Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets await BTC’s cue

- Bitcoin price restarts its consolidation after a brief rally to $30,000 between April 9-11.

- Ethereum price is on track to tag the $2,022 hurdle.

- Ripple price remains indecisive within the $0.336 to $0.537 range.

Bitcoin (BTC) price has slipped back into old ways as it consolidates after tagging a psychological level. This move has caused Ethereum (ETH) price to follow BTC’s lead and remain rangebound as well. Ripple (XRP) price continues to tighten as it loses its directional bias.

Also read: Bitcoin price explodes past $30,500, gains strength with US CPI release

Bitcoin price back to square one

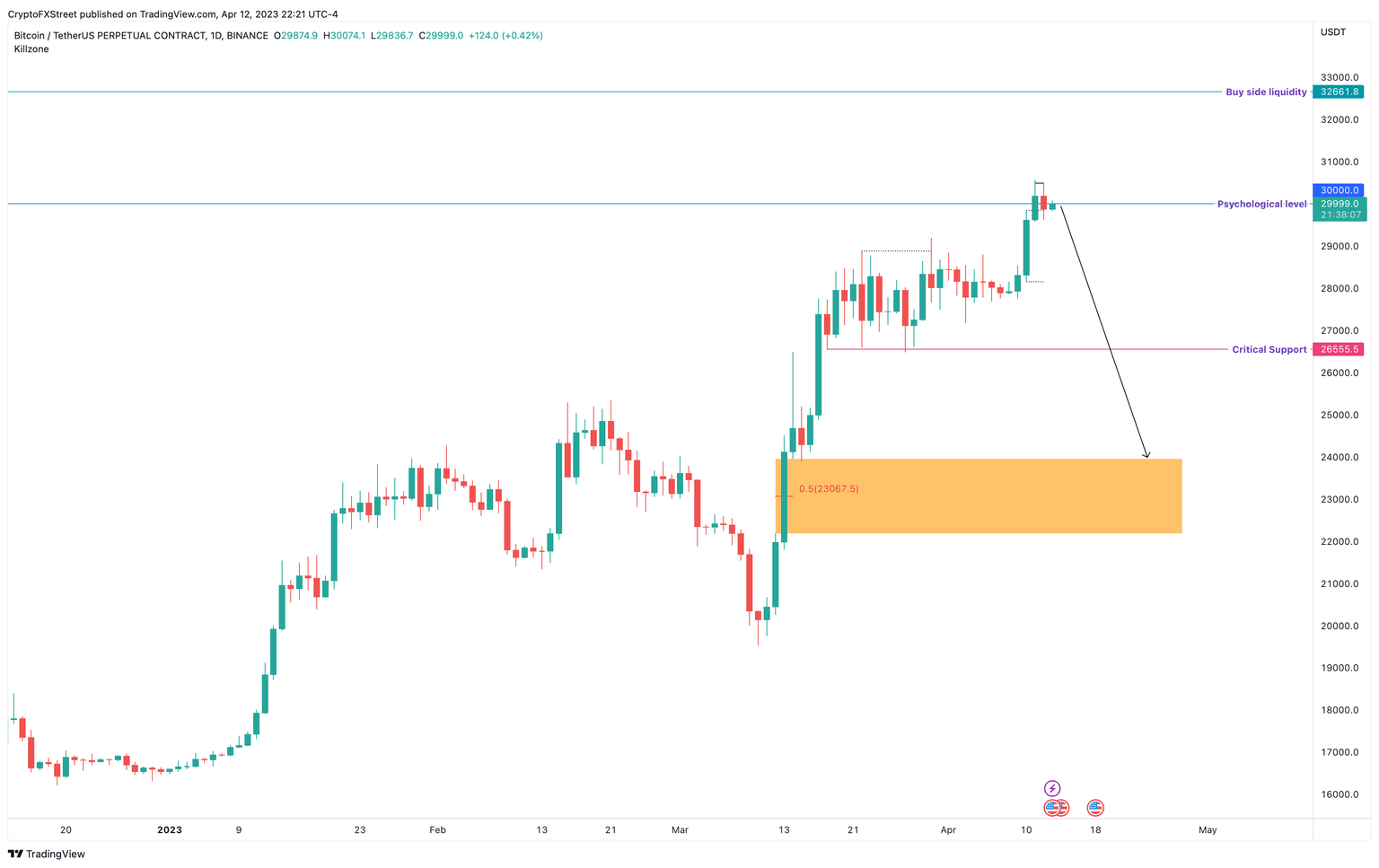

Bitcoin price tagged the $30,000 psychological level on April 11 and has since shown no directional bias whatsoever. The US Consumer Price Index (CPI) caused a bit of a volatile reaction in the short term but has not led to any significant moves.

A rejection at $30,000 could see Bitcoin price revisit the critical support level at $26,555. A flip of this barrier into a hurdle could send BTC lower into the $23,951 to $22,184 daily Fair Value Gap (FVG), giving sidelined buyers a chance for accumulation.

