- Terra's Luna price has flatlined into $0.00000001 SATs. On-chain analysis shows trades are still taking place despite the fact.

- BitTorrent Token flatlined in August 2020 at $0.00000001 SATs before fully reversing and rallying 1,000%.

- Invalidation of the bearish trend could be the first breach above $0.00000001 SATs.

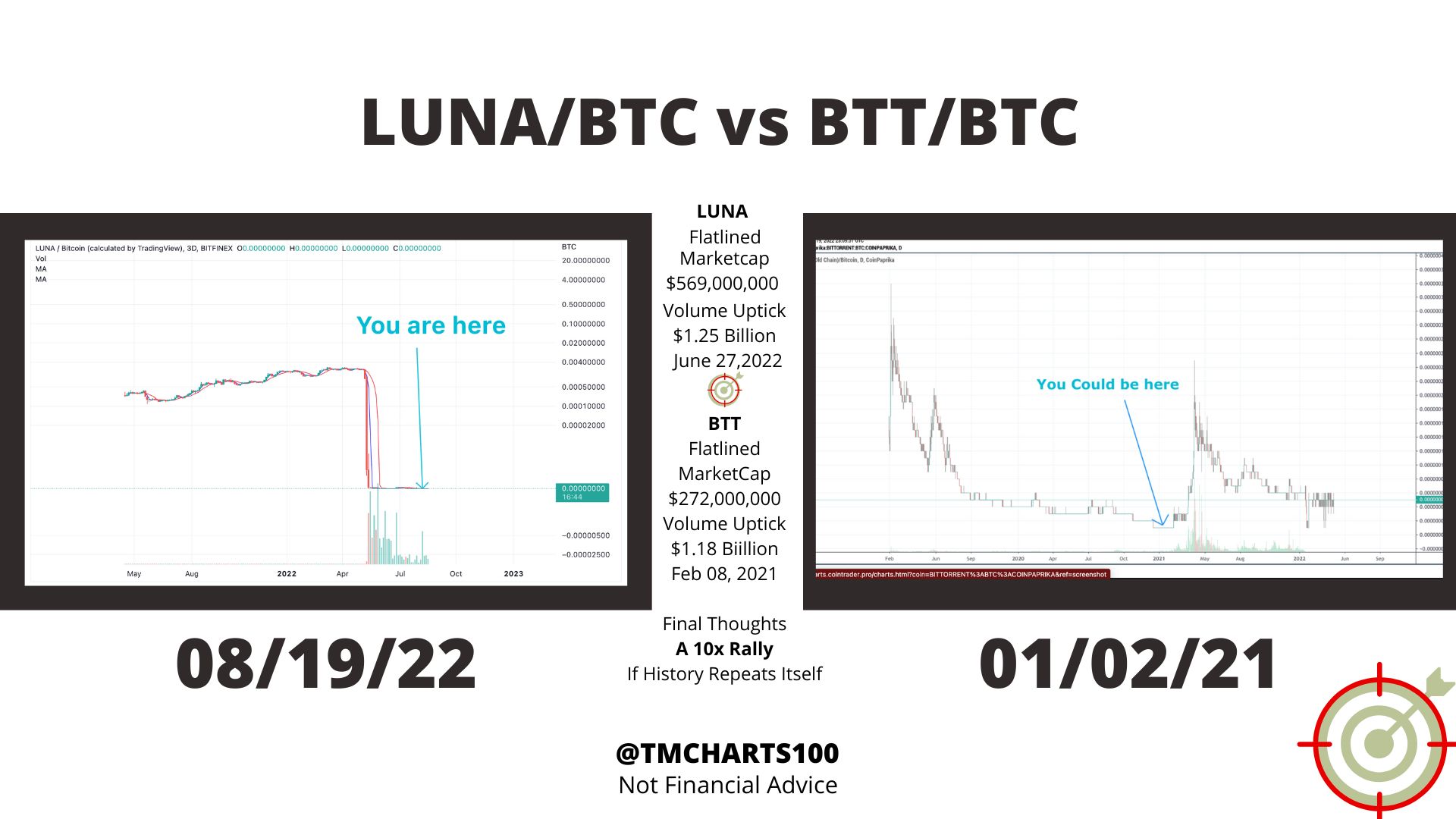

Terra's LUNA price shows staggering on-chain and technical comparisons to BitTorent Token's 2021 bottom, which induced an infamous 10x bullrun.

