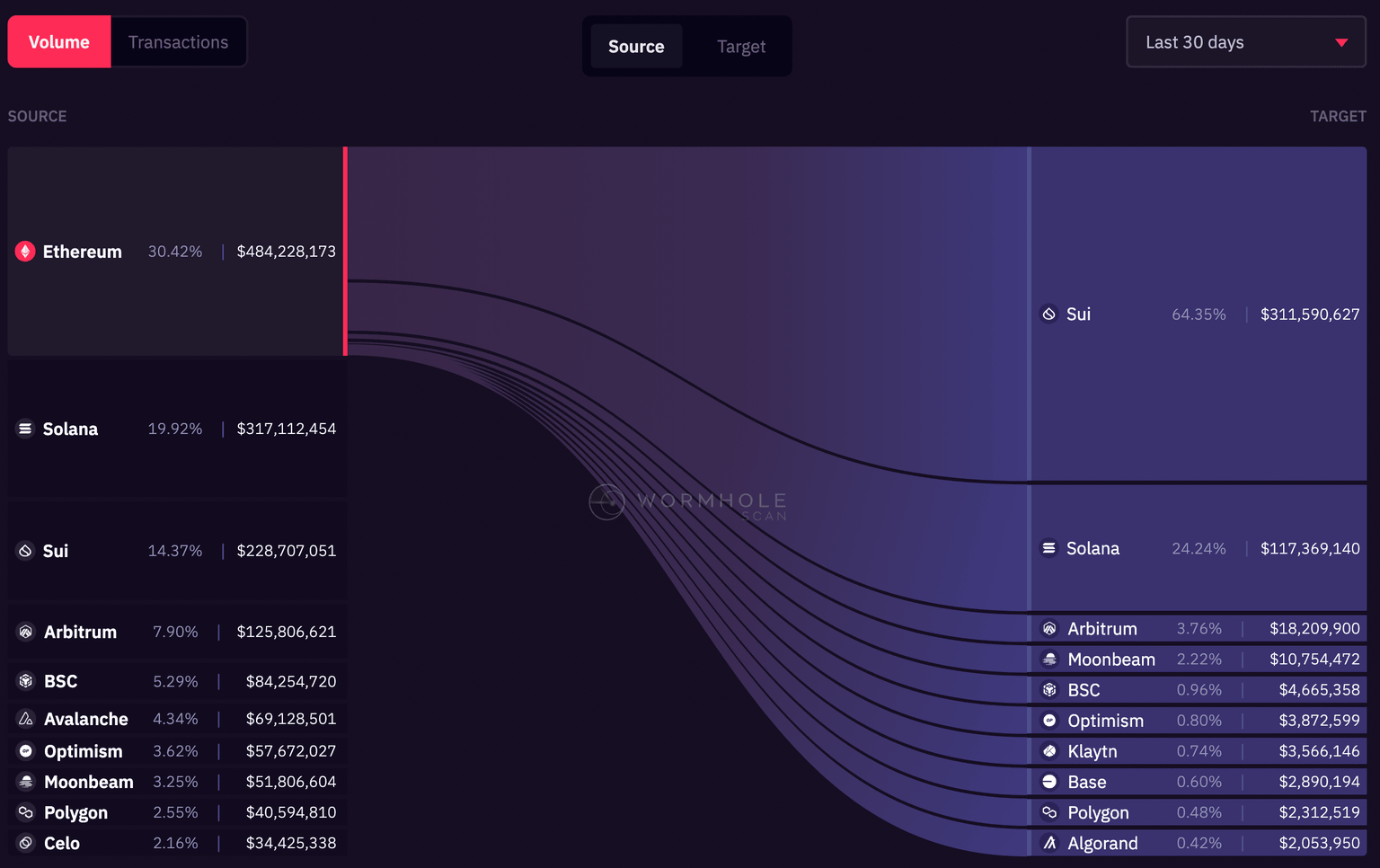

SUI bridged nearly $310 million in assets from Ethereum, exceeding all other blockchains combined

- SUI received $310 million in assets from the Ethereum chain in the past month through the Wormhole portal.

- Almost $500 million was bridged from Ethereum to the Wormhole, 64% was captured by SUI.

- SUI price declined slightly, nosediving to $1.81 on Friday.

SUI, the native token of the SUI blockchain, climbed to $1.81, yielding nearly 20% weekly gains for holders. The Total Value Locked (TVL) of assets in SUI has increased threefold since the beginning of the year.

Also read: Bitcoin profits rotate into INJ, RPL, PLA, STPT, BAT, altcoins see spike in whale transactions

SUI sees an increase in assets bridged from Ethereum

Data from the cross-chain messaging platform Wormhole shows that over $500 million in assets were bridged from Ethereum to other blockchains. Of this, nearly 64% or $310 million was bridged to the SUI blockchain. SUI left its competitors, Solana, Arbitrum, Moonbeam, BSC and Optimism in the dust, with large share of bridged assets from ETH.

SUI gets 64.35% of bridged assets from ETH. Source: Wormholescan.io

Since the beginning of 2024, the Total Value Locked in SUI climbed from 211.39 million to 606.1 million, an increase of nearly threefold, according to DeFiLlama data. The rise in TVL is considered an indicator of the increasing relevance of the SUI blockchain among market participants.

SUI TVL. Source: DeFiLlama

Santiment data reveals that SUI ranks in the top 10 cryptocurrency projects by development activity. On-chain analysts at Santiment have recently noted that development activity is positively correlated with a project’s relevance and its utility in the crypto ecosystem.

Here are #crypto's top projects, sorted by notable #github activity in the past 30 days:

— Santiment (@santimentfeed) February 15, 2024

1 @dfinity $ICP

2 @cardano $ADA

T3 @polkadot $DOT

T3 @kusamanetwork $KSM

5 @optimismFNP $OP

6 @hedera $HBAR

7 @ethstatus $SNT

8 @cosmos $ATOM

9 @ethereum $ETH

10 @suinetwork $SUI pic.twitter.com/VuxWd0eCCD

The developments in the SUI ecosystem are likely to catalyze gains in the token. SUI price is $1.81 at the time of writing. SUI has declined nearly 2% in the daily timeframe.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.