If this scenario plays out, it will be bearish in the short-term but bullish for long-term holders, as explained in a previous article.

BTC/USD 1-day chart

Invalidation of the short-term bearish thesis will occur if Bitcoin price flips the $30,000 level into a support floor. Such a decisive move could trigger an extension of the ongoing rally to tag the $32,661 hurdle.

Ethereum price to extend its rally

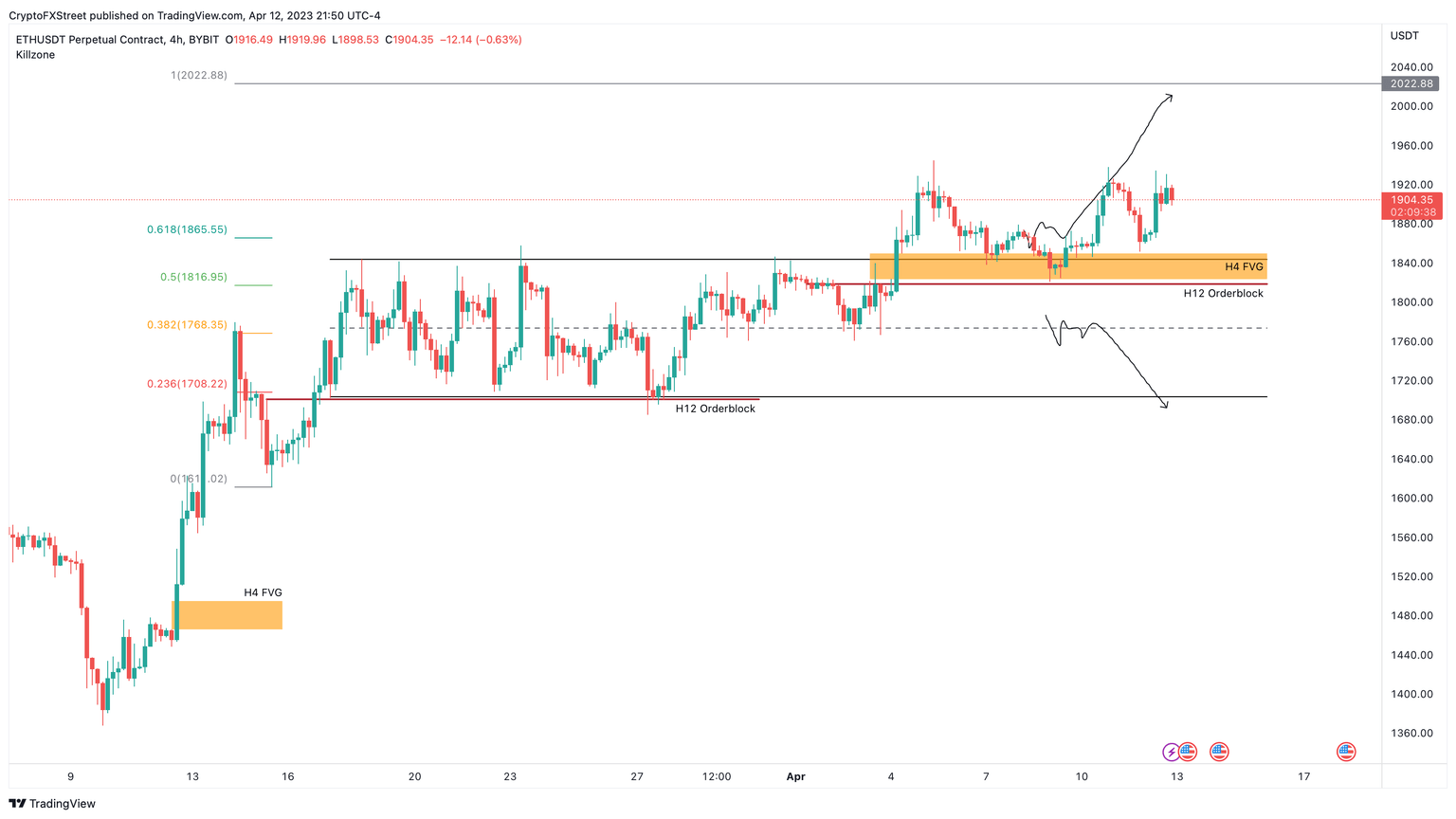

Ethereum price dipped into the four-hour FVG, extending from $1,849.53 to $1823.40, triggering an upswing as forecasted in a previous article. This move will likely propel ETH to its next significant hurdle at $2,022, which is close to the next psychological level.

Due to Bitcoin’s lack of volatility, Ethereum price has slipped into rangebound movement. As long as the $1,843.62 support level holds, the bulls have nothing to worry about.