Terra LUNA price hints at nostalgia

Terra's LUNA price is unquestionably a disappointing situation for the crypto community. There's no point in beating a dead horse. Older Investors are at a devastating loss, and newer investors are dually suffering a blow from trying to buy a dip amidst the Armageddon-style sell-off in May 2022.

This article is meant to encourage and inform investors about a similar time in the crypto market when a particular cryptocurrencies' failure to 0 was entirely reversed. The LUNA asset is showing similar technichal and on-chain data to Bittorent Token's market bottom which catalyzed a 2021-10x rally

LUNA vs BTT - Technical & On-Chain Analysis

Terra's LUNA price currently trades at $1.58. Traders, however, should be aware that the LUNA price, like most cryptocurrencies, also trades against the BTC. If you look at the LUNA/BTC chart, you will notice that Terra has completely flatlined in price trading at 0.00000001 SATs. Additionally, the Relative Strength Index has also flatlined, showing no interest from bears and bulls alike.

Contrary to many traders' beliefs, the original LUNA/BTC( also known as LUNA classic) is still actively trading. On June 27, Santiment's On-chain analysis indicators showed an influx of $500 million worth of transactions. The total market cap briefly tagged $1.25 billion. The volume profile is currently averaging about 50% lower at $569 million. Algorithmic trading bots are likely scalping on minute price levels.

Santiment's Market Cap. Volume &LUNA/BTC Volume Profile Indicators

Crypto traders may recall when the BitTorrent token witnessed a similar sell-off in August 2020. The BitTorrent company also experienced a controversial news-related event that created a sellers frenzy from Mid August 2020 to January 2021. Traders lost hope as the BTT token traded at $0.00000001 SATs and flatlined on the Relative Strength index.

Bittorent token's market cap fell to $272 million (half of LUNA's current market cap) until, in February of 2021, BTT saw a similar one-day spike of volume, briefly bringing the market cap up to $ 1.18 billion. After days of consolidation, the subtle influx in volume became the catalyst for a 1,000% bullrun in just 60 days.

LUNA vs BTT - Technical & On-Chain Analysis

A wise mathematician once said, "the least probable outcome is the most likely to occur ." If you invested in the LUNA price at any time, we at FXStreet hold you in our thoughts. We're rooting for you.

Invalidation of the bearish trend is the first breach above $0.00000001 SATs. The breach could translate as the first buy signal of the future LUNA Bullrun targeting the $26. swing high, resulting in a 1,000 percent increase from the current LUNA price.

In the following video, our analysts deep dive into the price action of LUNA, analyzing key levels of interest in the market. -FXStreet Team

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

VanEck sees Bitcoin reaching $61 trillion market cap, Marathon buys $100 million BTC

Bitcoin declined by 1% on Thursday following asset manager VanEck's forecast that the top digital asset will reach a $61 trillion market capitalization by 2050.

Ethereum Classic price sets for a rally following retest of key support

ETC edges higher by 2.3% and trades around $22.60 at the time of writing on Friday after testing a key support area the day before. On-chain data showing increased account growth suggests a bullish move ahead. Ethereum Classic price faced rejection by the daily resistance level of $25.13 earlier this week.

Celebrity meme coins lose their shine

Celebrity meme coins report by Jupiter Slorg on Thursday shows that these tokens have been in deep waters since early July after experiencing heavy growth in June. In a recent analysis, Jupiter Slorg revealed that celebrity meme coins are down by an average of 94% from their all-time highs.

Ripple gains 5%, Mark Cuban says Kamala Harris’ nomination could affect SEC lawsuit

Ripple (XRP) made a comeback above key psychological resistance early on Wednesday. Crypto traders are optimistic after the Ethereum Exchange Traded Fund (ETF) launch. Entrepreneur and investor Mark Cuban recently shared his comments on how Kamala Harris’ nomination to the Presidential elections could influence crypto regulation.

Bitcoin: Will BTC manage to recover from recent market turmoil?

Bitcoin recovers to $67,000 on Friday after finding support around $63,500 a day before. Still, BTC losses over 1.50% on the week as Mt. Gox persists in transferring Bitcoin to exchanges.