Toncoin price flashes 45% rally signal as Trump’s Ross Ulbricht pardon lifts Privacy coins

- Toncoin price crossed $5.3 on Wednesday, driven by bullish sentiment surrounding privacy-focused coins.

- Whales have acquired 435,000 TON tokens in the last ten trading days, reflecting strong demand amid rising market liquidity.

- Technical indicators show TON has formed a double bottom pattern, signalling a potential 45% breakout ahead.

Toncoin price crossed $5.3 on Wednesday, driven by bullish sentiment after President Donald Trump pardoned early-Bitcoiner Ross Ulbricht. On-chain analysis shows that whale investors had been on a 10-day buying spree before the latest bullish news events surrounding Privacy-focused coins.

Toncoin Price Retakes $5 Territory as Trump Pardons Ross Ulbricht

Toncoin (TON) surged on Wednesday, reclaiming the $5 territory, buoyed by strong tailwinds surrounding privacy-focused cryptocurrencies.

The rally was sparked by two significant events this week that provided a major boost to the sector.

A U.S. court reversed its ban on the cryptocurrency mixer Tornado Cash, lifting restrictions that had previously limited its use.

More so, former President Donald Trump issued an executive order pardoning Ross Ulbricht, the creator of the Silk Road marketplace, a move seen as favorable to privacy-centric projects.

These two key events are widely viewed as bullish for privacy-focused cryptocurrencies.

The court's reversal on Tornado Cash is seen as a step towards recognizing the importance of privacy in the crypto space, while Trump's pardon of Ulbricht signals potential leniency in the enforcement of crypto-related regulations, further cementing the value of privacy coins.

Both developments have generated increased optimism around the future of privacy in digital currencies.

