Tellor price peeks 70%, breaks out of leash as longs reevaluate their TRB take profits

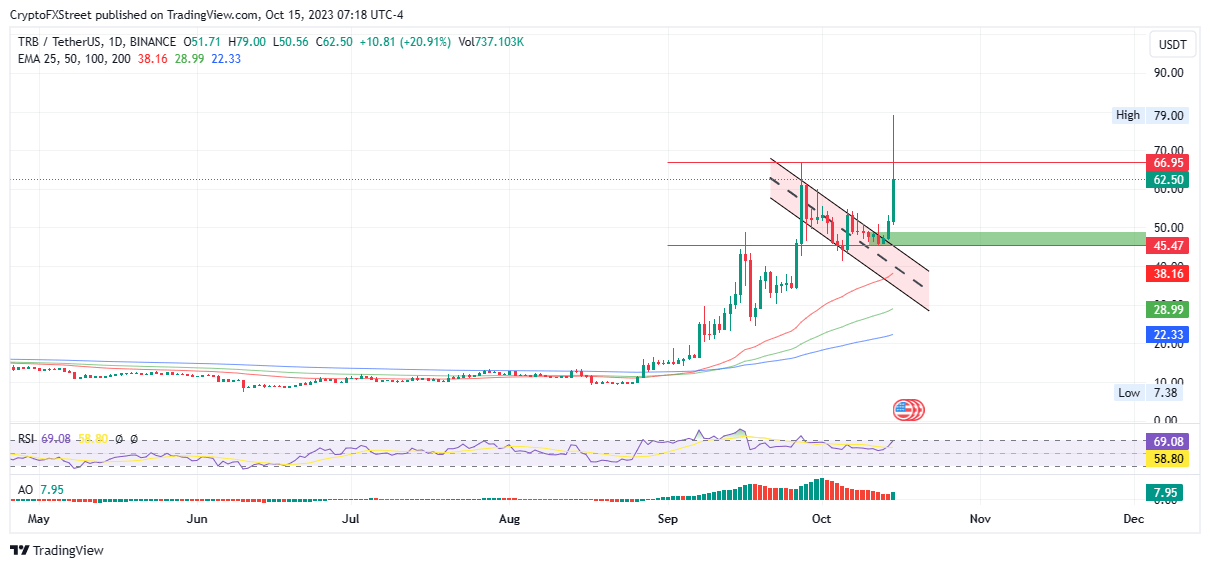

- Tellor price is up 30% in the last 24 hours, 35% high after breaking out from a bearish chart pattern.

- TRB could extend 10% to clear the immediate resistance at $66.95.

- The bullish outlook would be invalidated once the altcoin records a daily candlestick close below the $45.47 support level.

Tellor (TRB) price has broken out of leash after almost three weeks of confinement within a bearish technical formation. While perpetual traders anticipated the move, the surge caught some of them, causing a reevaluation of take-profit levels.

$TRB Literally printing over night.

— Kaz The Shadow (@KazTheShadow) October 15, 2023

Again 5/5 trades on this coin went perfectly as predicted, it’s pretty funny how it always go to my tp…

25% up from my entry, looking at that pump I think that my tp were a little bit conservative

Crazy coin but the most important thing… https://t.co/UE5CrJ8vBY pic.twitter.com/8jLjcrVomH

Tellor price breakout makes traders' take profits appear a bit too conservative

Tellor (TRB) price has outperformed the cryptocurrency market this weekend, recording a 30% surge. Based on technical indicators, the rally may not be over seeing as the Relative Strength Index (RSI) remains northbound while the Awesome Oscillator (AO) remains in the positive territory.

With this, Tellor price could still extend a neck higher, clearing the immediate hurdle at $66.95. In a highly bullish case, the gains could extrapolate for TRB to reclaim its intra-day high of $79.00, approximately 30% above current levels.

TRB/USDT 1-day chart

Conversely, if profit takers join the bears’ camp, Tellor price could pull south, potentially dipping into the demand zone extending from $49.09 to $45.21. A decisive candlestick close below this level would invalidate the current bullish outlook.

In the dire case, the load-shedding exercise could continue to the confluence between the midline of the channel and the 50-day Exponential Moving Average (EMA) at $38.16. Such a move would constitute a 40% fall below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.