Tezos Price Forecast: XTZ targets $5.5 as technicals scream buy

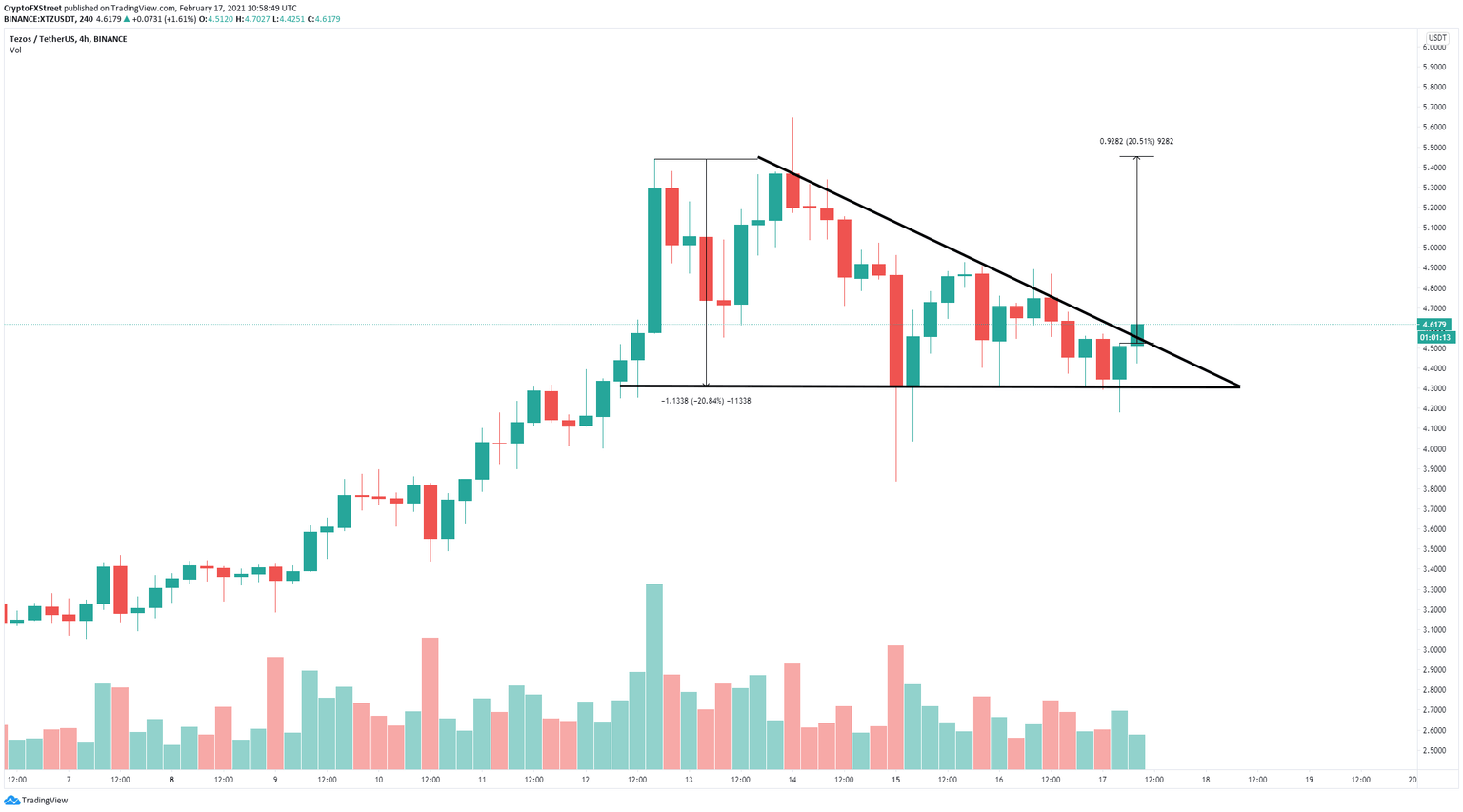

- Tezos price had a breakout from a descending triangle pattern on the 4-hour chart.

- A key indicator has just presented a strong buy signal giving credence to the bulls.

- A 4-hour candlestick close above $4.5 would confirm a bullish breakout with a target of $5.5.

Tezos price aims for a nice rebound after establishing a local bottom at $4.3. The digital asset had a healthy consolidation period from a high of $5.64 down to $3.83, after a massive 115% rally.

Tezos price can quickly jump to $5.5, supported by technicals

On the 4-hour chart, Tezos established a descending triangle pattern. It seems that Tezos price had a breakout above the key resistance of $4.5 but needs a candlestick close to confirm. The bullish price target is $5.5, a 20% move calculated by using the height of the pattern as a reference point.