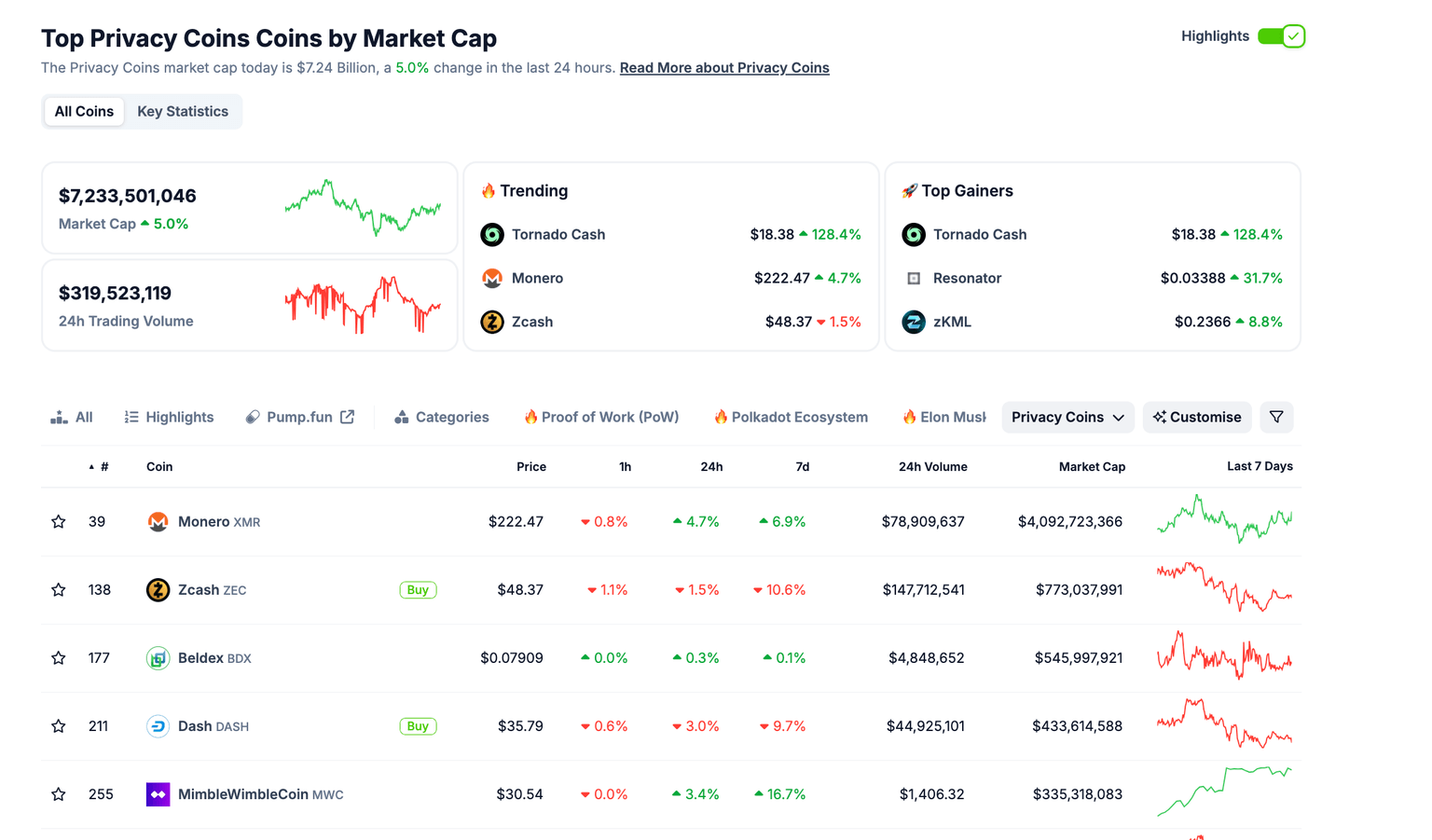

In terms of market reaction, the privacy coin sector saw a notable influx of demand on the day.

According to data from Coingecko, the privacy-focused tokens market grew by 5%, as traders sought to capitalize on the positive momentum generated by these pivotal events.

Tornado Cash’s legal victory, coupled with Ulbricht's pardon, acted as a catalyst that spread bullish sentiment across the entire sector, benefiting not only Tornado but also other privacy coins.

Notably, Monero (XMR), Tornado Cash, and Dash emerged as the top trending privacy tokens, with these coins experiencing significant price movements and surging interest from traders.

According to Coingecko’s search interest data, these tokens generated the most attention throughout the day.

However, Toncoin was not left lagging.

The chart above shows that TON price has increased by 5% since Trump’s inauguration on Monday, mirroring the uptrend in the privacy coin sector.

Toncoin, founded by the Telegram team, a privacy-preserving social media giant, was not left behind in the rally.

The TON market was also buoyed by the unfolding positive events, affirming the bullish trend across privacy-focused cryptocurrencies.

Toncoin Whales on $2.3 Million Buying Spree Ahead of Trump’s Inauguration

Toncoin’s 5% price gains over the last 48 hours have been linked to positive sentiment surrounding Ross Ulbricht’s freedom and the Tornado Cash ban reversal, boosting investor confidence in privacy-focused cryptocurrencies like TON.

However, a closer look at on-chain insights reveals that whale investors acquired an unusually high volume of TON in the days leading up to Trump’s inauguration.

