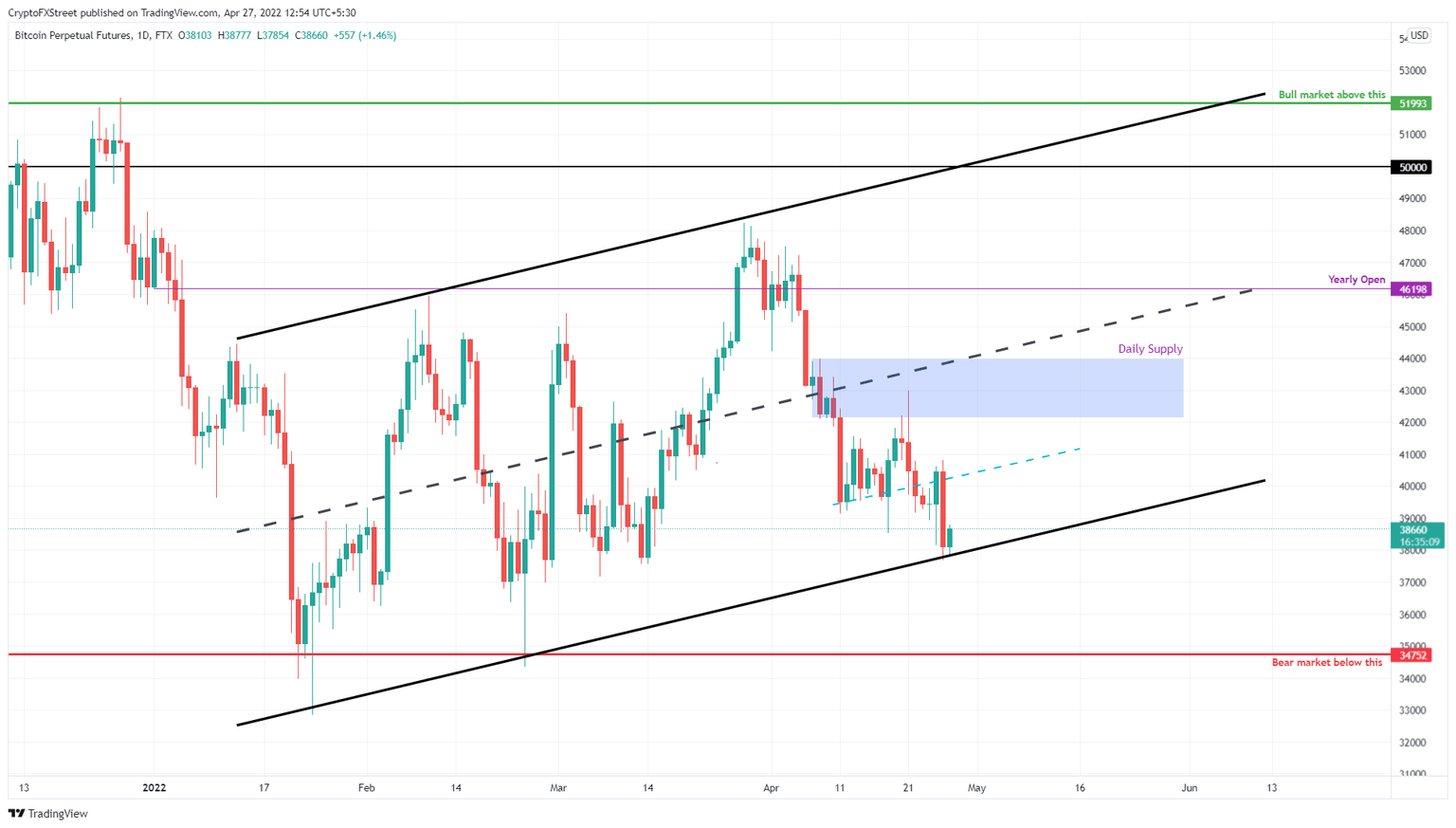

Bitcoin price reevaluates directional bias

Bitcoin price has been describing an ascending parallel channel on a three-day time frame for roughly three months. It has connected the higher highs and higher lows formed from January 14, to outline the channel’s formation.

The last two times BTC tagged the lower trend line, it recovered and rallied explosively. Interestingly, both these times, the candlestick bodies closed above the 200 three-day Simple Moving Average (SMA).

This time around, things are different as BTC has dropped slowly below the 200 three-day SMA at $40,084 and tagged the lower trend line of the ascending parallel channel. Such a development indicates that the bulls are losing control.

A bullish engulfing candlestick on the three-day chart would alleviate the bearish pressure and trigger an upswing. In such a case, investors can expect BTC to retest the 50-day and 100-day SMA at $42,035, $41,001.

Flipping these hurdles into support levels could see the big crypto rally toward the yearly open at $46,198 and in some cases, the $50,000 psychological level.

