Sui Price Forecast: SUI bears aiming for a 30% crash

- Sui’s price closes below its ascending trendline, indicating a correction ahead.

- The technical outlook suggests a pullback as momentum indicators show signs of weakness.

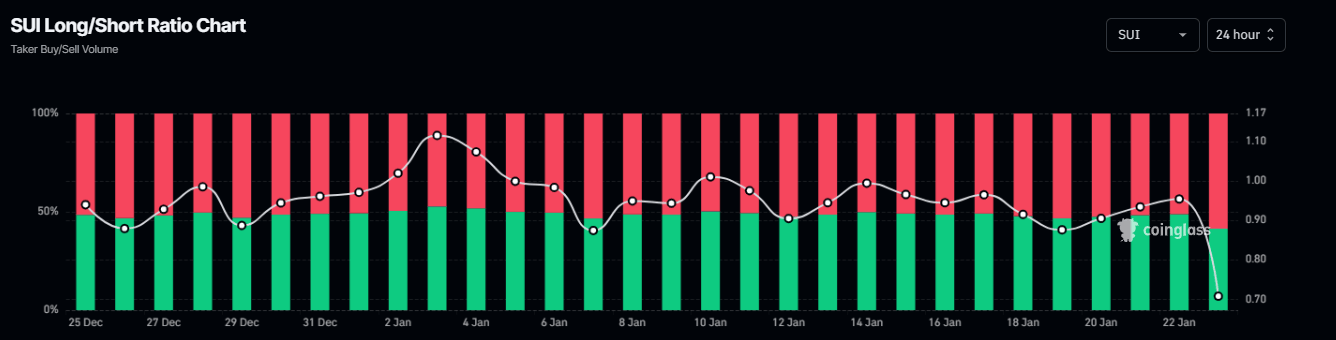

- Coinglass data shows that SUI’s long-to-short ratio reached the lowest level in over a month, reflecting a bearish sentiment.

Sui (SUI) price extends its decline, trading below $4.37 on Thursday after rejecting from its ascending trendline in the previous day. Coinglass data shows that SUI’s long-to-short ratio reached the lowest level in over a month, reflecting a bearish sentiment. Moreover, the technical outlook suggests a correction as momentum indicators show weakness, projecting a 30% crash ahead.

Sui price action shows signs of weakness

Sui’s price broke below the ascending trendline (drawn by connecting multiple daily close levels since November 26) on Sunday; however, it recovered slightly to retest the broken trendline on Tuesday and got rejected. A break below, retest and then rejection from the ascending trendline indicates the change in market structure from bullish to bearish. At the time of writing on Thursday, it continues to trade down around $4.37.

If SUI continues its pullback, it could extend the decline by 14% from its current levels to retest its 200-day Exponential Moving Average (EMA) at $3.75. A successful close below could extend an additional decline to test its next support level at $2.96, crashing 30% from its current level.

The Relative Strength Index (RSI) on the daily chart reads 45, below its neutral level of 50 and points downwards, indicating strong bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover on a daily basis. Moreover, it also shows rising red histogram bars below the neutral line zero, suggesting that the Sui price could experience downward momentum.

SUI/USDT daily chart

Another bearish sign is Coinglass’s Sui long-to-short ratio, which reads 0.79, the lowest level in over a month. This ratio below one reflects bearish sentiment in the markets as more traders are betting for the Sui price to fall.

Sui long-to-short ratio chart. Source: Coinglass

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.