- Bitcoin finds support above $6,340 but it should target $6,250 on probable dips.

- Ethereum finds support in the short term above $430, targets $405.

- Ripple limits the fall but is at risk of accelerating down to the $0.41 level.

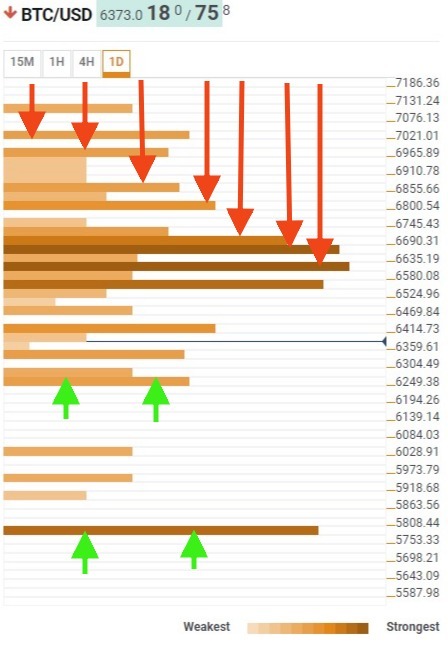

BTC/USD 1D

Bears have dominated the Crypto session in Europe and the United States. As of now, it is still a technical movement within the normality, especially for Bitcoin, as other Cryptos have been dragged to price levels that risk damaging them in the medium term.

Bitcoin presents a scenario favorable to a bearish continuation, with weak supports below the current price. The first one is located between $6,620 and $6,680, the confluence zone formed by the weekly S1 Pivot Point level, the weekly minimum and the monthly 23.6% Fibonacci level. If the money doesn't show up at this level, Bitcoin should go down to $5,800, month-low and also where the weekly S3 Pivot Point level awaits.

On the upside, BTC/USD will find a first medium resistance level at $6,420. This confluence zone has the S3 daily Pivot Point level as its main component. However, the real challenge for Bitcoin is between $6500 and $6,700, where a confluence of more than 25 medium and long-term indicators will make it very difficult for the bulls.

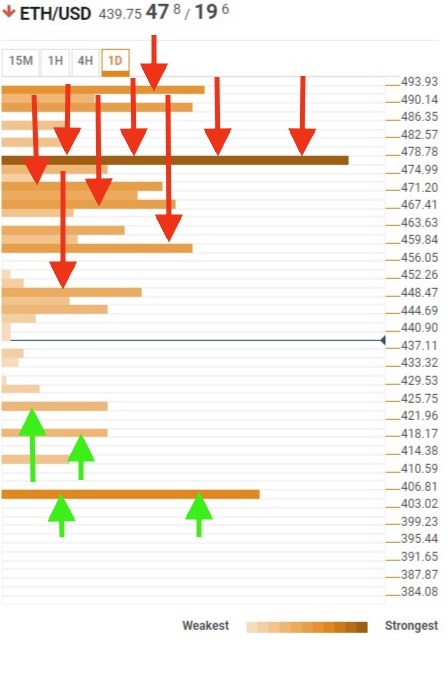

ETH/USD 1D

If you have followed the Ethereum chart, today's bearish move does not change the previous scenario. ETH/USD is looking for the base of a slightly bullish channel and for now that limit remains intact. If it misses today's low, our Confluence Indicator tells us that it shouldn’t find support until $405. It’s down there where the monthly lows and the weekly Pivot Point S3 level can support Ethereum, the last barrier before entering the disaster zone.

On the upside, the first challenging zone to cross for Ethereum at around $440, where last week's low, the S3 level of the daily Pivot Point calculation and the S1 level of the weekly Pivot Point converge, among others. The resistance zones are constant up to $480, a real technical strength, accumulating among many others, the 23.6% Fibonacci level in the daily range and the 38.2% Fibonacci level in the weekly range.

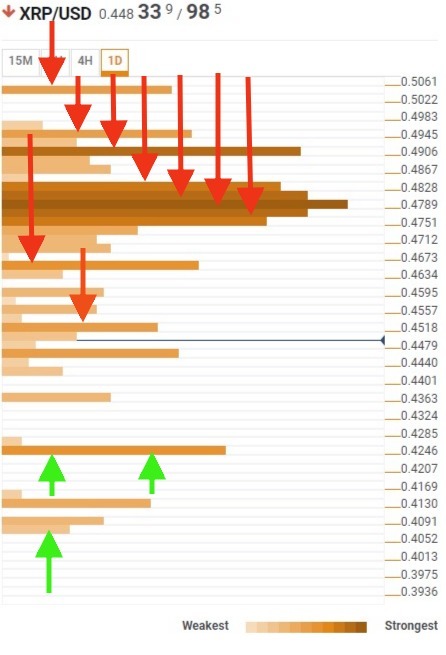

XRP/USD 1D

Ripple is, without a doubt, the most harmed Crypto by the movement seen today. Its chart does not justify the fall, being completely at the expense of the bears that have brought it to this level. XRP/USD has two possible areas to find the money that would enable a potential bull-run: the first is located around $0.42, where last month's lows were left. Below there, XRP/USD will need to move to $0.40 to attract some money, where it should find some support through the S2 Pivot Point level and the 161.8% Fibonacci extension in the weekly range.

On the upside, the current challenge is a major one for Ripple. Between $0.467 and $0.49, there is a confluence of more than 20 medium and long-term indicators that will make it very difficult for Ripple to return to the $0.50 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.