Sui price is poised for a rally following a retest of the breakout level

- Sui price breaks above a falling wedge pattern, signaling a bullish move.

- Grayscale, a leading crypto asset manager, launches Grayscale Sui Trust for its investors.

- On-chain data shows that SUI's TVL is rising, suggesting growing activity and interest within the SUI ecosystem.

- A daily candlestick close below $0.59 would invalidate the bullish thesis.

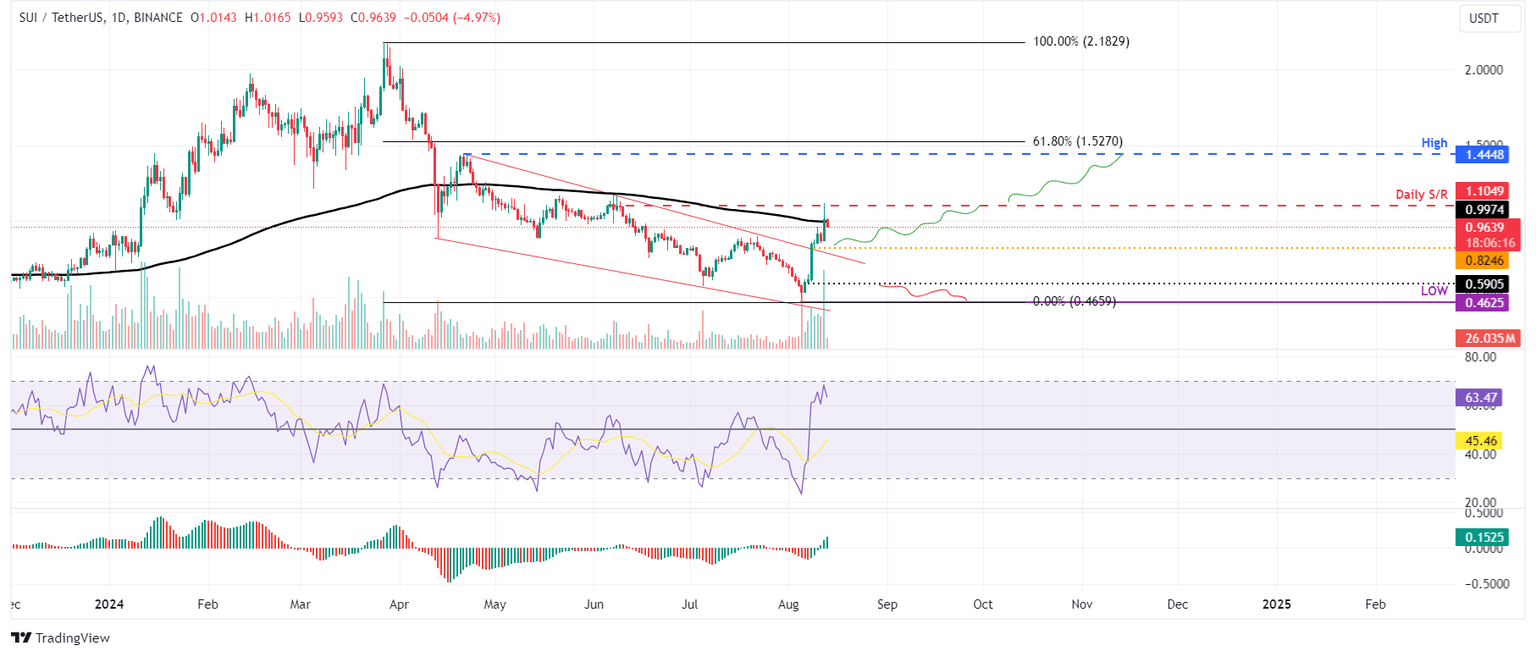

Sui (SUI) broke above the falling wedge pattern on Thursday and surged 19% in the subsequent four days, but as of Tuesday, it is experiencing a pullback, trading 4.8% lower at $0.96 at the time of writing.