BTC/USDT 3-day chart

A daily candlestick close below the $34,752 support level will invalidate the ascending parallel channel and the bullish thesis.

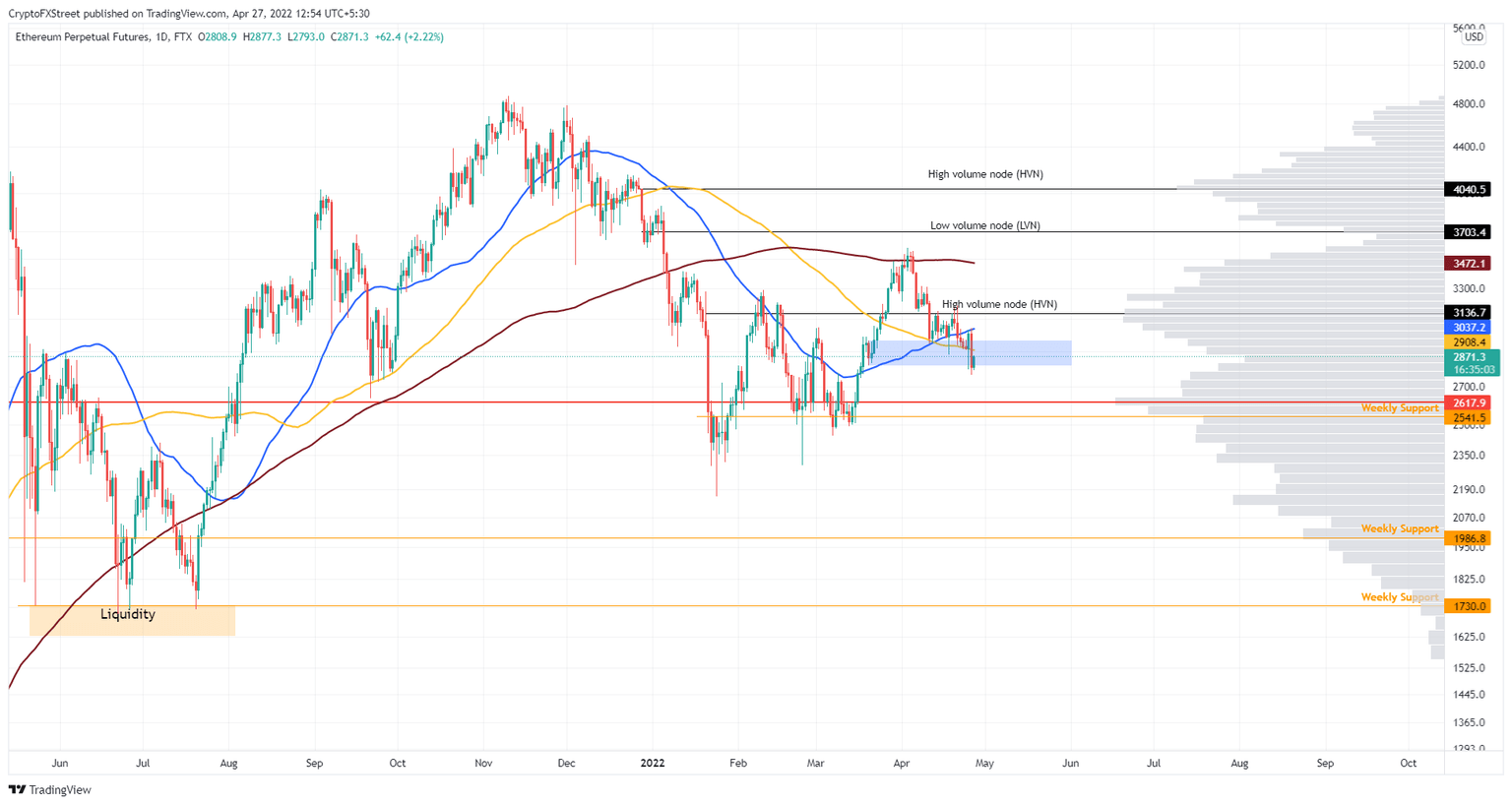

Ethereum price treads on delicate floors

Ethereum price pushed deep into the support cluster, extending from $2,800 to $3,000, indicating a short-term spike in selling pressure. Additionally, yesterday’s daily candlestick close was below the lower limit of the said cluster, invalidating it.

While a recovery seems to be in progress, investors need to be cautious as BTC is also hovering above the last line of defense. A spike in buying pressure is likely to propel ETH to retest the 100-day SMA at $2,908 and the 50-day SMA at $3,036.

If these hurdles were not enough, Ethereum price needs to overcome the 2022 volume point of control at $3,129 to make a run at the 200-day SMA at $3,472. Investors can expect a local top to form around this level.

ETH/USD 1-day chart

Regardless of the short-term bullishness, a daily candlestick close below the support cluster’s lower limit at $2,820 will invalidate the bullish thesis by creating a lower low. This move could further trigger a crash to the next high-volume node at $2,584.