XTZ/USD 4-hour chart

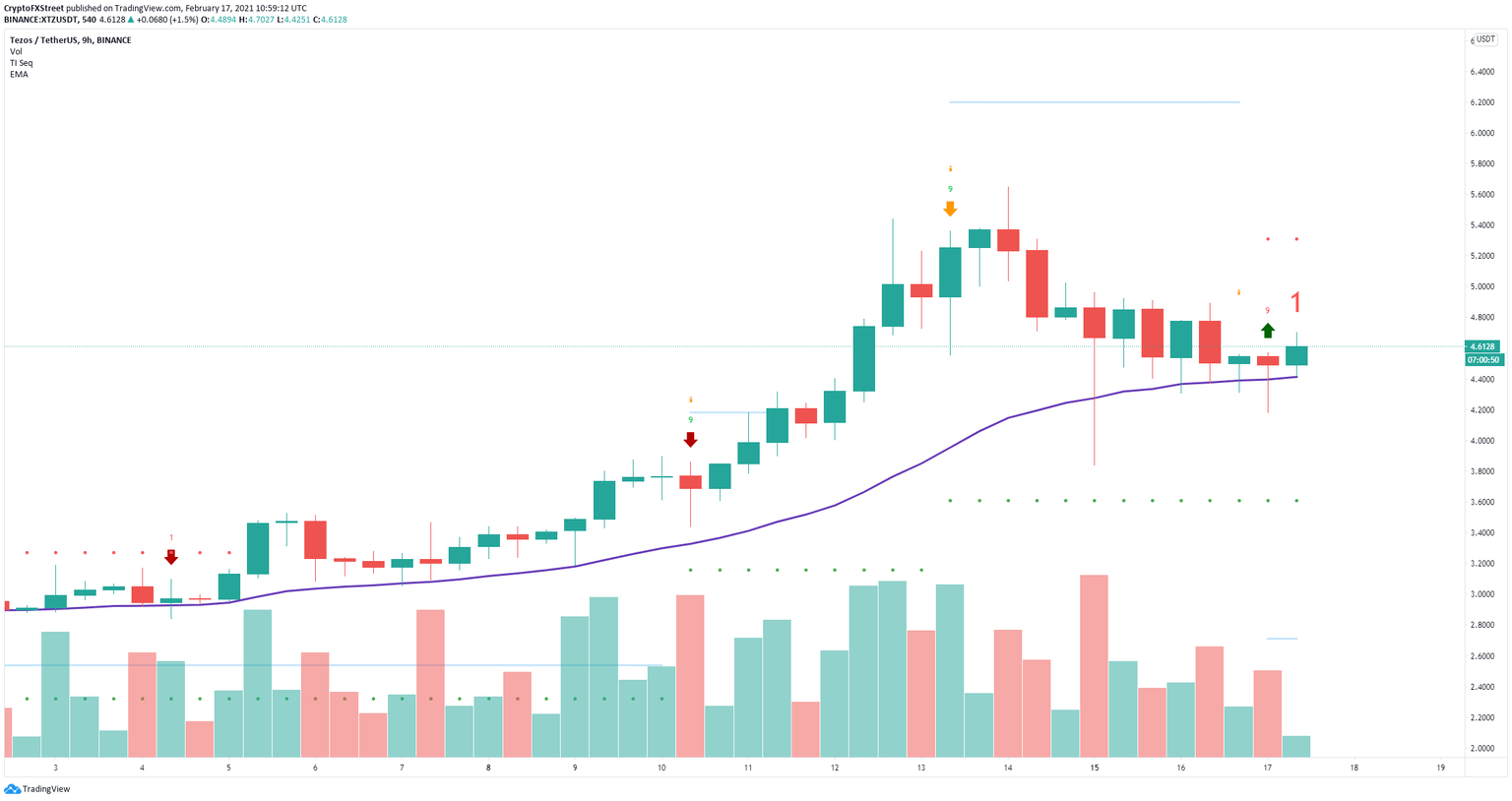

This outlook is supported by the TD Sequential indicator which presented a buy signal on the 9-hour chart. Additionally, Tezos price has defended the 26-EMA here several times and there is practically no resistance until the previous high of $5.64.

XTZ/USD 9-hour chart

However, if the breakout is not strong enough and Tezos gets rejected, bulls will need to hold the 26-EMA at $4.4 to avoid a major drop below $4 towards a low of $3.83 established on February 15.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.