- Bitcoin price is up 6.5% on the day but shows underlying bullish strength.

- Ethereum price may have printed an interim market top and could decline up to 25% in the short term.

- XRP price alludes to an upcoming move toward $0.44.

The crypto market is witnessing considerable resistance ear current price levels. Although skepticism has run hot during the uptrend, it may finally be time for bulls to begin securing profit.

Bitcoin price encounters trouble

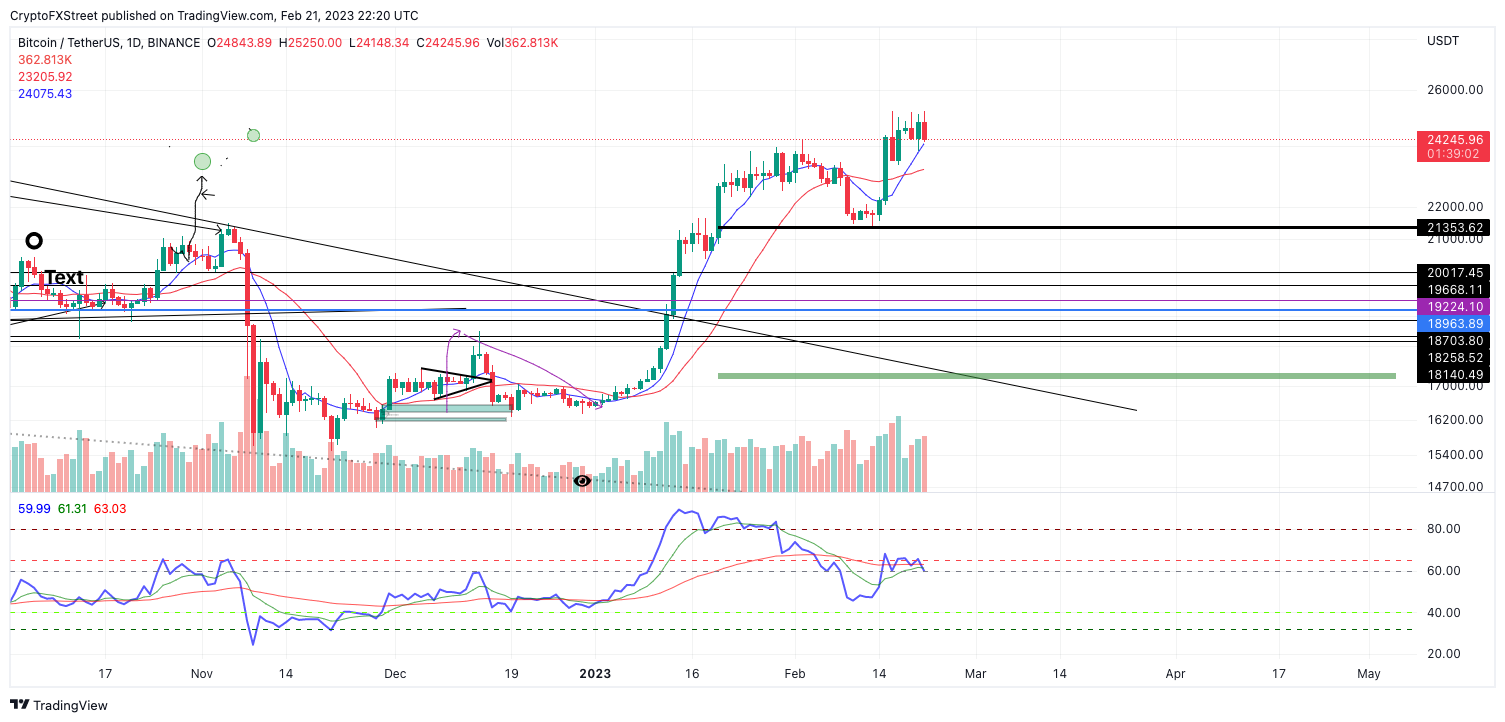

Bitcoin price continues to face resistance near the $25,000 zone. At that time of writing, The BTC is down 2% on the day; however, the uptrend that has rallied 47% since January 1 remains intact.

Bitcoin price is currently at $24,249. The 8-day exponential moving average (EMA) is being tested once again as support. This is now the second attempt for the bears to besiege the indicator after the bulls hurdled the EMA on February 14 during a 9% market jump.