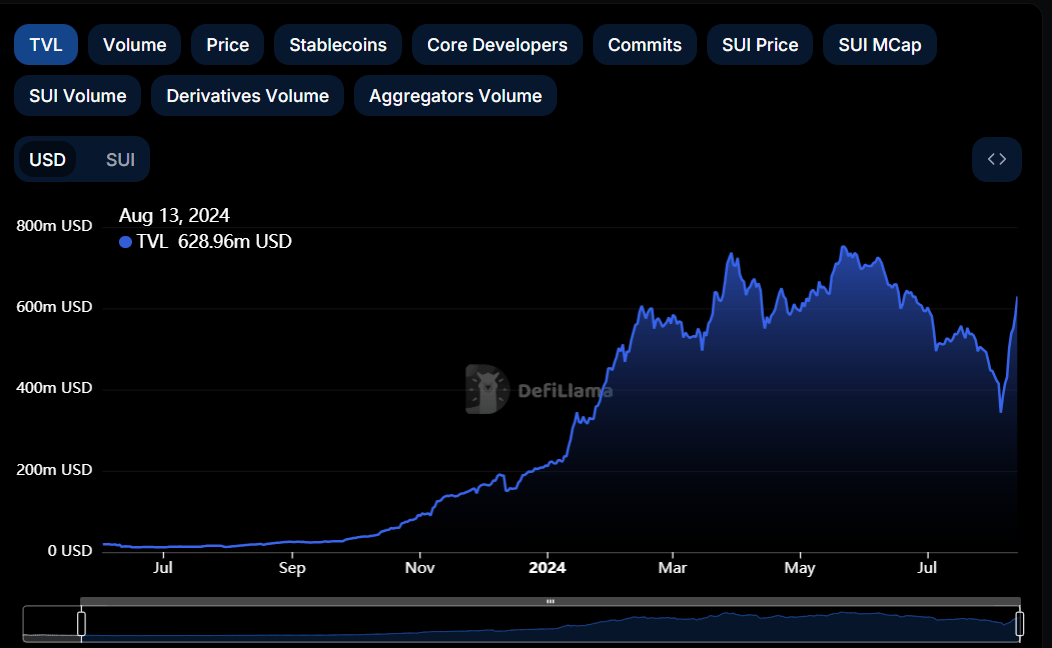

On-chain data indicates rising SUI's Total Value Locked (TVL), reflecting growing activity and interest in the ecosystem. At the same time, Grayscale's launch of the Grayscale Sui Trust on August 7 suggests a bullish outlook for SUI in the coming days.

We are proud to announce the creation of two new single-asset crypto investment funds, available through private placement: Grayscale Bittensor Trust $TAO and Grayscale Sui Trust $SUI.

— Grayscale (@Grayscale) August 7, 2024

Available to eligible accredited investors.

Press release: https://t.co/Xplh81KI9W

1/3 pic.twitter.com/pGcLhcZSdD

Sui price is set for a rally after retesting key support level

Sui price broke above the falling wedge pattern on Thursday, a formation created by connecting swing highs and lows from mid-April to August. This movement signaled a potential bullish trend, and the price subsequently surged 19% over the following four days.

As of Tuesday, the price is experiencing a pullback at the 200-day moving average, which stands around $0.99 and trades slightly lower by 4.8% in the day at $0.96.

If Sui continues to retrace, it could find support around the upper trendline of the falling wedge pattern at $0.82. If this support holds, SUI could rally 34% from that level, targeting $1.10, its daily resistance level.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) momentum indicators on the daily chart are comfortably above their respective neutral levels of 50 and zero, strongly indicating bullish dominance.

SUI/USDT daily chart

Additionally, crypto intelligence tracker DefiLlama data shows that SUI's TVL increased from $342.82 million on August 5 to $628.96 million on Tuesday.

This 83% increase in TVL indicates growing activity and interest within the SUI ecosystem. It suggests that more users are depositing or utilizing assets within SUI-based protocols, adding further credence to the bullish outlook.

SUI TVL chart

Despite the bullish thesis signaled by both on-chain data and technical analysis, if Sui's daily candlestick closes below the $0.59 daily low of August 7, the outlook will shift to bearish. This scenario could lead to a 22% crash to retest its August 5 low of $0.46.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.