Tezos price shows severe signs of a potential pullback towards $1.7

- Tezos price is bounded inside a descending wedge on the daily chart.

- Several indicators have turned bearish for XTZ showing it’s poised for a pullback.

Tezos has been trading inside a descending wedge on the daily chart since June 2020. Unlike other cryptocurrencies, Tezos hit its 2020-high of $4.49 on August 13 and has been consolidating since then.

Tezos price faces strong selling pressure in the short-term

XTZ price is not close to a breakout or breakdown of the descending wedge formed on the daily chart. However, the bulls have lost the 100-SMA and 50-SMA support levels as Tezos price is trading in the middle of the pattern.

XTZ/USD daily chart

The bears seem to have the upper hand after Tezos lost both moving averages. The potential price target would be the lower trendline of the descending wedge at around $1.7 in the mid-term.

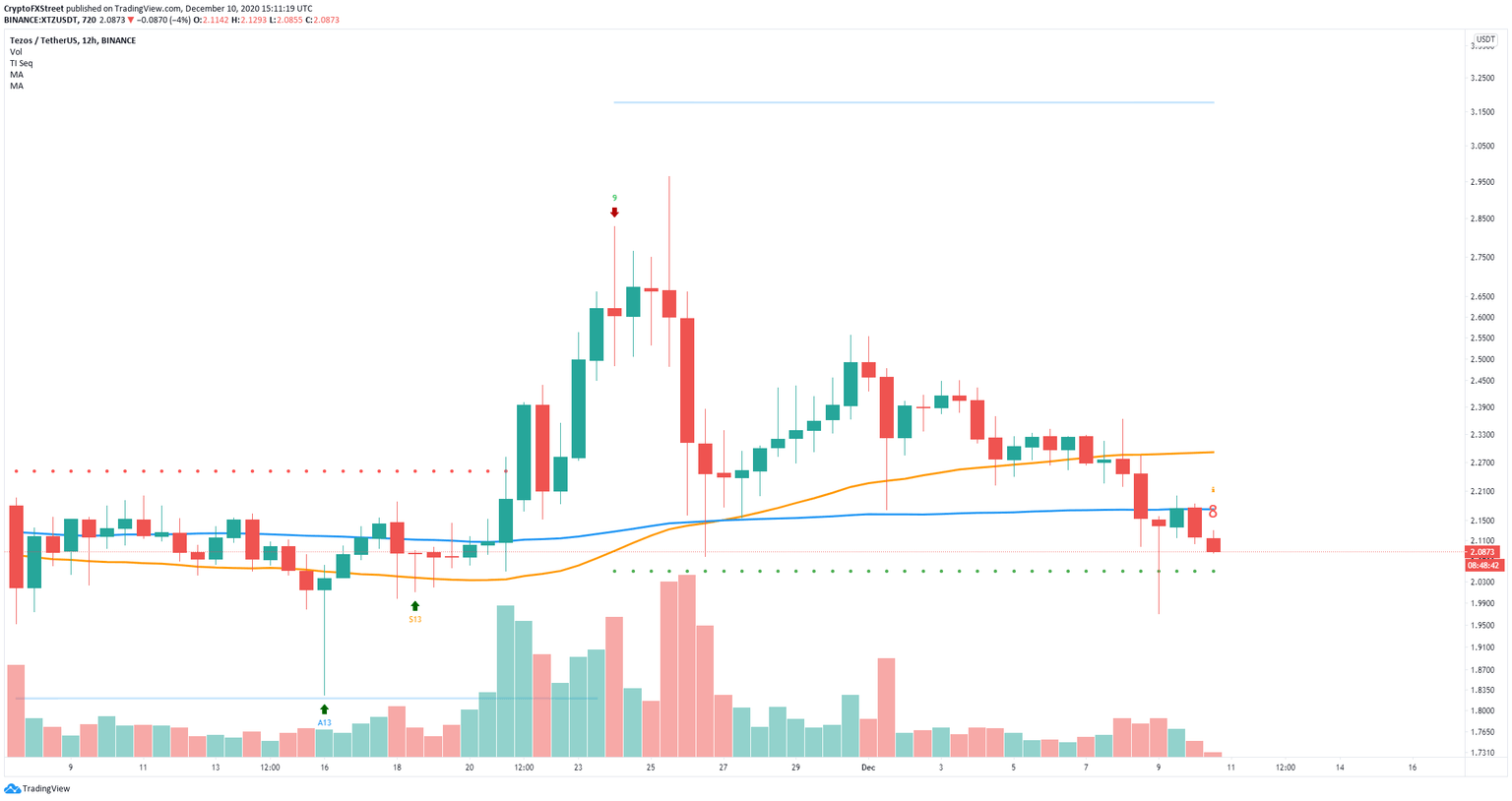

XTZ/USD 12-hour chart

However, on the 12-hour chart, the TD Sequential indicator seems to be on the verge of presenting a buy signal – in the form of a red nine candlestick – within the next 10 hours. If bulls can recover the 50-SMA and the 100-SMA as support levels on the daily chart, they could quickly push Tezos price towards the upper trendline of the descending wedge at $2.6.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.