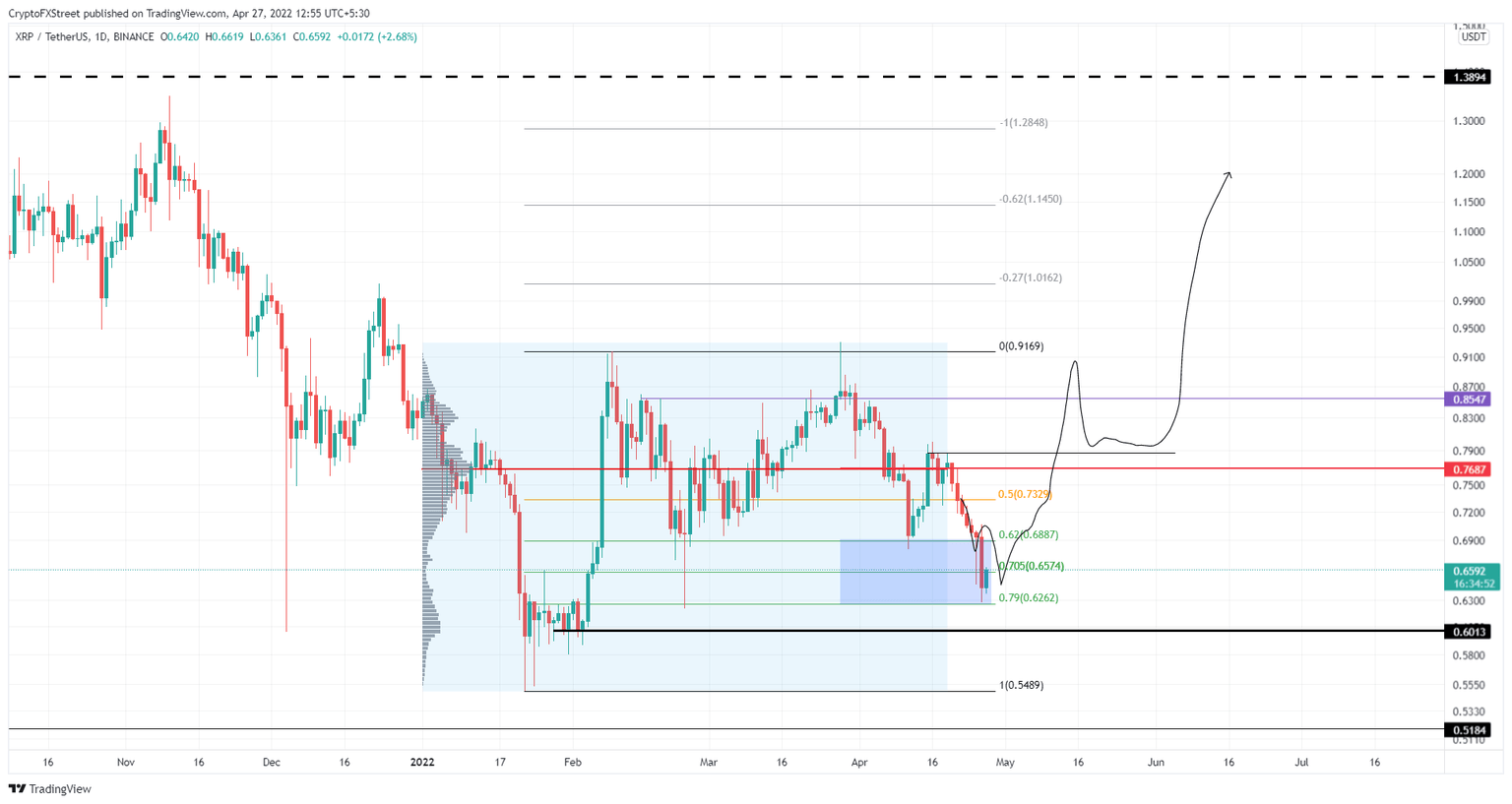

Ripple price slides lower

Ripple price has driven lower into the $0.626 to $0.689 buy zone, painting a similar trend seen across Ethereum and Bitcoin. Regardless, the remittance token seems to be holding its own around the $0.626 barrier.

A bounce here could push the XRP price to retest the 50% retracement level at $0.732. Clearing this hurdle will open the path to retest the 2022 volume point of control at $0.768. In total, the ascent would constitute a 17% gain from the current position at $0.652.

Since the point of control is a place where the trade volume for Ripple was the highest, a local top could form there. However, in a highly bullish case, XRP price might extend higher to tag the $0.912 barrier.

XRP/USD 1-day chart

While the outlook for Ripple price is bullish, a daily candlestick close below the $0.601 support level will produce a lower low and invalidate the bullish thesis. In such a situation, XRP might crash to the $0.548 support level and from there try to reevaluate its directional bias.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.