Stellar price must defend this critical support level to avoid falling towards $0.1

- Stellar price has crashed significantly since December 17, following the SEC going after XRP.

- XLM bulls need to defend a crucial support level to come back.

XLM had an insane run towards $0.231 from a low of $0.083, just two weeks before. Unfortunately, the digital asset suffered a significant correction and plummeted harder when the SEC announced it would sue Ripple because it considers XRP a security.

Stellar price can recover but needs to stay above this level

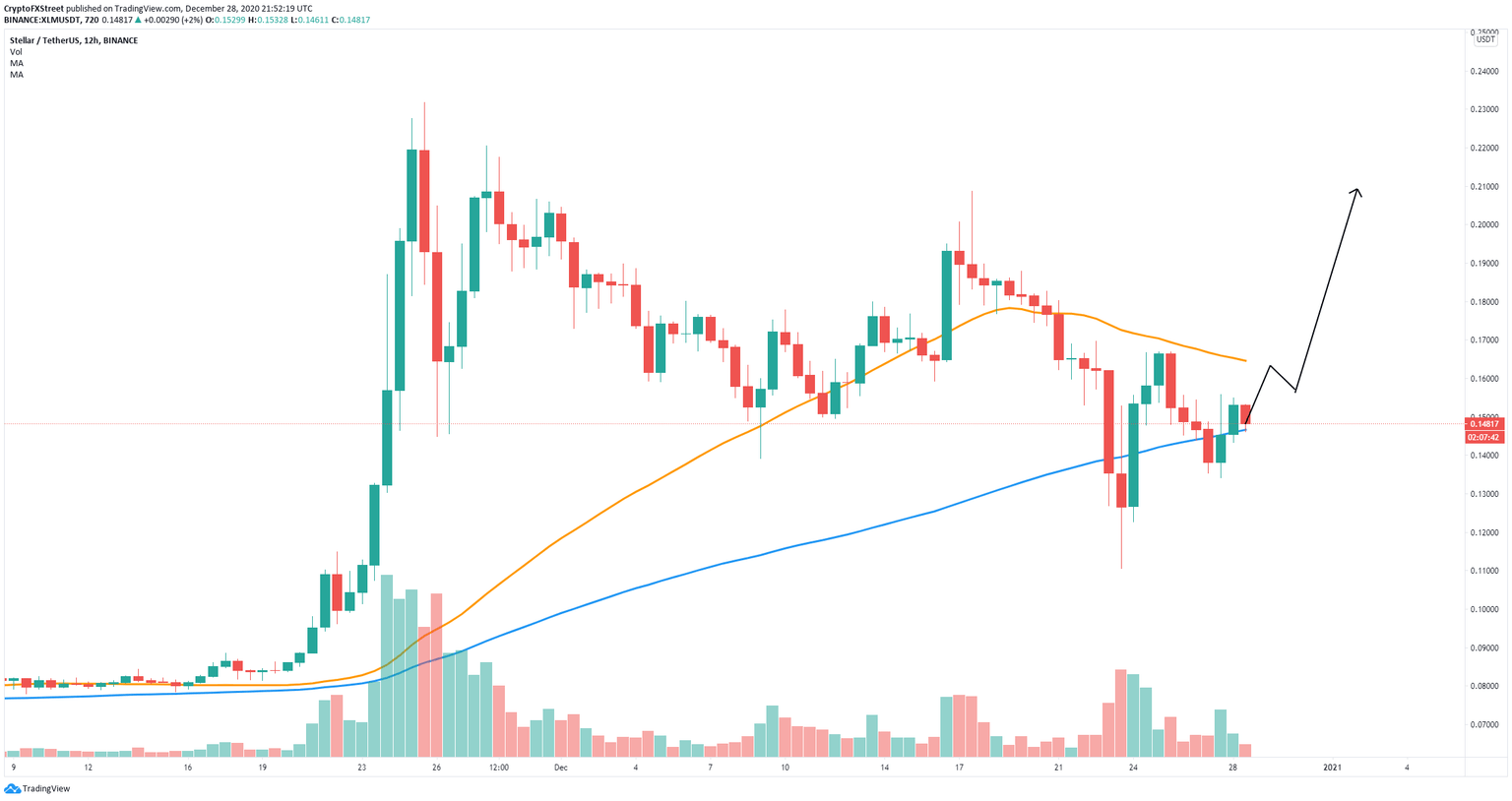

On the 12-hour chart, Stellar has lost its recent uptrend and dipped below the 50-SMA support level. So far, bulls have been able to somewhat defend the 100-SMA level at $0.147. Stellar price is currently trading at $0.148 just above the critical support level.

