Spot Ethereum ETF: SEC delays BlackRock application; ETH price stays dormant

- The SEC delayed yet another spot Ethereum ETF application, this time from BlackRock.

- Earlier last week, Fidelity experienced a similar outcome, and so will the rest of the applicants until May 23, the next crucial date.

- Ethereum price is presently not responsive to these delays as they are likely already priced in, given SEC’s history with the spot Bitcoin ETFs.

After Bitcoin, the spotlight is now gradually shifting to Ethereum as the altcoin is witnessing multiple spot ETF filings to its name, including the likes of BlackRock. There is a chance that history might repeat itself in the case of ETH ETF approval since it is already repeating with regards to the process, i.e., delay in decision from the SEC.

SEC delays another approval

The Securities and Exchange Commission (SEC), in a filing on Wednesday, delayed its decision on the spot Ethereum exchange-traded fund (ETF) filing from BlackRock. The world’s largest asset manager is among a couple of applicants who have already begun vying for approval from the SEC for their spot in ETH ETFs.

Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd https://t.co/2zBBvHkrVk

— James Seyffart (@JSeyff) January 24, 2024

The race began even before the regulatory body green-lit the spot Bitcoin ETFs and is likely going to follow the same journey BTC ETFs did. This means that since the precedent for spot ETFs has already been set after the court-mandated approval during the Grayscale vs. SEC lawsuit, the regulator will have to provide their approval for Ethereum-based spot funds as well.

However, imitating the journey would also include multiple delays and the need to rework the application, as witnessed by Bitcoin ETF applicants. BlackRock underwent a lengthy process of updating their filing as the SEC would not be satisfied until they finally managed to get it right per their rulebook.

The same events will occur over the next few weeks until at least May 23, 2024, which is most likely set to be the final deadline for VanEck’s spot Ethereum ETF decision. Since SEC will certainly defy the first mover advantage to Fidelity akin BTC ETFs, either all the spot ETH ETFs will be approved on May 23 or pushed to another date.

Regardless, the final decision is still a couple of weeks away, and it seems like Ethereum has already prepared itself for the journey.

Read more - SEC lives up to the expectations as it delays spot ETH ETF; Ethereum price makes no move

Ethereum price remains stagnant

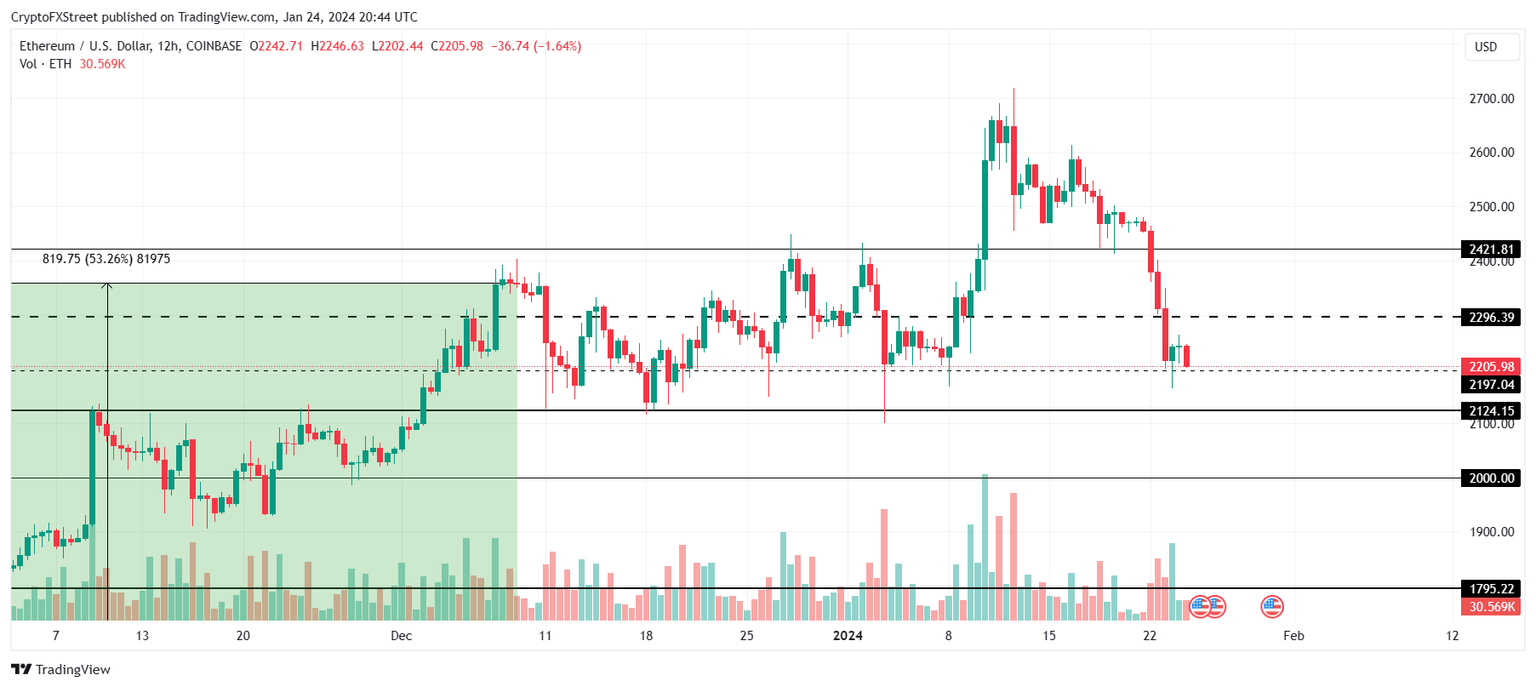

Neither did the Ethereum price witness any major volatility when it delayed Fidelity’s spot ETH ETF application, nor was it making any move at the time of writing. By the looks of it, delays in providing a decision by the SEC seem to have already been priced in by the market, which makes it likely that the altcoin may not move much until something substantial occurs.

ETH/USD 1-day chart

Following the news of the decision, Ethereum price only corrected by a little over 1% in the past hour, remaining afloat above $2,200. ETH will be facing another support level at $2,197, and if it falls through this level, the chances of a correction to $2,142 will be the last opportunity for Ethereum to bounce back before losing $2,100.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.