Spot Bitcoin ETFs approvals could make Coinbase exchange the biggest winner

- Coinbase was listed in the surveillance sharing agreement of 8/11 firms that applied for spot BTC ETF approvals.

- Besides the SSA custody, the US-based exchange will work with the issuers (if approved), on trading and financing, among others.

- This makes the trading platform a potential winner, with investors loading their stock portfolios into COIN over the months.

/definition-of-etf-21007500_XtraLarge.jpg)

Coinbase Inc., the largest US-based exchange, has been in the spotlight since the spot Bitcoin exchange-traded funds (ETFs) race began in June. With the campaign for product approval and subsequent launch taking place in the US, the trading platform’s heft as the country’s largest cryptocurrency trading platform puts it at a position of privilege, with most filers signing Coinbase for their Surveillance Sharing Agreement (SSA).

Also Read: Coinbase declares readiness for spot Bitcoin ETF approvals as BlackRock goes on the leaderboard

Coinbase to benefit the most if spot BTC ETFs are approved

Coinbase exchange, which was once a potential complication in the ETF campaign, is now poised to become the biggest beneficiary if the spot BTC ETFs are approved. This is because out of the eleven candidates in the spot BTC ETF race, eight have listed Coinbase for their SSA.

Coinbase to custody 8/11 spot BTC ETFs

An SSA is a contract between crypto exchanges and regulators or market surveillance providers such as the SEC, to enhance the integrity and transparency of the cryptocurrency market by sharing trading data and information. It means that if the SEC green lights the spot BTC ETF applications, all firms that listed Coinbase for their SSA would be sharing trade data with the SEC, and book information, among other relevant market data. This would quell the financial regulator’s concern of market manipulation.

Beyond custody services, the US-based exchange will work with the issuers post-approvals, on trading and financing, among other services.

In addition, on the off chance that in-kind redemptions go live, the exchange could be best positioned to finance the duration mismatch between the ETF and spot market since they hold all the collateral.

Notably, the biggest source of revenue for Coinbase is the money generated from retail trading. Playing devil’s advocate, however, while Coinbase could win as custodian, they may not be the frontrunner when it comes to organic volume on their platform for Bitcoin. This is because of high fees, with the ETF making it possible for Bitcoin ownership backed by the giants of the industry at reduced fees.

In addition, Coinbase recently that it is ready for spot BTC ETF approvals, fortifying and streamlining its systems to handle more trading volumes, increased liquidity, and general demand pressure.

Coinbase shares soar as investors load COIN in their stock portfolios

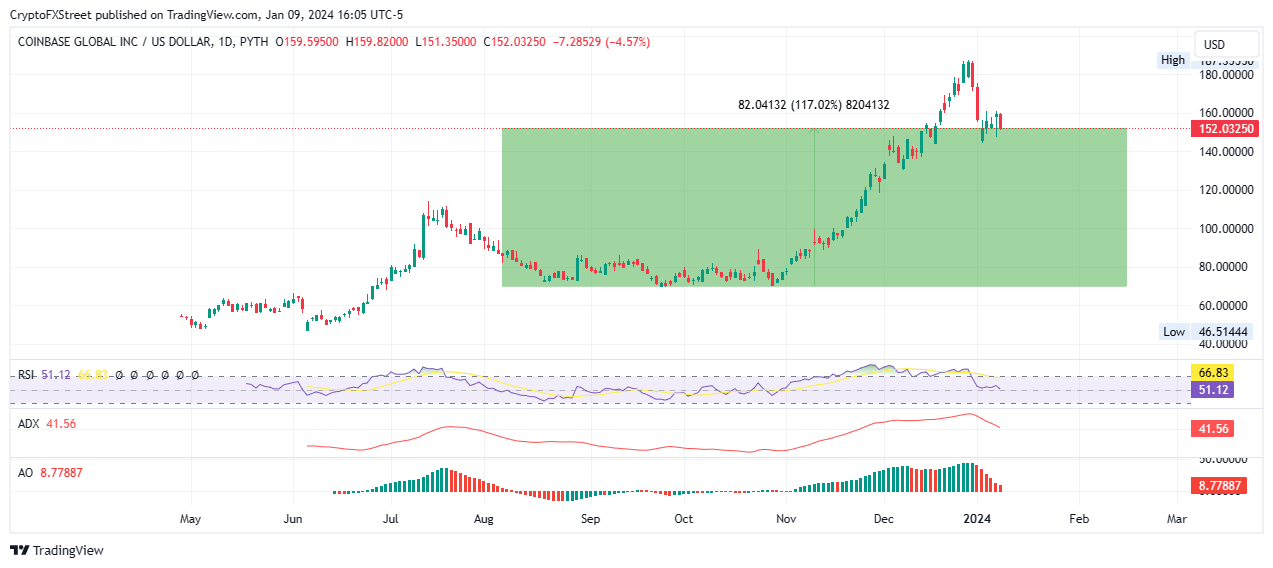

Meanwhile, Coinbase COIN shares remain broadly bullish. Across 2023, the shares recorded a 381% surge in value, with an instance on December 20 when COIN stock reached $168 to record a 20-month high while outstripping Bitcoin’s 160% gain and Nvidia’s 236% rise.

COIN 1-day chart

COIN is up almost 120% since the market turned bullish around mid-October, trading for $152.03 at the time of writing.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.