Terra Luna Classic Price Prediction: Clears signs of a market reversal surface on LUNC

- Terra's Luna Classic is down 4% on the day and shows signs of a market reversal.

- The bears couldn't do a 20% decline from the current LUNC price.

- The bulls need to hurdle the $0.00019621 resistance level to void the bearish outlook.

Terra's Luna Classic shows signs of a trend failure. Early bulls in the market may want to brace themselves for a steeper retracement. Bears could position themselves for a profitable trade idea in the coming days.

Terra's Luna Classic price setting up a market reversal

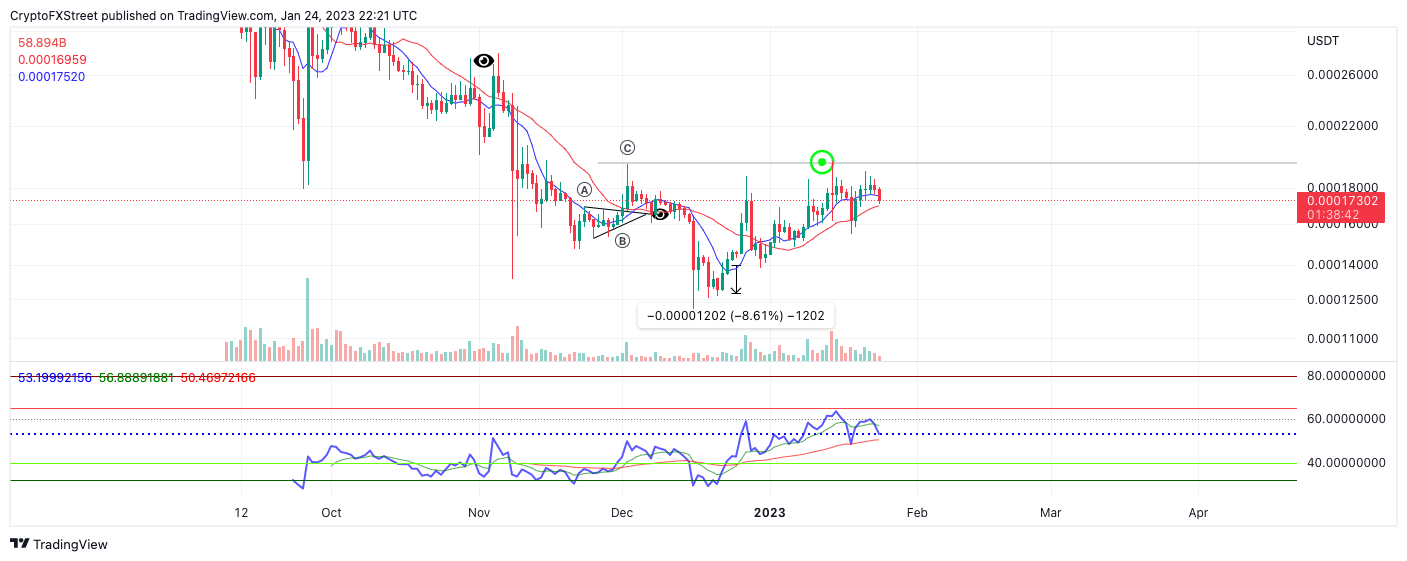

Luna Classic price could be in the initial stages of a strong decline. On January 24, the bears have breached the 8-day exponential moving average, forging a 3% loss on the day. Although the decline seems minuscule, it is accompanied by a bearish divergence on the Relative Strength Index (RSI).

The divergence can be spotted with a keen eye when analyzing the January 15 closing price at $0.00018075 and the January 22 closing price at $0.00018172. The January 22 day showed a lower reading on the RSI, which justifies the idea that the bullish trend may already have ended.

Terra Luna Classic Price currently auctions at $0.00017302. If the market is genuinely taking a turn to the downside, the key levels for bears to aim for will be the $0.00015000 liquidity level and the $0.00013200 level if bulls do not step into providing support. The bearish scenario creates a 24% decline from the current market value.

LUNC/USDT 1-day chart

The invalidation of the downtrend thesis would arise from a breach above the January 14 swing high marked at $0.000019621. A. breach of the level could induce a buying frenzy to challenge higher liquidity levels above. The next expected resistance would come in near the $0.00020882 level. The bull scenario would create a 23% increase from the current Luna Classic price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.