Top 3 Price Prediction Bitcoin, Ether, Ripple: Crypto summer will be back in the next spring

- Moving averages structures project the consolidation process for several weeks in the future.

- Forays into recent bearish scenarios cannot be ruled out, but they would be brief in time.

- Ether is still doing well against Bitcoin in the short term.

The attention of the financial world is right now on the equity segment. The force with which prices are moving down is extraordinary, with terrifying technical details such as a close below 3000 points on the S&P 500… 100 points down!

The crypto universe is still in the process of technical consolidation, an expected development, since after the sharp rises of the past weeks, the moving averages had been left far behind and it was necessary to recover normality before going back up again.

The time projection of this price contraction process indicates that the current downward lateral trend is likely to continue until the end of March.

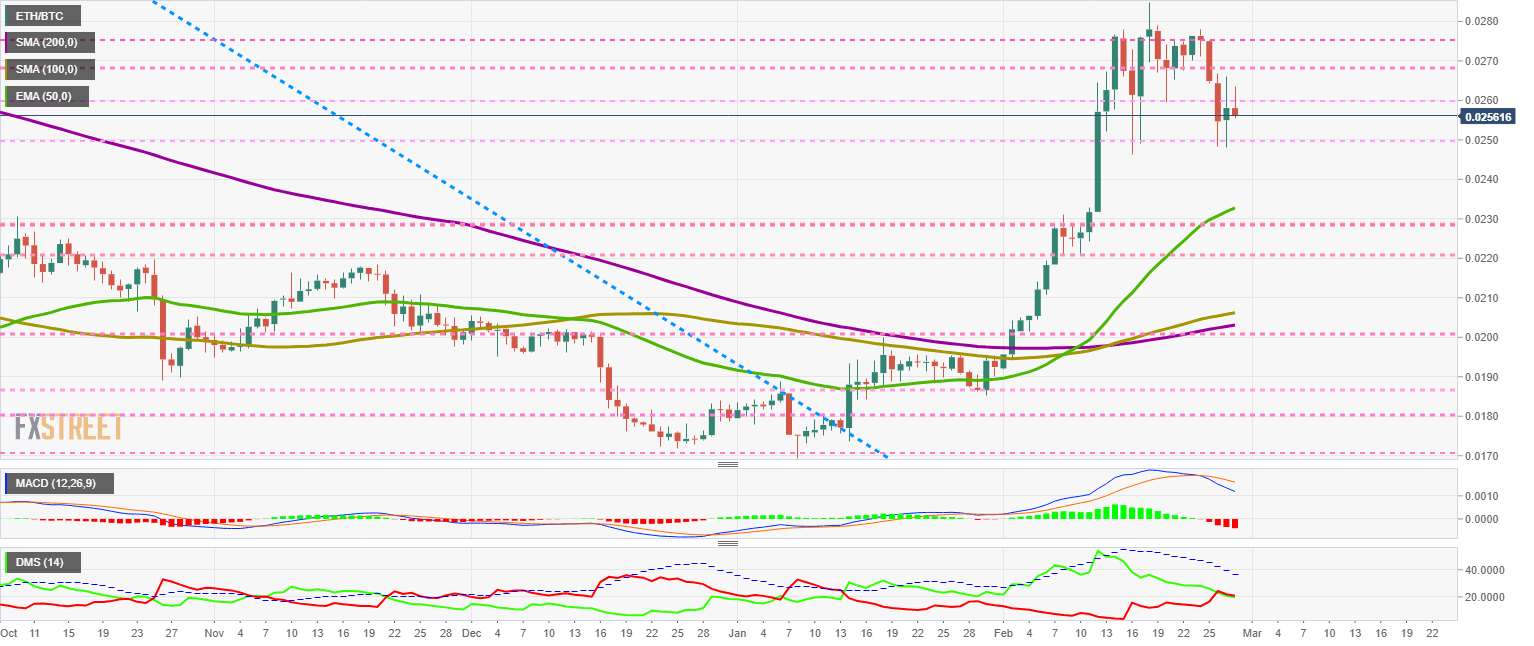

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0256. Ether's relative performance against Bitcoin continues to be very favourable compared to the general trend in the crypto segment.

Above the current price, the first resistance level is at 0.026, then the second at 0.027 and the third one at 0.029.

Below the current price, the first support level is at 0.025, then the second at 0.023 and the third one at 0.022.

The MACD on the daily chart shows no profile changes. The bearish setup with a lateral bias is still active.

The DMI on the daily chart shows how bears do not see the current time as an opportunity. The two sides of the market are staying very close together, and both are losing strength. The current setup is conducive to lateral movements and falling volatility.

BTC/USD Daily Chart

BTC/USD is currently trading at $8607 and continues to be at risk due to the proximity of support separating the previous bearish scenario from the current bullish one.

Above the current price, the first resistance level is at $8800, then the second at $9150 and the third one at $9650.

Below the current price, the first support level is at $8400, then the second at $8200 and the third one at $8000.

The MACD on the daily chart is piercing the 0 levels and entering the bearish zone of the indicator. The current setup indicates the acceleration of the downward movement.

