SEC lives up to the expectations as it delays spot ETH ETF; Ethereum price makes no move

- The Securities and Exchange Commission (SEC) delayed its decision on Fidelity’s spot Ethereum ETF, per a filing.

- Despite the spot Bitcoin ETF approval setting a precedent, the SEC stated that it needs time to consider the issues raised following evaluation.

- This was expected of the regulator, given its response in the past, and the next deadline is now on March 8.

- Ethereum price remained stationary around $2,450, unaffected by the decision, but is losing the strength to reclaim $2,500.

The crypto market faced a long battle with the Securities and Exchange Commission (SEC) when it attempted to secure a spot in Bitcoin ETF, which finally came to fruition when the court interfered. Now, it seems like Ethereum is set to witness the same ordeal as the SEC is taking two steps back after rejecting the spot ETH ETF application.

SEC says no to Ethereum ETF

After a long, drawn-out battle for the approval of the spot Bitcoin ETF, it was expected that Ethereum or other assets might not have to deal with the SEC in this regard. The reason was that spot BTC ETF, backed by the court, likely established a precedent for exchange-traded products (ETP) of such kind, but by the looks of it, this did not happen.

The SEC, in a filing today, delayed its decision on Fidelity’s spot Ethereum ETF application. The regulatory body took an early decision as the deadline for the same was set on January 21. The final deadline for the SEC is on March 8, though this will likely get extended, too, given the present scenario.

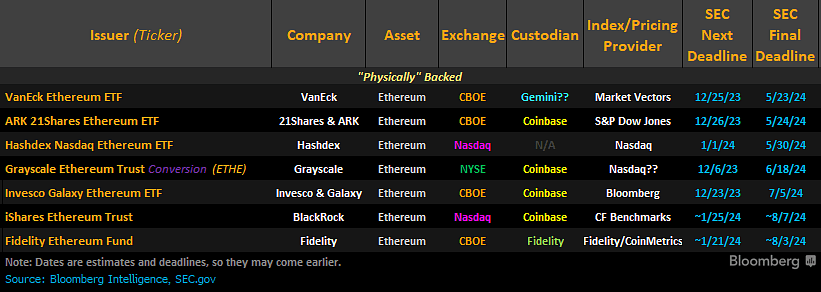

There is a chance the SEC might not obstruct the process this time, given its brush with the law last year. i.e., Grayscale’s lawsuit against the regulator. Furthermore, just like the last time, there is not just one applicant as seven major asset management firms have applied to issue their spot ETH ETF.

This includes the likes of BlackRock, ARK & 21Shares, and Grayscale too, which is attempting to convert the Grayscale Ethereum Trust (ETHE) into a spot ETF. Grayscale was the biggest catalyst in making Bitcoin ETF a reality, giving Ethereum ETFs a strong backup.

Spot Ethereum ETF applicants

Ethereum price sees nothing

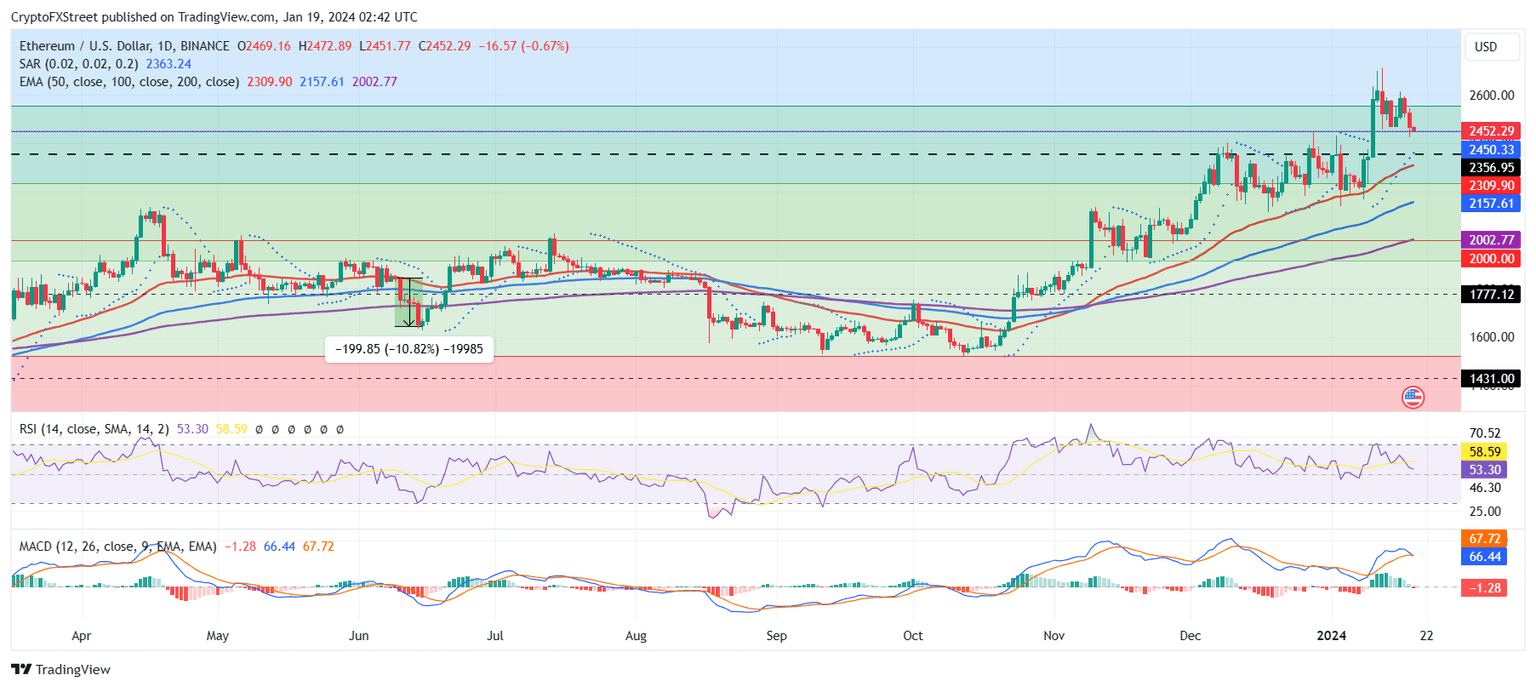

Ethereum price did not react exorbitantly as the altcoin remained mostly undisturbed and unaffected by the SEC’s decision. This can be seen in the chart below, where the second-generation cryptocurrency is keeping above the $2,450 support line.

This shows that the market had been expecting something like this to happen, hence the lack of bearishness at present. However, even if there is no bearishness, it does not translate to an abundance of bullishness either. The price indicators Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are both showing receding bullishness in the market.

The most harm this could do to Ethereum would likely be a correction to $2,356, where a bounce-off would revive the rally.

ETH/USD 1-day chart

However, a rally to $2,600 and beyond would invalidate the bearish thesis and set a new multi-month high for the Ethereum price.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.