This is why Bitcoin Gold price is up by 50% even as Bitcoin price remains stuck below $30,000

- Bitcoin Gold price is trading at $20 after rising to an intra-day high of $25, marking a 90% rally.

- According to Satoshi Talks, the surge in the Bitcoin hard fork could be the result of renewed interest in meme coins.

- This is partially correct, as Bone ShibaSwap (BONE) and Shiba Inu (SHIB) made headlines in the past few days.

Bitcoin price has been unable to flip $30,000 into a support floor for a couple of days now, but its namesakes and hard fork tokens seem to be doing pretty well. Recently, Bitcoin Cash was enjoying enormous gains. Over the past 24 hours, another hard fork, Bitcoin Gold price, shot up significantly.

Read more - BTC alternatives mark notable rises on the back of Bitcoin price retaining $30,000 support

Bitcoin Gold price rises because of meme coins

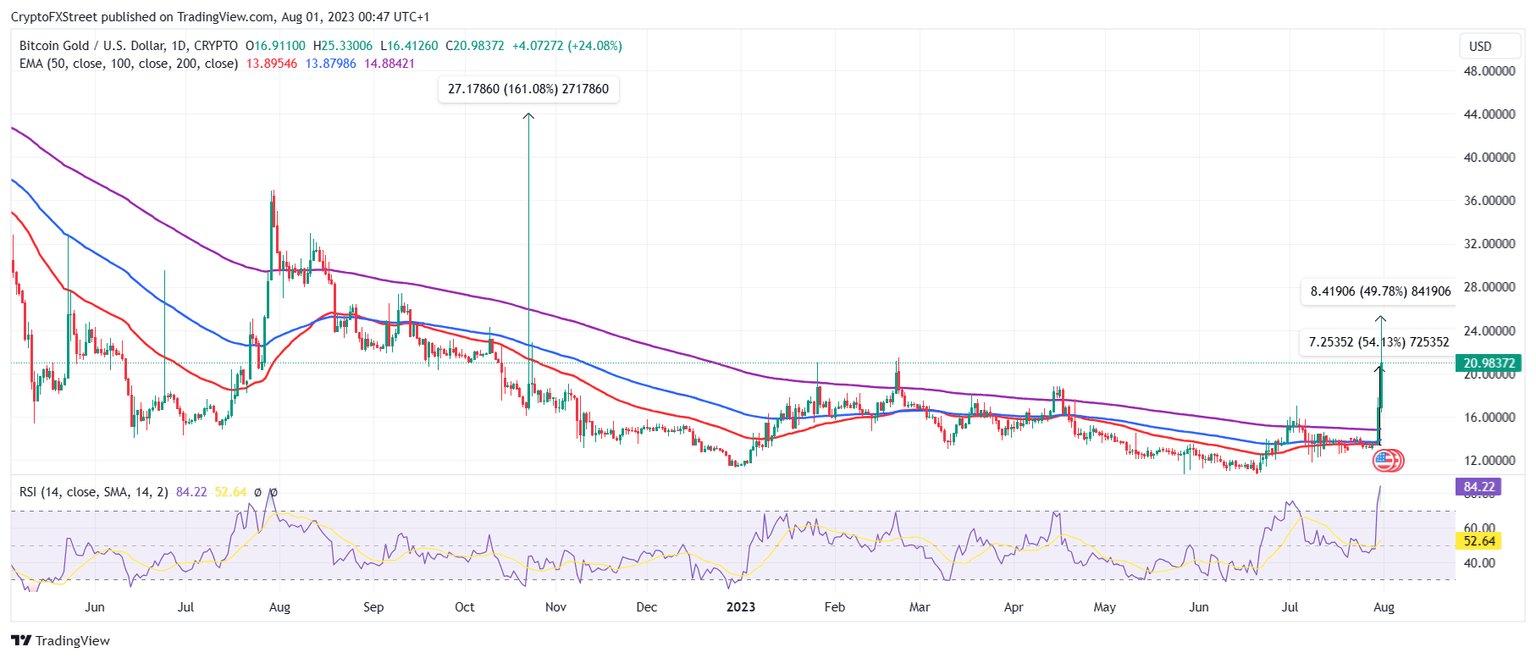

Bitcoin Gold price shot up by more than 54% in the span of just a day to bring the altcoin to $20.98 at the time of writing. While the rally in itself is pretty huge, during the intra-day trading hours, the cryptocurrency was doing even better. Hitting a high of $25, BTG shot up by nearly 90% in the past day before receding to the current trading price.

This is the first time in almost ten months that Bitcoin Gold price has registered such stark gains in a single day. The last time this happened was back in October 2022, when the altcoin shot up by more than 161%. At present, while the exact reason for the rally is unknown, speculation points towards meme coins.

BTG/USD 1-day chart

Satoshi Talks, a crypto influencer, tweeted that the renewed interest in small-cap tokens, including meme coins, could be behind the rally. This is partially correct, as the likes of Shiba Inu and Bone ShibaSwap (BONE) observed significant gains in the last few days.

Similarly, the speculated reason behind the rise sparked bullishness for the likes of Bitcoin Gold. The investors also jumped at the chance of making profits, and this was reflected in the trading volume of the digital asset.

Over the past 24 hours, BTG observed a total transaction volume of $209 million, which represents more than 60% of the total market capitalization of Bitcoin Gold worth $346 million at the moment.

This surge in trading volume was no less either as compared to the previous week’s average of $1.7 million; $230 million is a 13,430% increase. But this bullishness will likely subside, and the gains will correct since the Relative Strength Index (RSI) suggests that Bitcoin Gold is clearly oversold.

Bitcoin Gold trading volume

Since the market is overheated, it will need to cool down, and with it will come some drawdown, making Bitcoin Gold a not-so-necessary asset to add to your portfolio for now.

Read more - Shiba Inu price along with BONE rally as Shibarium-Ethereum bridge testnet kicks off

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.26.00%2C%252001%2520Aug%2C%25202023%5D-638264480075214457.png&w=1536&q=95)