Three altcoins that are likely to crash next week and here is why

- With Bitcoin moving sideways, altcoins have exploded in the past few days.

- Injective, Avalanche, Optimism, Chainlink and many altcoins have returned double and triple-digit gains and could trigger a corrective wave soon.

- Double-digit corrections are more than likely in the second half of November, especially if BTC slides down.

With massive rallies across the board, the cryptocurrency market capitalization has increased from roughly $831 billion to nearly $1.5 trillion in the last ten months. While the overall outlook remains undoubtedly bullish, investors need to expect the possibility of a 10% to 20% correction even during bull runs.

Here are three altcoins that exhibit signs of weakness:

- Injective Protocol (INJ)

- Avalanche (AVAX)

- Optimism (OP)

Honorary mentions:

- Chainlink (LINK)

- Render (RNDR)

- Fetch.aI (FET)

Bull run corrections are part of the cycle

Bitcoin (BTC) price has produced major sell signals on the weekly as well as the daily time frames. A correction seems all but inevitable, especially after the US Securities and Exchange Commission (SEC) hinted at a delay in ETF approval.

Analysts indicate that the Bitcoin spot ETF approval chances still sit at 90% and is likely to be approved by January 2024.

Between November 2023 and January 2024, these sell signals could play out and still retain the larger bull market trend. While Bitcoin price might only slide down 10% to 20%, altcoins could easily see corrections upwards of 20%.

Read more on why Bitcoin price could crash soon - Link

Yearn Finance (YFI) price experienced a 40% correction in the Asian trading session on November 18. Most altcoins will likely face a similar fate should BTC correct.

Read more: Yearn Finance crashes 40% in five hours, as altcoins lose footing

Three altcoins that could trigger double-digit corrections

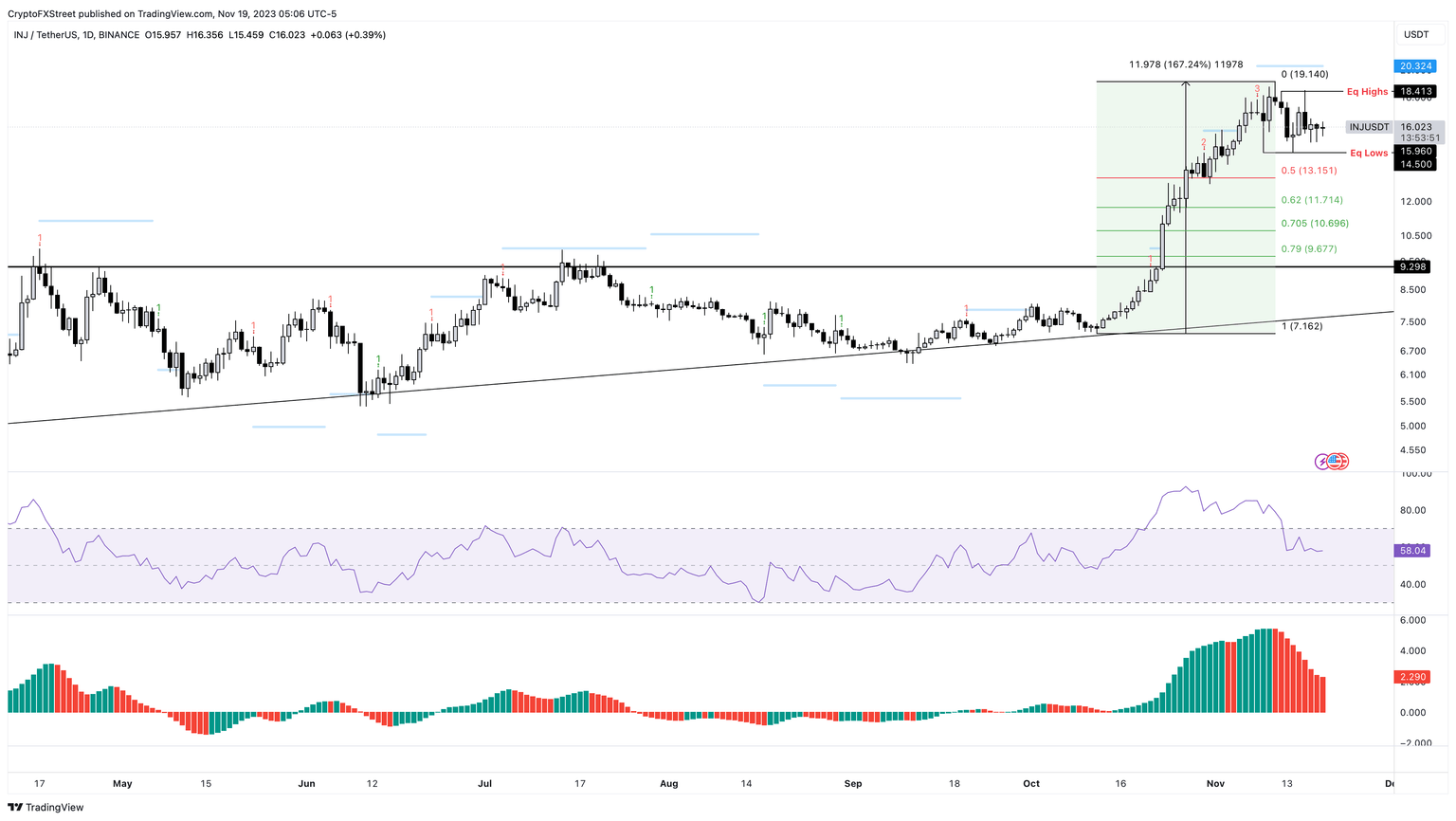

Injective (INJ) price has rallied a whopping 167% between October 12 and November 11. This impressive uptrend now looks exhausted.

- The Momentum Reversal Indicator (MRI) has flashed not one but three sell signals.

- A sweep of equal highs at $18.41 could occur next week before the altcoin shows more signs of a bearish outlook.

- Nearly 4.40% of the circulating supply is set to be unlocked in January 21, 2024.

- A 17% correction to $13.15 is likely, which is the midpoint of the 167% move.

INJ/USDT 1-day chart

While the short-term outlook might seem bearish, Injective price might rally ahead of the token unlock in January 21, 2024.

Avalanche (AVAX) price has shot up 185% between October 16 and November 13.

- The rally has cleared the liquidity resting above $22.56 hurdle.

- If there is a weekly swing failure where AVAX produces a weekly candlestick close below $22.56, it could trigger a 30% correction to $15.56.

- In some cases, AVAX could retest the $14.67 support level.

AVAX/USDT 1-week chart

Optimism (OP) price has inflated by 67% between October 16 and November 13, which is not as mush as INJ or AVAX.

- The weekly Relative Strength Index (RSI) for OP has overcome the 50 mean level recently.

- The RSI flip, while bullish, could see a pullback to retest the midpoint. This pullback could cause OP to drop nearly 20% and tag the key weekly support level of $1.41.

OP/USDT 1-week chart

While the short-term correction outlook for OP is bearish, the long-term outlook, however, remains largely bullish. A recovery above the $1.91 support level could push Optimism price to kickstart a massive uptrend to $3.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.