XLM/USD 12-hour chart

If the bulls can hold the 100-SMA level decisively and see a breakout above the 50-SMA at $0.164, they would confirm a 12-hour uptrend, shifting the odds in their favor. The potential bullish price target after conquering the 50-SMA would be $0.21.

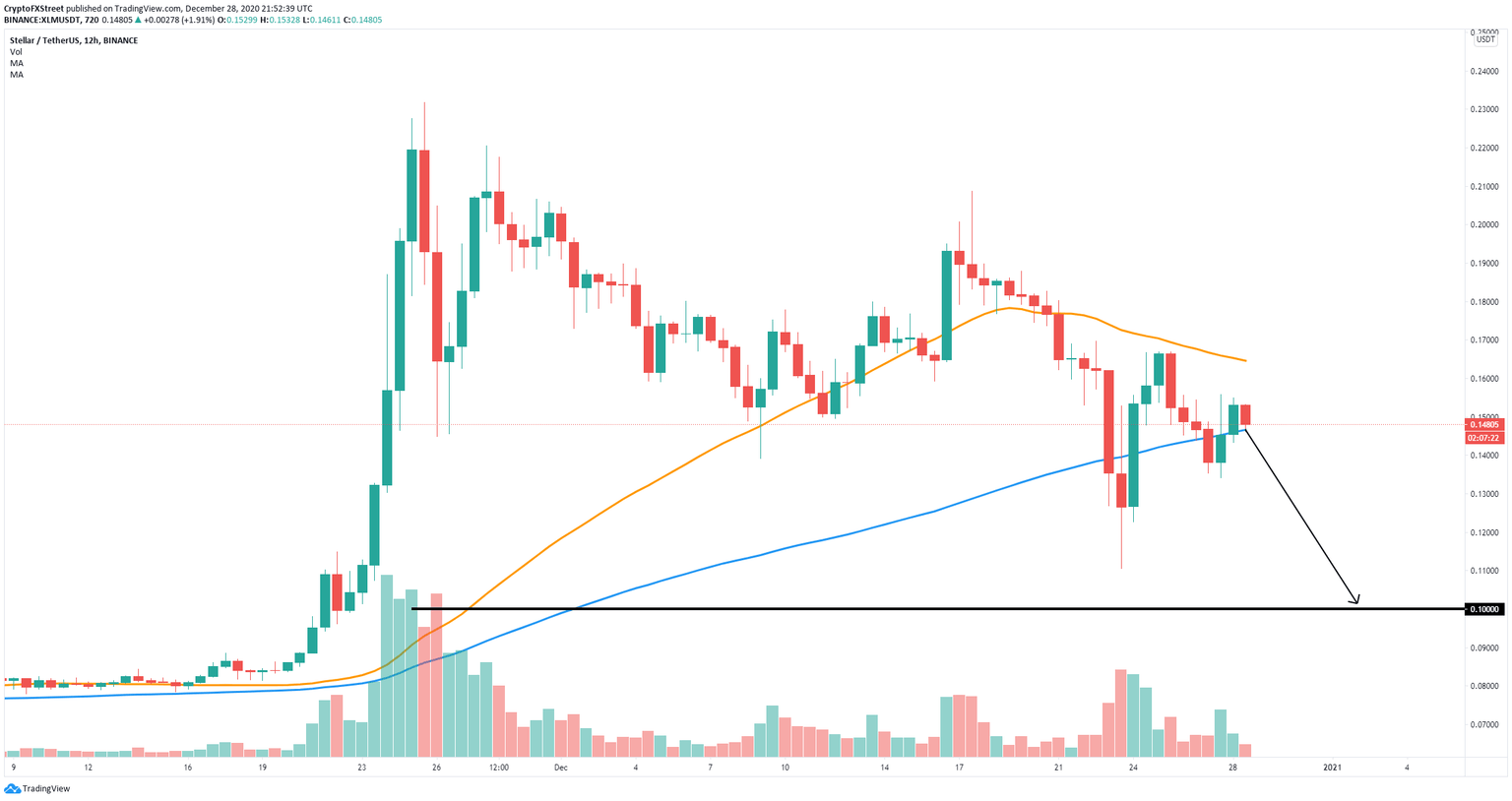

XLM/USD 12-hour chart

However, as stated above, bulls must absolutely defend the 100-SMA level, otherwise, Stellar price is at risk of falling towards the last low on December 23 at $0.11 and down to the psychological level at $0.1 as there is very little support to the downside.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.