As long as the Bitcoin price remains above the indicators, Traders should continue to approach the peer-to-peer digital currency with a bullish bias. A breach above the daily high at $25,250 could induce an upward swing targeting the $27,000 liquidity zone in the short term, Such a move would result in a 12% increase from BTC's current market value.

BTC/USDT 1-day chart

The Bitcoin price is undoubtedly in a trend-defining situation. A daily candlestick close beneath the 21-day simple moving average will be the final confirmation for trend-surfing bears to enter the market. The bear scenario could result in a decline toward the psychological $20,000 level, a 16% decrease from Bitcoin's price today.

Ethereum price shows five waves up

Ethereum Price Is showing the bearish influence that should have swing traders reviewing their risk appetite principles. At the time of writing, the decentralized smart contract token Is down 3% on the day; however, the technicals suggest Ethereum could be on the brink of a rapid.decline.

Ethereum price is currently auctioning at $1,649. The Relative Strength Index, an indicator used to gauge The strength of a trend shows a bearish divergence that should not be overlooked. For instance, the recent move north into $1,700 was kept near the resistance at 60 while displaying bearish divergences with the previous RSI readings in overbought territory, when Ethereum tagged $1,50

Under the Elliott Wave theory, the divergences paint a five-wave narrative, which means that if they're in price could now head for a 50 to 61.8% retracement of the entire uptrend move that began during the winter. The scenario creates the potential for a 25% decline targeting the $1,250 resistance zone.

ETH/USDT 1-day chart

However, it is worth noting that the bullish divergences that depict Wave 2 and 4 on the RSI are subject to interpretation and can be incorrect for traders looking to continue playing the bullish side of the market. Invalidation of the uptrend potential would be voided with a breach above Wave 1 at $1,352. A breach of this target level would confirm that Wave 5 is over and a three-wave pullback is underway.

XRP price is showing mixed signals

XRP price has displayed erratic behavior throughout February. At the time of writing, the digital remittance token is coiling within the 8-day exponential and 21-day simple moving average which suggests a volatile move is on the horizon. Still, the direction of the anticipated move will be difficult to predict.

XRP price currently auctions at $0.391. There are mixed signals on the road to a strength index, with traders justifiably backing off and seeking opportunities elsewhere in the crypto market. For instance, the RSI never broke out into overbought conditions. They're in the early stages of the winter rally. However, the recent decline towards the $0.3614 price level on February 13 did not breach oversold conditions as it bottomed exactly at the 40 level. XRP price is now performing a stair-stepping pattern on the RSI and technicals, which alludes that the next move could be north.

For traders looking to participate in a highly volatile move, an automatic buy-stop can be placed above the previous day's swing high at $0.409 while attempting to target the $0.44 liquidity zone. The target area has been extracted from previous outlooks, which show a strong confluence liquidity zone near the mid-$0.40 barrier.

XRP/USDT 1-day chart

Invalidation of the bullish thesis would arrive from a breach below the previous day's swing low at $0.3774. If the breach occurs, the bears could induce a downward swing targeting the $0.34 zone, resulting in a 12% decline from XRP's current market value.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink social dominance surged to a six-month peak on Friday as LINK holders increased their activity. LINK traders started taking profits, on-chain data trackers show. LINK price added 6% on Friday, extending its gains from mid-week.

Binance helps Taiwan crack a virtual asset money laundering case, BNB sustains above $570

Binance’s Financial Crimes Compliance (FCC) department joined forces with Taiwan’s Ministry of Justice and helped resolve a case of money laundering worth NT$200 million, or $6.2 million.

Bitcoin Weekly Forecast: Is BTC out of the woods? Premium

Bitcoin price shows signs of continuing its uptrend, providing a buying opportunity between $64,580 to $63,095. On-chain metrics forecast a bullish outlook for BTC ahead. If BTC clears $70,000, the chances of resuming the uptrend would skyrocket.

XRP trades steady at $0.50 as Ripple shares plan to expand services in Africa

Ripple hovers close to $0.51 on Friday, above the psychologically important $0.50 level, as traders await the court ruling of the lawsuit against the US Securities and Exchange Commission and amid new commitments from the firm to expand its services in Africa.

Bitcoin: Is BTC out of the woods? Premium

Bitcoin (BTC) price action in the past two days has confirmed the resumption of the bull run. However, BTC needs to clear a few key hurdles before investors can go all-in.