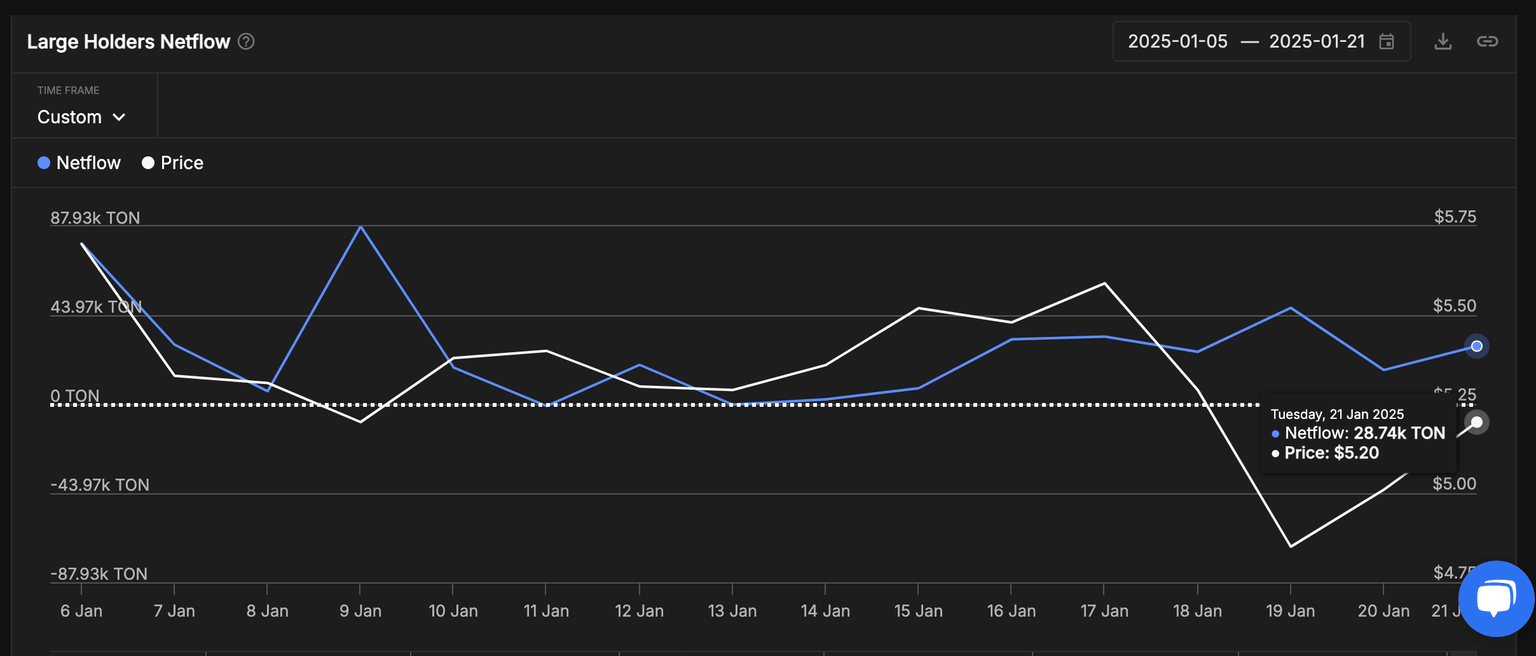

Validating this perspective, the IntoTheBlock chart below tracks the daily balance of deposits and withdrawals from wallets holding at least 0.1% of the total TON in circulation.

This data provides real-time insights into whale investors' trading sentiment around key market events.

Prior to the latest TON price rally on Wednesday, Toncoin whale investors had been on a buying spree since January 12.

The data in the chart above shows that large-holder wallets acquired 453,000 TON coins, worth approximately $2.3 million, by the close of trading on Tuesday.

This indicates that whale investors entered a buying spree nearly a week before Trump’s presidency, likely anticipating that the inauguration could trigger bullish tailwinds, as observed this week.

Notably, whales that began acquiring TON 10 days ago are now sitting on double-digit unrealized profits.

If they opt to sell, Toncoin’s price risks a significant reversal below $5. However, with positive sentiment around privacy coins, this seems unlikely.

Toncoin Price Forecast: Double-bottom pattern signals potential 45% breakout

Toncoin's recent price action showcases a well-defined double-bottom pattern, forming support at $5.30 and signaling a potential bullish breakout.

The measured move suggests a 45% rally from the $5.30 neckline, aligning with the $7.70 target.

This pattern indicates renewed buyer interest, confirmed by a notable increase in volume during the right-bottom formation, highlighting accumulation near the support zone.

The MACD histogram hints at a bullishness as the signal line trends closer to crossing above the MACD line.

Such momentum shifts often precede sustained price movements, adding credibility to the bullish thesis.

A daily close above $5.50, the first resistance, could ignite momentum toward the $7.70 target. Immediate resistance levels at $5.80 and $6.00 will require strong buying volume to overcome.

Conversely, a bearish scenario unfolds if Toncoin fails to sustain above $5.30. A breakdown below this level risks retesting $5.00 or lower, invalidating the double-bottom structure.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.