The DMI on the daily chart shows that the bears are dominating the pair even though they have lost strength in the last few hours. The setup is for continued downward movement with a background of lateral movement.

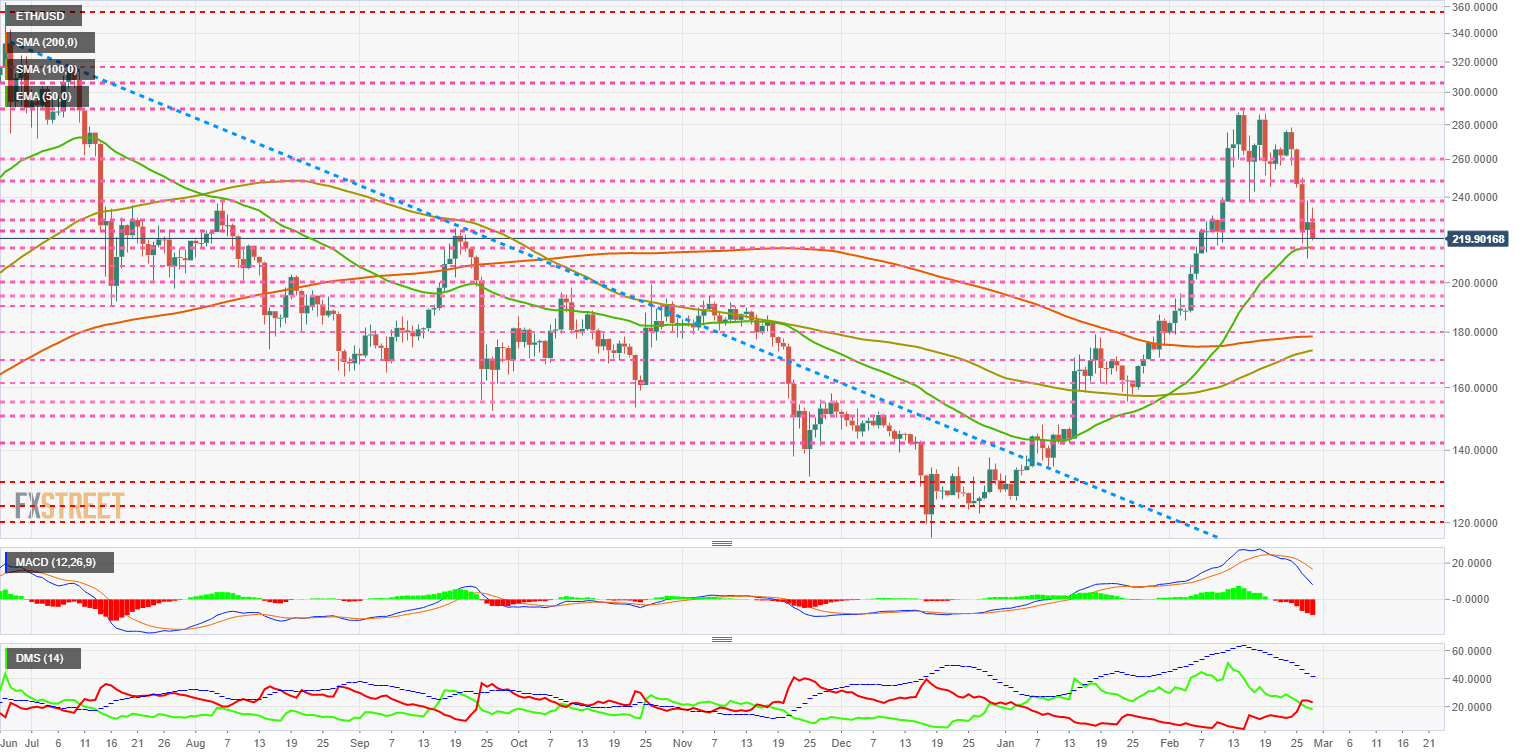

ETH/USD Daily Chart

ETH/USD is currently trading at the price level of $219.9 and finds support at the price congestion support level of $220.

Above the current price, the first resistance level is at $230, then the second at $240 and the third one at $250.

Below the current price, the first support level is at $215, then the second at $208 and the third one at $200.

The MACD on the daily chart is increasing the bearish profile but still well within the positive side of the indicator. The setup suggests a lateral downward movement.

The DMI on the daily chart shows the bears gaining on the bullish side. The current setup doesn't make clear the future development in the short term.

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.231 with the SMA100 acting as support. The clean moving average zone is above the price level at $0.26.

Above the current price, the first resistance level above the current price is at $0.24, then the second at $0.254 and the third one at $0.267.

Below the current price, the first support level is at $0.22, then the second at $0.20 and the third one at $0.19.

The DMI on the daily chart shows bears controlling the pair but not being able to break the ADX line. The set up shows undefinition in the short term.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Author

Tomas Salles

FXStreet

Tomàs Sallés was born in Barcelona in 1972, he is a certified technical analyst after having completing specialized courses in Spain and Switzerland.