ETH/USD 4-hour chart

While the uptrend outlook makes logical sense, a reentry into the $1,843.62 to $1,703.32 support zone will be troublesome for Ethereum price. In such a case, ETH could revisit the midpoint at $1,773.61 or the range low at $1,703.32.

Ripple price lacks directional bias

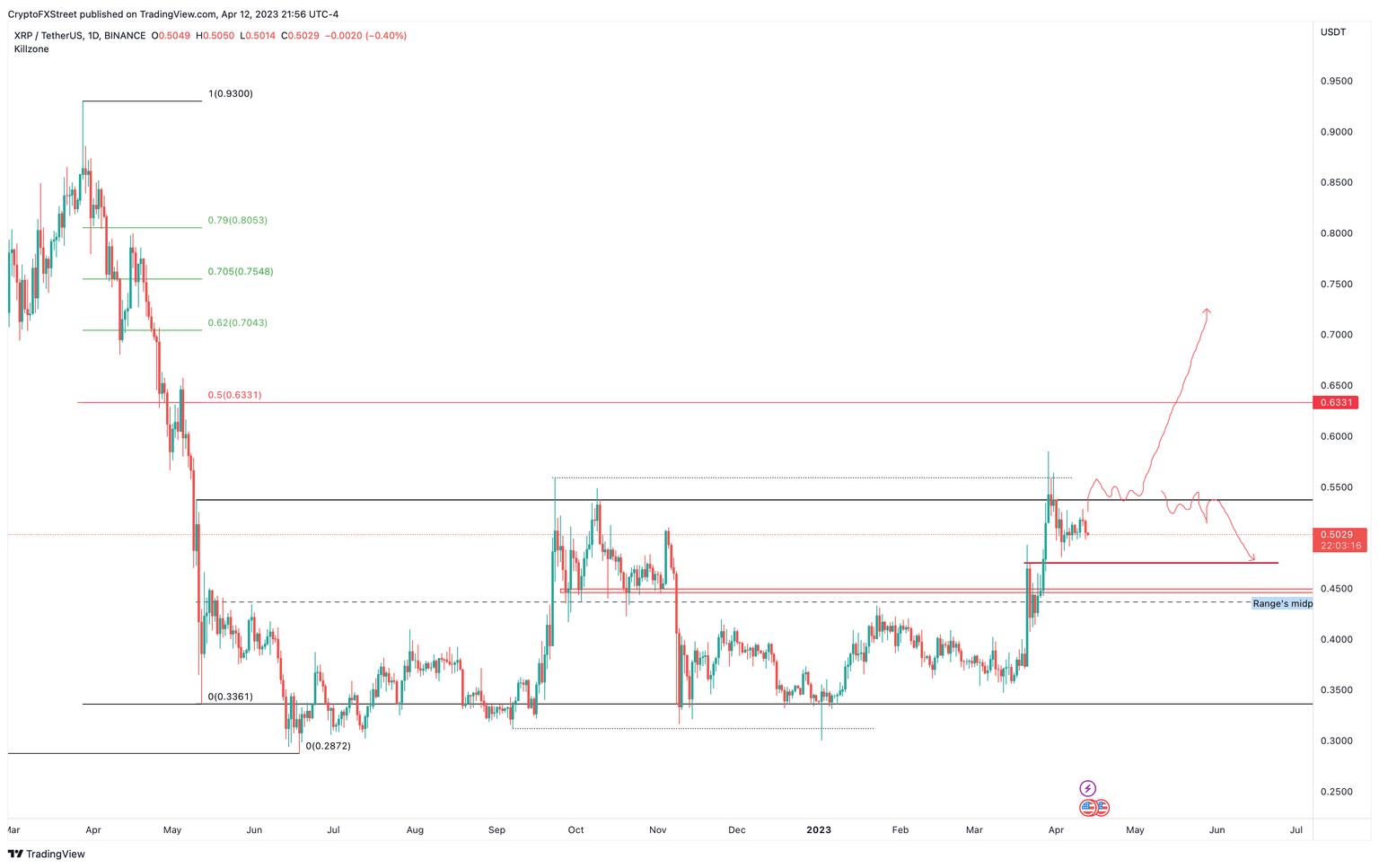

Ripple price continues to be indecisive as it hovers inside the long-term range, extending from $0.336 to $0.537. A retest of the range high will be key in determining where XRP will head next. A flip of the $0.537 level will likely trigger a 17% rally to $0.633, but rejection will knock the altcoin lower.

So investors need to sit on their hands at the momentum until Ripple price gives them a trade they can take.

XRP/USD 1-day chart

A rejection at $0.537 will likely kick-start a 12% slide to retest an accumulation zone, extending from $0.475 to $0.436. Here, investors can add on their positions before XRP price attempts a rally to breach the range high at $0.537.

However, a flip of the $0.436 level into a resistance barrier will invalidate the bullish thesis for Ripple price and potentially trigger a correction to $0.336.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.