Crypto stablecoin legislation advances, but Democrats say Trump’s USD1 raises red flags

- The US Congress began reviewing a Crypto Stablecoin bill on Wednesday.

- This comes a week after Trump-backed WLFI announced the launch of its USD1 Stablecoin pegged 1:1 to the US dollar.

- Despite concerns, the House Financial Services Committee voted to recommend the crypto stablecoin bill for full legislative process.

The U.S. Congress took a major step toward crypto regulation on Wednesday, reviewing a stablecoin bill amid growing private sector.

Crypto stablecoin legislation advances, Trump’s USD1 poses major risks

The U.S. Congress has taken a significant step toward stablecoin regulation, as lawmakers on Wednesday reviewed a proposed crypto stablecoin bill.

The legislative process comes just weeks after Trump-backed Web3 Liberty Financial Initiative (WLFI) announced the launch of its USD1 stablecoin, pegged 1:1 to the U.S. dollar on March 25.

Democrat lawmakers voiced skepticism over Trump’s affiliation with USD1, citing potential risks to financial stability and regulatory oversight particularly due to the President’s immunity powers.

According to Reuters’ reports, some committee members also raised questions about the implications of a politically affiliated stablecoin gaining mainstream adoption.

Critics argue that without stringent federal oversight, stablecoins like USD1 could pose systemic risks or be exploited for political and financial leverage.

With the bill now progressing through Congress, the debate over stablecoin regulations is set to intensify.

Industry stakeholders will closely monitor how lawmakers address concerns surrounding transparency, compliance, and the intersection of digital assets with political influence.

Meanwhile Binance, the world’s largest exchange has delisted Tether (USDT) stablecoin for customers residing within the European Union in compliance with new MiCA laws.

While Stablecoins continue to make headlines, markets have not shown any outlier movements on Thursday.

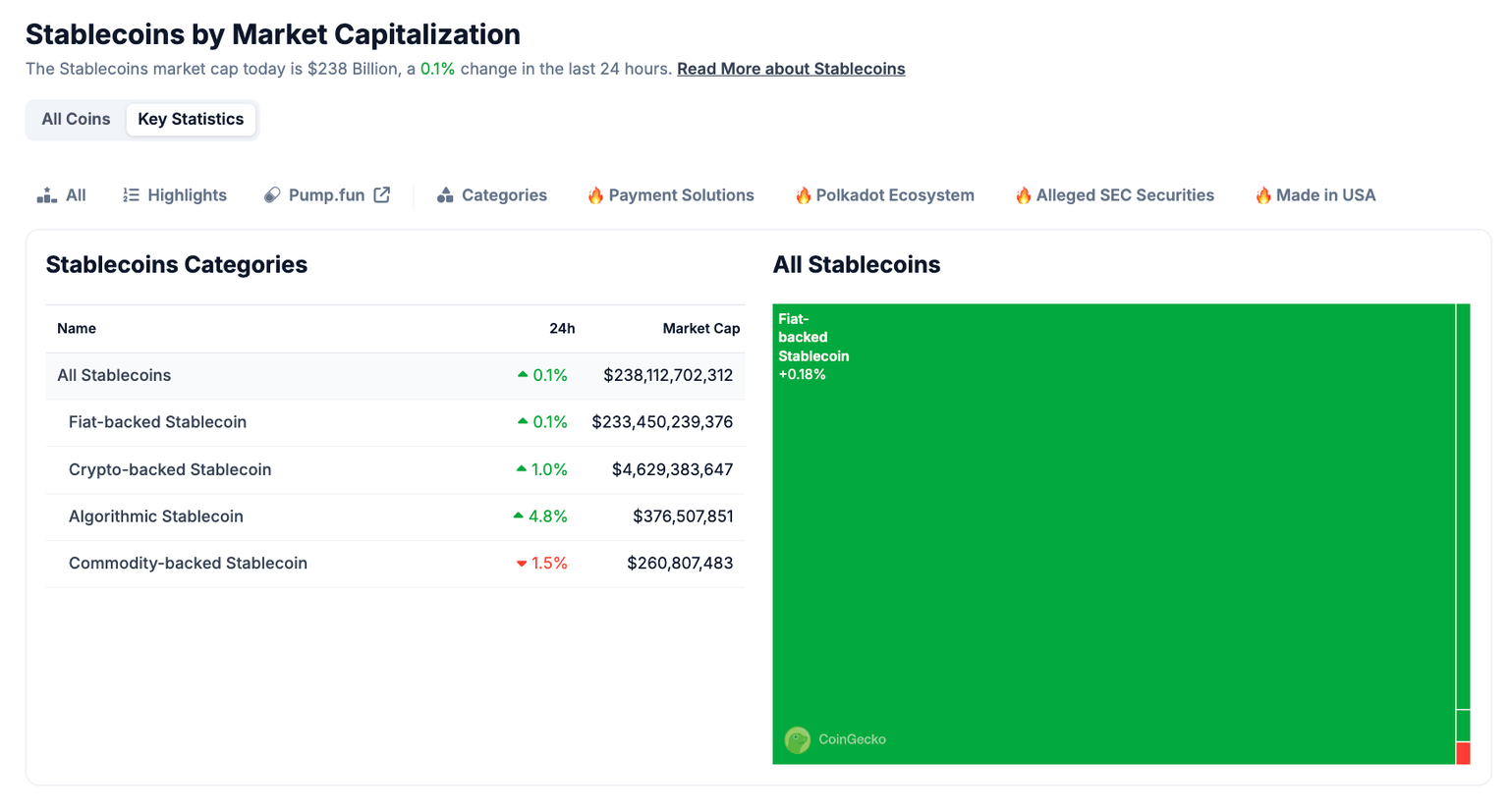

According to Coingecko data, the total stablecoin market cap stands at $238 billion with a mild 0.1% uptick in the last 24 hours.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.